The time has come: ShimmerEVM is here (Magazine)

⌨️ From the editorial desk...

[ - by Ness]

After some quiet weeks in the IOTA / Shimmer ecosystem, the last month was everything but quiet! If you hang around in Discord or on X it is hard to not come across all the news and also all the fud.

The end of Assembly and the increase of the IOTA token supply caused a stir within the community. Some members became loud and raised their concerns. If you are still unsure what this inflation means for the IF, for the community, but also for potential investors, make sure to read Linus' article "Que bono? Who profts?" carefully.

On the same day the IF also announced that after the launch of IOTA 2.0, they will introduce programmability on the IOTA L1 by integrating general-purpose smart contracts. Furthermore they will setup a new dedicated Ecosystem Fund and become more active in the UAE. In his article, DigitalSoul.x explains, what those decisions mean for IOTA and why the IF made those decisions.

Shortly after all the stir it finally happened: ShimmerEVM went live 🔥 But not only that. IOTA 2.0 is making great progress. You find everything you need to know about the tech side of IOTA and Shimmer in ID.Iotas Monthly Technical Update.

And last but not least we also have some great interview guests. Mart talked to Laura Kajtazi to give you more insights to the IF. And of course we listened to you and brought back the Community Spotlight with no one less than Kutkraft, who you probably all know from his famous Spec Weekly videos 🌟

👨💻 Monthly Technical Update

[ - by ID.Iota]

GM 🌅 #IOTA Fam 🤖

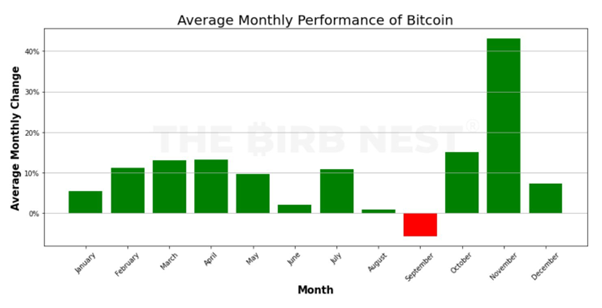

We have managed to stay alive during September - notoriously known for being the month with the worst crypto performance year over year - and thus are ready for October and November - historically good performing months.

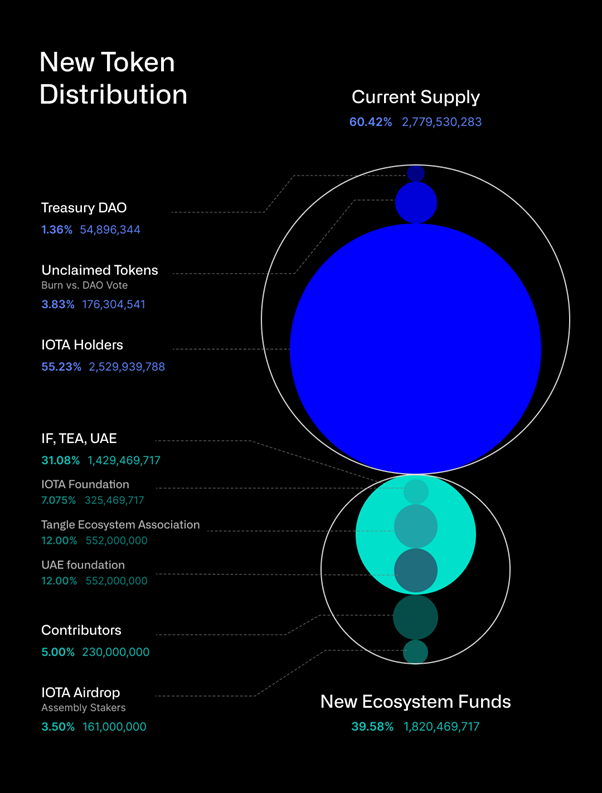

Fitting to that Theme, the IOTA Foundation also announced their plans to change the tokenomics of #IOTA within September. With the Stardust Upgrade the maximum Token Supply gets increased to 4,600,000,000,000,000 IOTA tokens (post Stardust upgrade they are called “micros”). 40% of the token supply will be allocated for a “New Ecosystem Fund”.

While this is hard to grasp, it also allows us to sustain and fund the development efforts for Layer 1 Smart Contracts and obviously IOTA 2.0. And with that lengthy introduction we are finally at the core of what we are trying to discuss today.

What happened with IOTA 2.0 in September?

Let’s start with a look into the statistics, since this should give you a little bit of insight into progress being made. Last time we analyzed the work on pull requests within the GitHub repositories of iota-core, iota.go and hive.go so let’s continue with that approach. The team has collectively worked on 90 (94 in August) pull requests, of which 83 (87 in August) have already been merged into the codebase, leaving 7 (7 in August) still open. So arguing by numbers you can assume that the overall activity is on the same high level that we have seen last month.

Before we dive into the actual Issues and PRs that are worked on remember to “Read the disclaimer baby!”:

Disclaimer: The information provided in these updates comes from the official IOTA GitHub (https://github.com/iotaledger) and the IOTA discord server (https://discord.iota.org). The interpretation of that information, however, does not represent official information from the IOTA Foundation. While we strive to ensure the accuracy and reliability of the content, it is important to note that the updates reflect community perspectives. For official announcements and statements, please refer to the IOTA Foundation's official channels and communications.

As usual, let's take a brief moment to recap what we discussed last month. In August we said that an initial release candidate of IOTA 2.0 might be nearly feature complete. We discussed four features that were missing to reach feature completion.

- Adaption of the Autopeering Mechanism. ✅

In order to participate in the IOTA network a node needs to discover and maintain a small list of "neighbor" nodes that it communicates with. This process of discovery and start of communication is called autopeering. The iota-wiki contains a good overview of the process.

This Feature was tracked in Issue #49. It has been resolved with the merge of PR #316. So that Item is off the list.

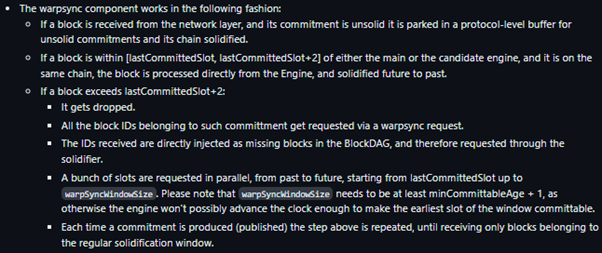

2. WarpSync ✅

The second missing feature was WarpSync (Issue #193). A short summary by @hus_qy of the WarpSync Implementation is given in the picture below.

With PR #280 being reviewed and merged into the code base, the WarpSync Feature is adjusted according to the needs and the corresponding issue resolved.

3. TipSelection ✅

The TipSelection Process for Validators was due for a rework. The corresponding Issue was initially Issue #240, however it has been closed to restructure the problem into three separate Issues (Issue #299, Issue #308, Issue #309) that need to be addressed separately.

Relevant for the IOTA 2.0 testnet is only Issue #309 so far, since it will come with a PoA Consensus. Issue #309 has been resolved with PR #307.

4. Implicit Account Creation ✅

Last but not least, the Account Creation - Issue #278. I’ll cut it a little short here. This Issue has been resolved with finalization of PR #344 and PR #497.

So if the mentioned Issues were the only ones that needed to be implemented to be feature complete we should be feature complete right? RIGHT?!??

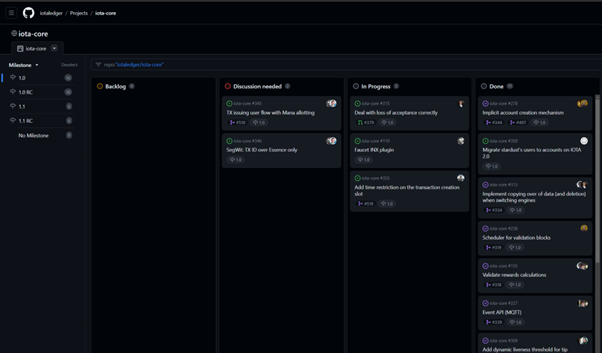

Well… Yes. We are actually super close. At least the node software is actually super close to being feature complete. Let me show you the newly integrated IOTA-core development Kanban-Board:

What you can see is the overview of Issues necessary to address to get the Node Software feature complete. As you can see the column “backlog” is empty. So they don’t have anything planned feature wise for the initial release of a iota 2.0 testnet.

There are three Issues being “in Progress” at the moment. Those are:

- Add time restriction on the transaction creation slot #355

This Feature just adds a validation rule, that a transaction can only be added into a block if the transaction creation time is lower than the slot index of the block. This should be natural behavior, but they might have found a problem where they had to make sure only blocks that follow that rule are allowed.

The Issue is linked to iota.go PR #519. The PR has been merged a week ago. Usually this should resolve the Issue. Since i don’t have additional information i don't know if they just haven't updated the status of the Issue (to “Done”) or if they hold it for a particular reason. I’ll keep you posted.

Update 6th of October. The Issue is resolved. The corresponding PR is merged into the code base.

2. Faucet INX plugin #110

This issue is likely just a testnet feature allowing the community to automatically receive a few testnet tokens to play around with. It’s likely a simple task and should be resolved within a few hours, if someone finds time to work on it.

No PR is assigned yet.

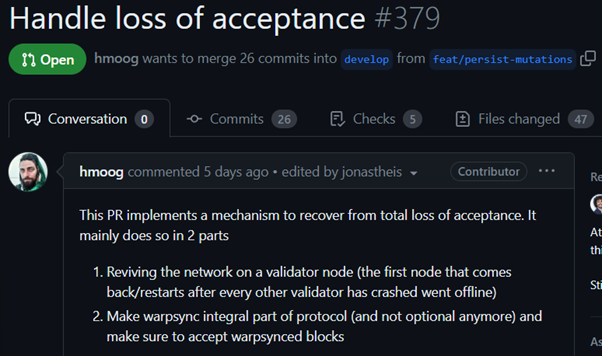

3. Deal with loss of acceptance correctly #315

This is actually a pretty interesting topic. If you have the time please read through the Issue on GitHub. It’s just so well-documented.

Since most of you (including me obviously) are lazy however, and only get your butts up to ask for "wen?" I'll try to summarize it… In a cryptocurrency network, validators need to handle situations where they lose acceptance and don't have commitments for a certain period in the past (MaxCA). We need a set of rules to decide on how to behave if we lose acceptance. Those rules are discussed in the Issue.

The solution for loss of acceptance is defined in PR #379. This PR again is very well-documented and absolutely worth a read. Hans wrote a little bit of an TL:DR how it works. You can see it in the picture below.

The PR itself seems to be finished. It is ready to be reviewed and should be resolved soon. So that Issue won’t stay with us for much longer.

Update 6th of October. The PR has been successfully reviewed. The Issue should be resolved now.

So as you can see the Issues in the “In Progress” column all seem to be easy to handle or done. That leaves us with the Issues in “Discussion Needed”.

- TX issuing user flow with Mana allotting #345

The Issue is well-explained. A block issuer needs to allot exactly the amount of mana in the contained transaction as it gets burned for issuing the block. This leads to a Hen/Egg problem, since the transaction itself leads to increased network workscore and therefore to increased Mana demand for block issuing. While issuing a block you would need to anticipate the necessary work score for that block.

The team has very likely managed to work around that issue through adjusting the mana calculation in a way it is predictable. This change makes it necessary to adjust the Evil-Spammer for test cases in order to align them. I don’t see why the Issue hasn’t moved on to “done” or at least to “in Progress” but it most definitely shouldn’t be blocking.

2. SegWit: TX ID over Essence only #346

This Issue with transaction malleability is also a well known one in the blockchain world. The Mt.Gox Hack was actually one of the biggest known exploit of “Transaction Malleability”. This Transacation Malleability has been solved through Segregated Witness (BIP141) - or SegWit. The team is aiming to implement a similar solution in IOTA 2.0.

I don’t see any actual progress yet. There is no discussion documented in the Issue, nor a pull request linked to solve the issue. So we will likely need to wait a week until we see some progress here. Nothing to worry about, more like a fix to think about and implement.

Update 6th of October: A corresponding pull request has been opened (# 389) and is already merged into the codebase. The issue hasn’t been moved to “Done” yet however, so there might be more to come?

That shall be it for this monthly development recap and outlook. As you can see the team is not only making progress on being feature complete but is also greatly improving the transparency of the code base and the actual development progress. This is huge, since it marks the first step towards actual permissionless innovation for the IOTA protocol. I have written in a Twitter Thread about that topic here.

So I expect us to be feature complete in the coming two weeks. This does not mean that we will get a testnet to play with in October. There is still a lot to do for getting the feature complete node protocol into a releasable state. At the moment the IF team is looking for additional 16 issues, they want to fix before they are happy to release a testnet. Furthermore I can’t comment on the progress for infrastructure that is necessary to use the network like a block explorer or wallets. So that might or might not lead to a few more additional weeks.

Keep your hopes high. We are still fully on track to get a testnet to play around this year. I wouldn’t expect to get a Shimmer Release of IOTA 2.0 but let’s hope for the best.

ID_IOTA

TL;DR:

The IOTA development team is actively working on its node software for IOTA 2.0, with a focus on achieving feature-completeness. They have merged numerous pull requests and resolved critical issues related to auto peering, WarpSync, TipSelection, and implicit account creation. Currently, only a few issues are in progress, and none appear to be significant blockers. However, some discussions are needed for certain features, such as mana allotment for block issuance and implementing Segregated Witness (SegWit) for transaction malleability. While feature completeness is on the horizon, the release of a testnet should be still on track for this year.

🤑 Que bono? Who profits?

[ - by Linus Naumann]

In September 2023 the IOTA Foundation announced its unilateral decided to mint new IOTA tokens through a hard fork, resulting in a total supply increase of about 60% over the course of the next four years (~12% inflation per year). Most of these new tokens go to the IOTA Foundation itself and its offshoots in Switzerland and the United Arabian Emirates (~75% of new tokens) with the rest going to, so far undisclosed, contributors and to the Assembly-stakers. Although these funds will all be minted at day 1, they will reside inside time-locked UTXOs and will only be released in small bits every 2 weeks.

But what does it mean?

The IOTA Foundation

IOTA originally was famous for having no pre-mint and no insider allocation of tokens at the start of the project. 100% of all tokens were publicly sold, to the point that even the founders themselves needed to buy with their own, private funds. This decision looks good on paper, but left the IOTA Foundation without any meaningful warchest with which it could compete against other crypto projects. They were left without resources to start certain big partnerships, could not employ market-makers and stood locked-out of certain exchanges, because many of those kind of deals required a certain percentage of the token supply offered away.

The situation was even worse, because these low funds also meant that the IOTA Foundation was also not able to pay large teams of expensive, top-level developers, leaving it with smaller teams of mostly idealist, that voluntarily accepted to work for salaries below market-rate. Even though dedicated and highly professional individuals were ready to push IOTA technology regardless, this situation in the end slowed down development of everything from the core protocol to wallets and smart contracts.

This newly announced, very large token inflation that mostly benefits the IOTA Foundation and its sub-organizations has a chance at solving these problems. Now they can grant certain percentages of the token supply to key partners and they can sell tokens fund their teams of highly skilled developers.

However, this forced approach might also leave a bitter taste with many, potentially reducing trust in the project and the token. This in turn could scare off new investors, lead to hesitant future investments and protest sells, which would diminish the value of the newly minted tokens.

Sentence: Even though risks regarding investor trust are involved, the IOTA Foundation and its related organizations largely profit from the newly minted tokens.

IOTA token holders

On first sight it might seem clear: If the total supply of tokens in the network is increased, but you as a token holder don’t get an equal share of these new tokens, then your piece of the pie gets smaller. You own a smaller share of the network.

However, the story is in fact more complex.

Firstly, not all new tokens will hit the market at once and increase sell-pressure. Since these tokens were minted inside time-locked UTXOs they will only be freed, and potentially used, in small steps every 2 weeks.

Secondly, and more importantly, these tokens will presumably be used with the intention to push the IOTA technology and ecosystem into serious growth. Important partnerships and a stable financial situation at the IOTA Foundation have the potential to offset the negative effects of the token inflation and additional sell-pressure.

The deciding question is: Will the newly printed tokens grow the IOTA ecosystem well enough to increase the token price by MORE than 12% per year? If that is the case, then the average IOTA token holder profits.

Sentence: Token holders will benefit if the newly minted tokens give IOTA a positive future. Quantitatively speaking, holders profit if the IOTA price rises more than 12% per year because of how the newly minted tokens are used.

Potential Investors

For all investors, market makers and partners that were interested in IOTA but could not receive a sensible token offer to join the ecosystem, the new token mint is very good news. They might now get offered inviting entry-conditions into the IOTA markets, either through OTC buys or other kinds of special deals. Once they hold IOTA tokens they have a vested interest into the success of the project and will further the network will full attention, simply because their very own financial outcome is at stake.

On the downside, the main worry for these potential partners could be that this one-sided decision by the IOTA Foundation will make it hard to sell the vision and market potential of IOTA to more people and other investors.

Sentence: Potential ecosystem partners largely profit from this new token inflation, with a certain risk that this new token inflation soured some peoples opinion about IOTA.

My personal opinion

I think the IOTA Foundation tried for many years to work with their very limited funds to do as much as they could. This lead us slowly falling from the top 10 projects by market capitalization to barely surviving in the top 100. Just sticking to this strategy might satisfy our idealistic wishes, but would not have been sustainable and would not have lead to IOTAs big success. This means I agree with increasing the IOTA supply and giving most of the new tokens to the IOTA Foundation and its partners – there is no other player in the our ecosystem that could do more good with these tokens. I would rather turbo-charge our efforts with more tokens – even at the risk of devaluing my own holdings – than seeing IOTA moving at a snails pace out of the spotlight of the crypto market.

Should this decision have been discussed with and decided by the IOTA community? I am of mixed opinion here. I am a fan of community participation, however I also see that such a strong decision could probably not have happened (and especially not have happened that quickly), when a full, years long, governance process would have taken place. Other ways, like a party-community driven decision, for example by giving the community two options of how many tokens should be printed and let them decide by on-chain vote, seem like a good middle-way to me, but might have created a similar large outrage, drawn out the process too long and might have left the IOTA Foundation with again too less funds to finally really thrive.

We live again in exciting times for the IOTA ecosystem. I wish to see these new tokens put into action by onboarding new, big partners and accelerate development on all fronts. If that happens, I am sure all players in the ecosystem profit.

🏆 NFT Top 3

[NFT data provided by EpochZero]

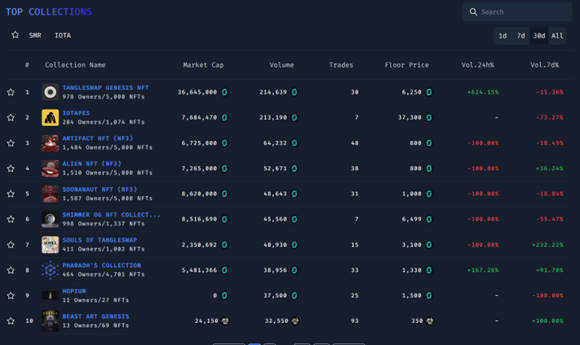

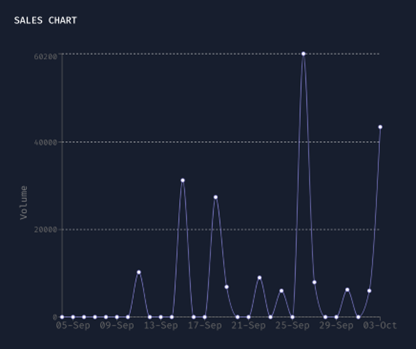

With the introduction of EVM, the NFT landscape has experienced a seismic shift. Making waves is ShimmerSea NFT Marketplace, a fresh and dynamic entrant to the arena. Soonaverse is unveiling new DeFi innovations while IOTABEE is teasing exciting developments, and NFT adventure games like IOTAHeroes are piquing interest. The top 10 rankings have been shuffled since our last update. Let's delve deeper!

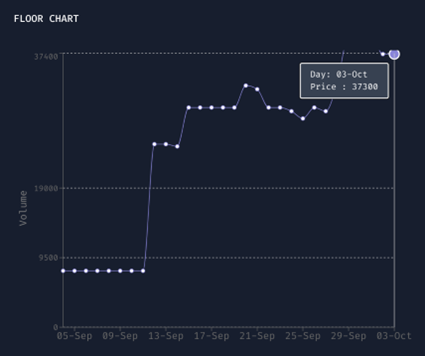

#1. Tangleswap Genesis NFT– Ascending to the throne with a total trading volume of 214,639 SMR. A remarkable 30 trades paved its way to the top of the charts.

#2. IOTAPES– Hot on Tangleswap's heels, they recorded a trading volume of 213,190 SMR, narrowly missing the top position. It's noteworthy that just 7 trades generated this volume, showcasing their impressive floor price of 37,300 SMR.

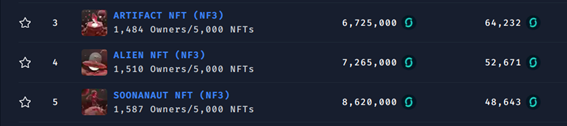

#3. Artifact NFT – While its trading volume stands at 64,232 SMR, it's pivotal to highlight that this is just one of three collections. The other two collections are noteworthy in their own right, securing spots 4 and 5. Artifact NFT has seen a cumulative trading volume of 48 NFTs.

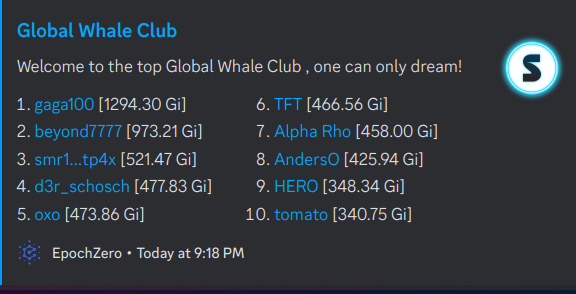

SPOTLIGHT – Global Whales

As we navigate the ever-evolving world of NFTs, it's clear that the horizon holds more surprises and innovations than we can anticipate. The swift rise of platforms like ShimmerSea and the fervent trading activity around the likes of Tangleswap Genesis and IOTAPES only underscore the dynamic nature of this burgeoning space. Stay tuned with us, as we continue to spotlight the groundbreaking developments and trailblazers that shape the future of digital art and blockchain technology. Until next time, happy trading and collecting

👩 Meet the IF - Laura Kajtazi

[Interview by Mart]

The Tangleverse Times: Since we have established our “introductory” question, we just start as always: how did you find out about IOTA and how did you find your way to the IOTA Foundation?

Laura Kajtazi: Before working full time as a Project Manager for the IOTA Foundation I studied and completed my Master Programme in International Economics and Management. In my studies I focused on Entrepreneurship and Macroeconomics and began to more closely deal with the crypto area from an entrepreneurial and monetary policy perspective. I was with excitement following the crypto area and also IOTA. At some point during my Master studies I wanted to gain practical experience within that specific area so I applied as a working student for the IOTA Foundation and I was actually lucky to be accepted. Once I finished my studies I started working full-time for the IOTA Foundation as a Project Manager and I am really happy to be on board.

TvT: Do you have any secret morning routine you couldn’t live without? Any secret life-hack you are totally going to tell us right now? Something like TikTok users telling you to add lemon juice to your coffee?

L.K.: I wish I had haha. Generally for me it is important to start the day with something that motivates me. In my case I usually start my morning with coffee and music as these are things I really enjoy, which puts me immediately in a good mood and full of motivation to start my day. Also what I realized helps me a lot is before I start work to go over my tasklist and set my priorities for the day. This provides me with a fresh mind and more guidance during the day.

TvT: If I would send you now to a beautiful lonely island in the middle of the Caribbean to spend the next year there, but you would be forced to binge-watch a single YouTube video of your choice, what would it be?

L.K.: If I would need to watch a single YouTube video over and over again, I would probably say no video, haha. But as I need to choose I would pick something that the more often I watch it provides me with more insides, new messages I might have not recognized before.

TvT: So Mariana took the freedom to tell me that you’re originally from Kosovo. After googling “Delicious dishes from Kosovo” I found quite some. But since you’re the expert here, what meal do we really need to try? What’s your favorite meal from your youth?

L.K.: I'd wholeheartedly recommend "Mantia," which are filled pastries traditionally made with chopped meat. In my view, you can also experiment with chopped vegetables like eggplants, mushrooms, and onions, although it might not be advisable to suggest this to an Albanian mother who prefers to stick to the original recipe. Once I prepared Mantia with chopped vegetables, my mother jokingly told me that, to her, they couldn't be called Mantia anymore, haha.

Here is a picture of the dish:

TvT: Mariana is originally from Colombia and you spent some time there in 2020 as well… is this just a funny coincidence or did you get to know each other there?

L.K.: Indeed this is a coincidence. During that period, I happened to be on a semester abroad in Colombia. When I joined the IF, meeting someone from Colombia, particularly Mariana, was a truly happy moment for me. Overall, I have a deep fondness for Colombia and Latin America as a whole. It's my favored region for both exploration and travel.

TvT: You work for different panels and sustainability groups etc., so basically pushing real world adoption and acceptance of the technology. Is there also a degen part hidden inside you? If so, which NFT project is your guilty pleasure?

L.K.: I think soonaverse is a really cool project. There are some NFT collections on their Marketplace that I really like such as one with Frida Kalho or the collection Diá de los Muertos. This is also because I find Mexico as a country very interesting. Also Frida Kahlo happens to be one of my favorite artists in history.

TvT: It started with Dom’s cutie, Christian Saur, who told us he would love to have a “non-smelling dog that can walk itself” and continued with Mariana’s lovely doggo. Do you also have a pet? If so, WE WANT PICTURES! If not, what would you love to have at some point in the future?

L.K.: Unfortunately, I don't have any pets. I was really fond of them when I was a child, but my parents weren't pet enthusiasts, so I never formed a strong bond with animals…until I met Mila. Honestly, this dog has played a significant role in gradually turning me into more of a pet person. If I am at some point getting a dog myself, Mariana's dog definitely had an impact on this transformation!

TvT: One serious question is allowed in this format, so I’m gonna ask it right here: What is your experience as a woman in the “blockchain sector”? What needs to change? Is there anything where crypto is actually ahead of traditional sectors?

L.K.: Being a woman in the blockchain sector is genuinely thrilling. However, I believe it's not solely about being a woman; rather, the industry itself offers a chance to be part of a cutting-edge field with the potential to revolutionize sectors ranging from finance to supply chain and beyond. It's an environment that fosters innovation and embodies a pioneering spirit. This spirit makes communication and exchange with others much more fluid for me.

Nonetheless, there are hurdles to navigate. Like many tech-related fields, the blockchain sector has historically been dominated by men. Consequently, women may encounter situations where they feel underrepresented. Personally, I haven't experienced a lack of representation, but given the lower proportion of women in this sphere, it can indeed be a challenge.

In light of this, I believe networking and mentorship play pivotal roles for women in the blockchain sector. Connecting with fellow women in the industry offers invaluable support and avenues for personal and professional growth.

In a broader sense, being proactive and advocating for diversity is crucial. This proactive stance can help break down barriers and pave the way for more women to enter the field. Moreover, diversity within a team is immensely beneficial for the growth and progress of the industry as a whole, in my opinion.

TvT: What was the best series you watched the past year?

L.K.: I really enjoyed watching “Wednesday”, that was my highlight in 2023. I also enjoyed Money Heist, One Piece, Inventing Anna just to name a few.

TvT: Since the timing of this interview somewhat matches with the ShimmerEVM launch, are you excited for it? Anything you’re going to try in the first couple of days? Or are you more like Jelle, pushing the technology itself forward but not really liking the degen stuff?

L.K.: I was super excited for the ShimmerEVM launch as this marks an important event for the community. I have not tried anything yet on the public ShimmerEVM. I would say currently my primary focus lies in driving projects forward.

💻 The Programmable Tangle: Implications of Layer 1 Smart Contracts on IOTA

[ - by @DigitalSoul.x]

Introduction

In light of the recent bombshell announcements from the IOTA Foundation, I think it’s important that we take a step back and really consider why these decisions have been made. After all, such steps were surely not taken lightly, and since the IOTA Foundation has come to this consensus they must be fully convinced that this is the best (if not only?) path to success.

Now, I will quickly concede that these decisions came as a shock to me when I first learned about them. They sounded drastic and hasty, and considering some of the questionable actions of the IOTA Foundation of the past, it felt like maybe they hadn’t really learned from past mistakes. Why hadn’t the community been solicited for input and advice here? Were they afraid that the community wouldn’t agree with the decisions? Did they see these steps as their only option? These were some of the thoughts that immediately occurred to me.

After taking a step back and trying to see the situation with a bird’s eye view, it became clear that these decisions each fall into place like logical dominoes, and there really isn’t another viable path, in my opinion. In the end I believe that there is no other course of action if we are to give IOTA / Shimmer the best chance of success, even if we must endure another period of pain as holders. Luckily this isn’t new to us. If nothing else, we are all united by our utopic vision of the future and our herculean pain tolerance, bordering on masochism. At least let me share my thought process with you in the hopes that it will ease your mind a bit as it has mine.

Where We Are Now: ShimmerEVM Layer 2 Programmability

With the launch of ShimmerEVM imminent, we will finally have smart contract functionality available on Shimmer. And as you probably know, ShimmerEVM represents a Layer 2 solution, a blockchain built on top of Shimmer that periodically anchors into the tangle for security and finality:

These L2 blockchains do offer certain advantages. First of all, they promote higher protocol scalability since the transactions are batched outside of the tangle and only occasionally require L1 throughput. Also, L2 smart contracts help to preserve privacy since individual transactions are batched and then anchored as a set on the tangle rather than each interaction being immutable. Another advantage is that L2 solutions reduce bloat on the core protocol and reduce the burden on node operators.

The bottom line is that ShimmerEVM already represents a huge step in the evolution of IOTA. It offers the ability for practically limitless new projects to build on top of the tangle, to leverage its unique combination of fast, feeless, and ultra-secure transactions. We are only just beginning to comprehend the full implications of this new functionality.

Where We Are Going: Layer 1 Tangle Programmability

So, if Layer 2 smart contracts offer clear advantages, why do we need Layer 1 smart contracts? Well, as is the case with most solutions, there are pros and cons to each approach. As it relates to IOTA / Shimmer, there happen to be some really great reasons we would want programmability on L1, but before getting into tangle-specifics let’s touch on the basics. The primary reasons for choosing to deploy smart contracts directly on the base layer are increased security, increased decentralization, and lower trust threshold. As the IOTA Foundation pursues its vision of “Digital Autonomy for Everyone”, it follows that they would embrace these core tenets of crypto through L1 smart contracts.

Increased Security

As mentioned earlier, smart contract chains built on top of base protocols (aka L2s) only occasionally anchor to Layer 1, and all other transactions occur in a silo. In contrast, those chains executed on the base layer inherit the full security and immutability offered by the underlying consensus mechanism. In the case of IOTA / Shimmer, this refers to Proof of Authority (PoA) for Stardust and Proof of Stake (PoS) for IOTA 2.0. These consensus mechanisms are time-tested and highly resistant to attacks, offering much more peace-of-mind to high-value and security-critical use cases.

Increased Decentralization

By their very nature, Layer 1 networks are much larger and widespread than the Layer 2 networks built on top of them. This means that they are naturally more decentralized, with many more nodes executing the smart contracts and validating transactions. This, in turn, reduces the chance that a single point of failure could bring down the chain. It also promotes an open, inclusive, and permissionless environment that fulfills one of the core principles of crypto.

Lower Trust Threshold

When smart contracts are offered as L2 solutions on top of the core protocol, there are a limited number of validators responsible for processing these transactions. Users of these smart contract chains must trust that these validators will act in good faith, and this can be a leap in crypto where most people are anonymous. In contrast, programmability built into the core protocol draws upon a much larger pool of nodes to validate the transactions. This means that users can utilize the contracts without relying on more centralized actors, and it also ensures that the programs have predictable operation. This fulfills another core principle of blockchain tech.

Tangle-Specific Benefit of L1 Programmability

With IOTA 2.0, our entire consensus mechanism is changing. We will be moving from PoA to PoS via On Tangle Voting (OTV) with Mana enabling throughput on the network. By allowing for L1 smart contracts, asset tokenization, and IOTA Chains anchoring, there will naturally be more demand for the IOTA token, and when demand exceeds supply (including inflation), the price will rise. And as the value and reputation of the network rises, the security of the network increases, as well as the demand for throughput (Mana). These mechanisms complement each other organically to support the value and security of the entire network.

Projects Possibly Requiring L1 Smart Contracts

So what types of projects might choose to deploy on L1 rather than L2? Well, we’ve already discussed above that projects requiring increased security, increased decentralization, and a lower trust threshold would likely choose to deploy on the base layer. There is also much more extensive documentation and developer support available to those building on Layer 1, which may be crucial to some projects. Let’s list some specific applications that might benefit from L1 smart contract programmability:

- Decentralized Finance (DeFi) Protocols: While DeFi projects could also choose to use L2 scaling solutions, many core DeFi protocols (e.g. lending platforms, decentralized exchanges (DEXs), stablecoin issuers, etc.) are better suited for Layer 1. This is because these applications have significant Total Value Locked (TVL) and often require the highest level of security and decentralization.

- Security Tokens: Security tokens are assets that represent real-world tangible goods (e.g. stocks, real estate, bonds, etc.) on the blockchain. These tokens must comply with local regulatory requirements, and so security is also of the utmost concern. For this reason, L1 is a preferred choice to ensure legal compliance and investor protection.

- Initial Coin Offerings (ICOs): ICOs raise funds by issuing tokens to investors. These token sales often involve large sums of money and require a high level of security and trustlessness. To handle these transactions properly and provide peace of mind to the investors, the ICO should be hosted on L1 for the highest level of security and decentralization.

- Non-Fungible Tokens (NFTs): NFTs are tokens that represent unique digital assets like digital art, collectibles, memberships and more. L1 smart contracts are often utilized for NFT minting as well as associated marketplaces due to their security and the assurance of true ownership. The immutability of the base layer is key here. Also, NFTs can be very valuable assets that demand the added security of L1 programmability.

- Critical Infrastructure: Crypto-based identity systems, supply chain management, and voting systems are examples of critical infrastructure applications. These may be overseen by local governmental or regulatory bodies. Because of this, these applications demand the highest security and trustlessness. L1 solutions are recommended to ensure the integrity of these systems.

- Governance and DAOs: Decentralized Autonomous Organizations (DAOs) and other governance mechanisms often depend on L1 smart contracts. In many cases, this is the best way to ensure the security and transparency of the decision-making processes, and to record them in an immutable way.

- Legal Contracts and Agreements: There may be smart contracts used for legal purposes, such as notarization of documents or the execution of legal agreements. They are also frequently hosted on L1 to ensure the legal validity and security of these contracts.

As you can see, the projects listed above are big-time: Enterprise level, Governmental, Regulatory, etc. They require L1 smart contract support in most cases. While there are clear advantages to hosting smart contracts on L1 or L2, individual projects will need to weigh factors such as security, scalability, transaction costs, decentralization, developer support, interoperability, etc. when deciding on which layer to deploy. Layer 2 is commonly used for everyday transactions and applications that require high scalability or increased privacy. Layer 1 is better-suited for high-value transactions, security-critical applications, and programmability with the highest level of decentralization. The key takeaway here is:

IOTA L1 Smart Contracts and Assembly

We’ve now come to the conclusion that L1 smart contract functionality is key to the future growth of the IOTA / Shimmer ecosystem. Until recently this functionality was not considered possible. How would such functionality affect the Assembly network? Well, the Assembly network was proposed to be a network to organize the validators of the L2 chains connected to the Tangle. But, with L1 smart contracts there will be a seamless integration between L2 chains and the Tangle, so Assembly is defunct. Also, there has been plenty of speculation (notably from Hans even), that Assembly would take value AWAY from IOTA, as another token / network would only serve to fragment the ecosystem further. Apparently this criticism was well-founded.

According to the IOTA Foundation, rapid, recent technological developments in the crypto-space have opened new, exciting opportunities that actually could allow for L1 IOTA smart contracts. With these advances, why support another network (Assembly) that would cannibalize value from the IOTA? Now that there does seem to be a way to offer L1 programmability on IOTA, wouldn’t you prefer it this way? Let’s make IOTA ubiquitous in the space! Let’s make the Tangle the Swiss Army knife of crypto that it should be! This just simplifies everything and puts the focus back where it belongs: on IOTA. Personally, it makes sense to me that if IOTA can perform the original intended function of Assembly, then Assembly can be abandoned. This logically follows if smart contracts can indeed be deployed on the Tangle.

I feel your pain. Yes, IOTA stakers deserve something for their dedication and belief in the project. After all, we chose to stake because we were offered tokens in return, even if we were unsure of the future value of those tokens. To abort the Assembly network before it is born is just unfair to the staunchest supporters of the network.

How could we reconcile this? Simply abandoning all of those staked tokens is unacceptable, because we gave up something in return for those promised tokens: the ability to use our tokens for other purposes, otherwise known as opportunity cost. After all, IOTA was trading around $0.75 per MIOTA back in early April of 2022. We all know where we’re at today. If I hadn’t been staking, would I have sold? I don’t know… probably not, to be honest. But the point is, I would have considered the option more strongly for sure.

Plus, it’s not only the IOTA stakers who need to be considered, remember the millions of dollars pledged by early Assembly partner supporters?

Well, these partners are large, influential corporations, capable of really pushing the ecosystem forward. And clearly they would be interested in supporting L1 smart contracts on IOTA since this is the same purpose and vision promised by Assembly. And let’s be honest, we can only assume that any funds already provided by these organizations have already been spent on development up to this point (speculation). We can’t leave these entities high and dry, since we will need their clout and resources to push our ecosystem forward. With Assembly scrapped, let’s bring them to IOTA! But what can we offer?

The only way to reward stakers and entice partners, if not with Assembly tokens, is with other ecosystem tokens: IOTAs or SMRs. And the only one of these that really makes sense is IOTA tokens, because the IOTA network will be performing the function of the proposed Assembly network. The problem is that the IOTA Foundation is already operating on a shoestring budget — there is no possible way they could attempt to make stakers whole and partners satisfied with the tokens they have on hand, it’s just not possible. “You can’t get blood from a stone!”

The Reluctant Solution: Mint New IOTA Tokens

“Blasphemy!” “Heresy!” “Sacrilege!” But wait, don’t kill the messenger…

Many of us have proudly boasted about IOTA’s non-inflationary model. I count myself as one. The entire token supply was minted and sold completely fairly, with none being pre-sold to VCs, none gifted to founders and early devs, none minted epoch after epoch, diluting the holdings of the most faithful, long term supporters. One IOTA is one IOTA, no matter the rate of inflation of my local currency. And yes, this sounds great on paper, just like many other initial lofty IOTA principles that wound up being unfeasible and are beyond the scope of this article.

And where did it get us? The IOTA Foundation has never had the budget to really compete with the largest, most well-funded crypto ecosystems. This last year has seen the IF tightening its belt to depression-level rations to survive. Many working groups have been spun off, and this prolonged bear market has added fuel to the fire. Sure, the IF is a bit hamstrung by the constraints placed upon them by their non-profit foundation status, but the recent formation of the Tangle Ecosystem Association in Switzerland offers a host of new opportunities. We just need FUNDING.

Suppose, just suppose, we begin minting new IOTA tokens. How might they be used?

- Offer IOTA rewards to IOTA stakers expecting Assembly tokens. Since there are no Assembly tokens to give, and we’ve already discussed that the only fair thing to do is to offer IOTA stakers something, why not give them tokens of the network that will replace Assembly, namely IOTA?

- Offer IOTA tokens to the partners that Assembly had procured. These partners had already pledged funding to support the development of a new smart contract network in the IOTA ecosystem. Does it really matter that this ‘new’ network is actually an old, O.G. network getting some shiny new upgrades? And no need to be concerned about stability or security, all upgrades can be tested on the existing sister network, Shimmer. Offering these partners IOTA tokens keeps them in our ecosystem and helps to further bootstrap the new and improved IOTA.

- Establish a proper war chest for the IOTA Foundation. This will allow them to further fund their research and innovation, helping to maintain the cutting-edge tech needed for tomorrow’s use cases. I’m talking ZK Rollups, sharding, etc.

- Establish the funding needed for a dedicated Ecosystem Fund. Let’s really get the word out about IOTA. Let’s reward our content creators who tirelessly attempt to promote the protocol, for little more than love of the tech. Let’s give IOTA the chance to succeed that it never had.

The IOTA Foundation is hoping that this inflation will have a limited effect on the price of the token, all other things being equal. This is because the newly minted tokens won’t be dumped on the market, but will be distributed to stakers over a period of 2 years and also be held in the IF’s war chest. But some people will not like this inflationary model and may sell, and some tokens will need to be sold to support the IF’s mission. In the grand scheme of things, 12% inflation per year is not terrible if it’s partially counteracted by airdropped tokens and the resulting war chest increases the value of the network substantially from an outsider’s point of view. The ecosystem fund will bring many new opportunities, and this will help to take some of the sting out of the inflation.

You must ask yourself: can the IF leverage the 12% inflation to generate even more value through strategic investments? This is key to deciding if you can live with the decision.

Moving from 2.78 Billion tokens today to 4.6 Billion tokens in 4 years will mean that your total percentage ownership of the protocol today would decrease by 40% in 4 years, not including your airdrop in place of Assembly tokens. This is just the hard truth of the matter. But let’s look at the math to see how the IOTA airdrop could counteract the 12% inflation.

I’ve already shown in the previous Assembly chart that 12.29 Billion ASMB tokens have been promised. But these numbers were taken from the Assembly Twitter announcements for each staking period, and apparently aren’t 100% correct. Reading through the recent blog post, the IF states that 12.38 Billion ASMB tokens are due, so let’s use this more accurate number. As you can see above, 161M IOTA tokens have been allocated to compensate these stakers. [Note that 1 IOTA after the hard fork will be equal to what we previously called 1 MIOTA.] This tells us that we will receive 0.0130 IOTAs (new notation) for every ASMB we have earned through Firefly. Simply open your Firefly wallet or input your address in the list found here to check for your total ASMB rewards and multiply this number by 0.013 to see how many IOTAs you will receive in the airdrop.

It’s also important to note that 10% of the total IOTAs to which you are entitled will be airdropped and unlocked immediately. The other 90% of your IOTA tokens will airdropped bi-weekly over a period of 2 years.

The following is a bit of personal observation to give you all a bigger picture of the impact of these airdropped tokens. I had an amount locked up in cold storage, collecting ASMB since the beginning. The math for me worked out as follows:

Criticisms

Just because I can understand the reasons that the IF made the decisions it has, doesn’t mean I am in complete agreement with the way that these decisions are implemented. My biggest criticism of this entire process is the way that the IOTA Foundation announced it in such a unilateral, this-is-how-it’s-going-to-be manner. I understand that there are a few reasons that the IF decided not to solicit community feedback: 1) it would take many months to utilize the governance framework to approve these measures, which the IF didn’t believe they had, 2) the IF truly believes that this is the ONLY way forward, and if these measures aren’t enacted the IF will need to close their doors, and 3) Dom himself has said recently that community governance and DAOs are still in their infancy, and one token, one vote is not fair for this type of decision, since whales would have outsized influence.

Regarding point 1), I would argue that the IF could have solicited community feedback if they really have been discussing this internally for as long as they say they have been. In a way it feels like the IF doesn’t trust the community to make decisions that are in the best interest of the protocol. But I think we would surprise them if given the chance. Why have we been developing this governance framework anyway? If our goal is to develop a truly fair, decentralized protocol, the IF must relinquish control and let the community take the reins. I believe that we all want this protocol to succeed, and we will do what’s necessary to help make that happen. If it came down to a Firefly vote that barely passed, I think the community would accept that, even a good number of those that would have voted against it. And if the vote failed, I think the community would have come forward to propose other creative ideas to solve the problems at hand.

Regarding point 2), this feels like the IOTA Foundation is acting to preserve their existence at all costs. And while I would fully agree that we need the IF to continue research and development on the network even after IOTA 2.0 (ZK rollups, sharding, etc.), I also question the amounts of inflation and the entities that are being formed. Do we really need so much for the UAE Foundation? And these Ecosystem / Contributor Funds feel like money is being taken from the community, only to slowly give it back to those who are willing to contribute. And while I am a longtime contributor and hope to be able to recoup some of those funds through future contributions, not everyone can or will contribute, so it still doesn’t feel quite right.

Regarding point 3), yes, DAOs may have a long way to go, but I personally don’t think they have “failed”. The governance structure that we have developed for use with the Shimmer Treasury is sheer proof of that. One could even argue that one token, one vote might be appropriate for just this situation, because whales will lose more access to the network after the token inflation than small holders, so it might actually make sense here. And even if the community doesn’t agree that one token, one vote is fair in this case, this isn’t the only voting mechanism. How about quadratic voting or some other creative mechanism?

There is also one last piece of criticism I’ll share. The way I understand it, some of the newly-minted tokens will be made available to institutional and accredited investors at a nice discount. It seems that they will be able to buy these tokens at 20–30% less than market prices at that time. And while this practice is somewhat common in the investing world, it doesn’t seem right that this discount would apply to newly-minted tokens. Perhaps we should assemble like-minded community members who are willing to offer funds to a multi-sig wallet so that we can form a community institutional entity, to buy tokens at discount to recoup some of the dilution we are facing. I’d be interested in forming such an entity, and I know several others who would be as well …

For even further discussion about criticisms against these actions by the IF, I would recommend the following very well-articulated and thoughtful piece by IOTA co-founder David Sønstebø: Can lightning serve as a silver lining?

Wrapping It All Up

Listen, I get it, inflation is hard to take. IOTA has already felt like the black sheep of the crypto community for years. And now there may be more pain ahead. But to be fair, I’m no soothsayer. Strange things happen in the market, and maybe this is just the type of news that will entice large outside entities to invest in the protocol, seeing the new opportunities that these plans enable. I’ve definitely seen stranger things happen in terms of price action with IOTA in the many years I’ve been here. I would have expected a sharp reaction in the IOTA price already, and instead there has been a dump in Shimmer while IOTA has remained more stable. Who would have guessed?

Let’s face it: this is make-or-break time. Either this works, and we wind up back in the top 10 on CMC where we belong, or it’s over. At least we’ll know one way or the other and we gave it our best shot. I’m going to stick around for the ride, if for nothing other than principle alone. The virtues of feeless crypto transactions make too much sense for me to be able to fully support another crypto network while IOTA has a chance.

At the same time, there are many exciting opportunities on the horizon that were never possible before. The implications of Layer 1 smart contracts on a feeless DAG are truly breathtaking — this is what we really need for EBSI, complete Digital Identity, DeFi, etc. Demand will begin building for the IOTA token as well as Mana. The IF will have the war chest they have always needed to properly compete in this market. If they have accomplished what they have over the years on a shoestring budget, imagine what they will be able to do with this scale of funding! And the entire ecosystem will get a boost as well, so that those who want to contribute to the success of the protocol can be properly compensated for doing so.

Despite the relatively harsh way that the IOTA Foundation’s plans have initially come across, I hope I have shown above that the steps they have proposed are a natural, logical progression from the first realization that smart contracts could be deployed on the Tangle. There really isn’t a better solution that I can see, I just wish that these plans had been accomplished through more community involvement. As a community we need to rise up and become more involved in the decisions that shape the future of IOTA, anf the IF needs to welcome this. I hope you agree and decide to stand firm as we hold on for the ride. It’s gonna be a wild one.

🌟 Community Spotlight: Kutkraft

[Interview by Mart]

The Tangleverse Times: The community probably heard quite some parts of your IOTA story in your videos, but can you give a condensed version of how you found out about IOTA?

Kutkraft: I held BTC back in 2013 on Mt. Gox, which means I lost them all to a hack. I got so butthurt that I couldn’t stomach seeing the word ‘cryptocurrency’ or ‘bitcoin’ for like 4 years. But, I started to pay attention again when Ethereum was starting to show real world applicability with smart contracts, so I decided to dip my toe back into crypto… and I had no idea it would lead me to where I’m at now.

So it’s early 2018, and my girlfriend at the time agreed to invest in crypto with me, and we started to research projects that would have the best chance of reaching mass real world adoption. And… she found IOTA... this is all her fault.

Long story short, after reading about the vision, and with IoT being one of THE trends of that time, I fell into the rabbit hole. Got active on Reddit, felt like that wasn’t enough, so I ended up finding my way to Discord and Twitter (VROM was the first IOTA account I followed). And here we are… 5.5 years later…

TvT: You’ve traveled quite a bit in the past couple of months, until you got back to Australia, right? What stood out the most for you on your travels and what did you miss the most during that time?

K: I lived in Japan for 18 months in my early 20s, being there gave me a sense of ‘newness’ that I hadn’t experienced since I was a teenager. When you’re in a situation that is completely foreign to you, where the things you take for granted at home become a mission, like ordering a coffee, or being able to read the labels on products when you’re shopping for groceries. This experience puts you in a position of constant troubleshooting, and while you’re in a state of trying to decipher everything that is going on around you, your days feel longer, time slows down, and every day is different… you start to feel like you’re living and not simply existing.

This is part of why I wanted to get away for a while, now in my 30s, to recapture that feeling of living, unique to the experience of traveling in a foreign place. And that’s what I’ve been missing since being back home.

TvT: Apart from your omnipresent positivity, you have a good feeling about general crypto vibes and trends. What do you think IOTA / Shimmer should focus on in the near future? Is there something that doesn’t get as much attention as it should?

K: I feel like trends and hype are hard to see in bear markets, nothing really sticks as a narrative when no one is seeing any opportunity, people just aren’t interested right now, and that makes it hard to see what is beyond the current crypto landscape.

Having said that, I think ‘useful’ NFTs have got a place in the near future. Crypto will likely see a move away from NFTs as ‘jpegs’, and more towards the next iteration of NFTs as ‘tools’. The concept is applicable in a lot of real world applications, probably most impactfully, as ‘digital twins of commodities’. But if we use an example in something I’m more in tune with, then I think ‘equipable’ NFTs are shaping up to be huge in the GameFi space, where we can embed NFTs within NFTs (like upgrading weapons in COD for example) to directly impact our in-game experience.

-Want to mine materials quicker? Then equip your Character (NFT/Parent) with a better pickaxe (NFT/Child).

And that’s where I think our community is culturally at. Many of us have looked at crypto as a tool, an idea that is related directly to IOTA’s original IoT vision. So, I think it’s natural that we look at derivatives like NFTs in the same way. I mean, we’ve already seen our DeFi platforms do this with their NFT collections, where holding their NFT rewards the owner with airdrops of ‘x’ amount of tokens, or ‘x’ amount of discounts on trades, etc…

In a nutshell, I think pushing the ‘useful NFT’ idea forward is something we’re in a good position to do with our IOTA/Shimmer ecosystem, both technologically and culturally.

TvT: How much did Chris Müller influence you in your videos and your style?

K: Chris’s influence on my videos is in the perpetual optimism he always had. I remember getting most excited when he’d express his confidence on a personal level, when in times of uncertainty he gave us his perspective. Of course watching him explain the updates was great, cos he had a real clear way of explaining what was being done (and it made me feel less smooth-brained), but it was when he revealed how he felt, that I would feel inspired with confidence.

My favourite part of his videos was when he’d bless us with the Steve Jobs clip, my nipps would go wild when I heard ‘and one more thing’. So I guess I’d say the biggest thing I took from Chris, is his positivity… and leaning into how a development feels on a personal level, after I’ve tried to explain them.

TvT: When face reveal?!

K: Dude I was thinking of doing it this year when I returned from my time off (around April/May). But! things didn’t go as I imagined they would… I haven’t been able to secure consistent financial support for producing Spec Weekly, and my savings are slowly disappearing. So, in not knowing if I can turn this into a career, I have to keep my face hidden… I don’t want potential future employers or coworkers to know about all the crypto degeneracy and nipple talk.

I’m thinking if things get better for me in the next 6 months. Like if my NFT project takes off, and my work in our ecosystem helps put food on the table and pay rent… then yeah I do de face reveal.

TvT: What about some Kutty specials? What are your favorite TV shows? What’s the biggest surprise you watched in the last year or so?

K: My guilty pleasure is trash TV. I watch a lot of ‘90 Day Fiance’, and I have a history of watching ‘Ex on the Beach’ and ‘Temptation Island’. I don’t know why I’m so into the trash, I can’t explain it. I like good shows too. ‘Yellowstone’ was dope, and so was ‘The Last of Us’, they were my favourite shows in the last 12 months.

What I was most surprised by was the ‘Dark Side of the Ring’ series from MTV. I was a huge pro-wrestling fan when I was a kid, and I had no idea about how hard it is to be a pro wrestler, they do some crazy shit. Definitely recommend the series if you’re into wild stories.

TvT: You briefly shared some ideas in Spec about a NFT project / game that you were planning to do. Any updates? Do you still plan to do it?K: YES! We are now 9 months deep into the project, I managed to secure the best tech partners I could have hoped for. They made me sign an NDA, so I can’t say who they are, but they are trusted and embedded in the ecosystem. You know finding a builder was my biggest worry early on… I say that cos I mentioned ‘useful NFTs’ a little earlier, and the vision I have for the project is to stimulate maximum engagement and excitement from the community that builds around the project… and to get that kind of buzz, I feel you need to introduce gamification, consequences, and rewards.

So being an artsy/ideas guy, there’s no chance I could have done this alone. So, I’m feeling blessed to have a professional team by my side to turn this crazy idea into reality.

The challenge right now is in getting our MVP up for some internal testing, and when we have the first PoC running, the team will be able to give me a realistic go-live date, I’ll then start going public with the project when I have an ETA to work towards.

The art is about 50% done, I’m doing it anime style.

I’ll do some teasers in the Discord of one of my partners ‘Epoch Zero’ in the coming months.

I’m hopeful it becomes one of our blue chip NFT projects…

And thank you very much for asking this question! I’m fkn pamped!

TvT: Did you ever consider becoming a voice actor? I could totally see you synching some Bollywood movies! No… jokes aside, your voice is just something else and you really should consider doing some movies or audio books!

K: HAHA! Bro… ever heard your own voice on a recording? Makes you wanna vomit… and here I am sitting through hours and hours of editing, cringing every minute. I’d do some voice acting if I didn’t have to listen to it. I offered to do it if Shi-Universe wanted to make an Aussie character in their game. But no way for anything serious…

TvT: Honest question: How many Australians are scared of spiders? While quite some of them are ginormous, there aren’t that many poisonous ones right? But is it just normal for you guys down there to meet spiders the size of a Chihuahua every other day?

K: I’m scared of them. I saw a funnel web spider once while camping, it’s one of Australia’s deadliest spiders. It’s hard to explain their colour, it’s a deep black that makes your balls shrink. Kind of like, the dead black of a shark’s eyes. It makes you want to either kill it or run, and I think that’s the most common reaction for us here. Hope I’m not offending anyone out there, but these little alien creatures are like little 8 legged demons that sit in the corner of your room and just watch you, motionless… waiting…

Having said that, we don’t see the big ones or the real dangerous ones in urban areas. So it’s really not a daily thing. But out in the country, where people have outdoor toilets, it’s not unusual to get your left testicle bitten. Or ladybits bitten if you’re a lady.

TvT: Final question, this question was asked in various different formats across the Tangleverse Times Magazine, but you might be a prime candidate to get an amazing and cool answer: The year is 2039, we’ve long since made it. You’re chilling in a hammock and reflecting back on all the crazy things that happened in Moonaco years ago. How’s your life, now that you’re financially free? What name do your kids have and was it a wise decision to make Moonboy Thomas their godfather?

K: I lay in my hammock, the tropical breeze caressing my sun kissed skin, as I swing gently to the rhythm of inertia. A smile creeps across my face as I remember the early days, the craziness, my fears, my bros in the Discord, the p parties, the salt mines, the FUDDERS, and the champions… ‘I wonder what they are doing right now…’

I look over to the backyard of my coastal home, somewhere on the equator, to see my (future) wife watering the flowers. I’m grateful, reflecting on how I was able to be there with her and the (future) kids, as they grew up, thanks to the risks I took in another life…

My morning begins on the beach that is connected to my home, holding hands with my wife as we walk in unison on the golden white sand. My days are simple… I take the kids to high school, come home and do some clay sculpting, then pick them up in the afternoon.

They study, we eat dinner, we talk, we watch a show, we play some PS6…

I’m sorry to disappoint that it isn’t a lavish hi-tech life of adventure and expensive shit. But to me, this vision of my future is paradise.

🛣️Tl;dr: IOTA's path to decentralization

[ - by Ness]

Gabriel Zani from CoinMarketCap interviewed Dom Schiener about how the IOTA2.0 upgrade helps bridging the gap from Web2 to Web3. If you don’t have the time to listen to the recording: here is your tl;dr.

Since its beginnings in 2015 it has always been important for Dom that they are doing something different than Bitcoin and that they were serving a purpose with IOTA. He mentioned two main founding reasons for IOTA:

- The believe that they can build a better blockchain architecturethat is not based on blockchain but on a DAG. That way they want to solve the scalability and decentralization issues and also tackle the fees.

- They had a strong vision, that they want to apply blockchain into the real world and having an impact there.

As IOTA was more of an enterprise blockchain instead of a crypto blockchain as Dom called it, they did not play a big role in the last bull run since there were no DeFi, no NFTs, no tokenomics. But just recently the IF launched the ShimmerEVM and Stardust, which introduces tokenization on L1. As a next step IOTA will become fully EVM-compatible with lots of dApps and a thriving ecosystem.

Deeply embedded in the vision of IOTA are the 5 principles it is build on:

- Accessibility

The node requirements for IOTA are incredibly low so that everybody can participate as a validator which makes the project more decentralized. - Parallelism

The DAG architecture of IOTA makes it more scalable since it scales horizontally by removing the blocks and the chain. There is no limit to a number of blocks that can be added to the chain. - Volume and Velocity

This principle is about speed. A transaction on IOTA should be confirmed within sub-seconds. - Social dynamics

Digital Identities are also embedded in the protocol. They create a safer and more secure environment to manage your assets and participate in the network. - Sustainable Tokenomics

To make sure that the network participants are fully aligned, IOTA uses a novel architecture. Network participants are incentivized by introducing a secondary token that gives them access to the protocol. Those who have enough Mana can execute feeless transactions on L1.

Especially when it comes to the cost of a transaction, IOTA can offer something unique: feeless transactions. Dom separates those who want to execute a transaction into two groups. The first group are those who are invested in the protocol, the token holders. They validate the protocol and therefore receive Mana as a credit. When they use the network, they burn those credits to execute the transaction. There is no need for a transaction fee. The second group are those without credits. They need to buy credits on the market and can then use the network.

A glimpse into the future

Gabriel asked Dom what he thinks IOTA will look like in 2026. Here are the four key achievements Dom believes in:

- Having at least 1 to 5 billion USD in tokenized assets on IOTA

- IOTA being one of the largest web3 ecosystems, including DeFi, GameFi and NFTs

- 50.000 to 100.000 active daily users

- Strong strategic partnerships with governments, enterprises and institutions

Dom also gave some advice for people that are new to the IOTA / Shimmer ecosystem. Most importantly you should “be in it for the right reason”. Just joining because you want to get rich quick won’t go far. DYOR, be engaged and become a part of the community!

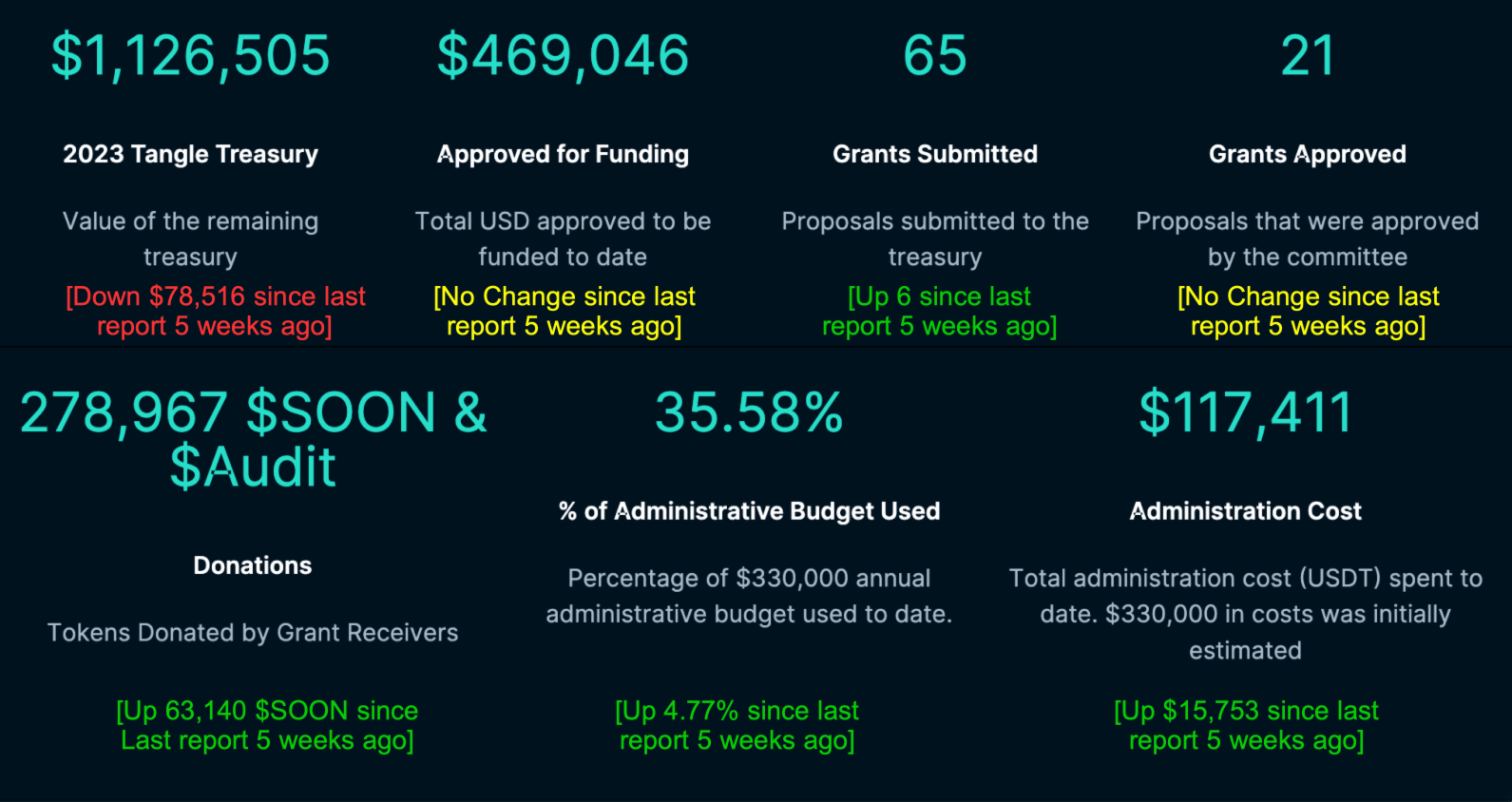

🆕 Tangle Treasury Update

[ - by DigitalSoulx]

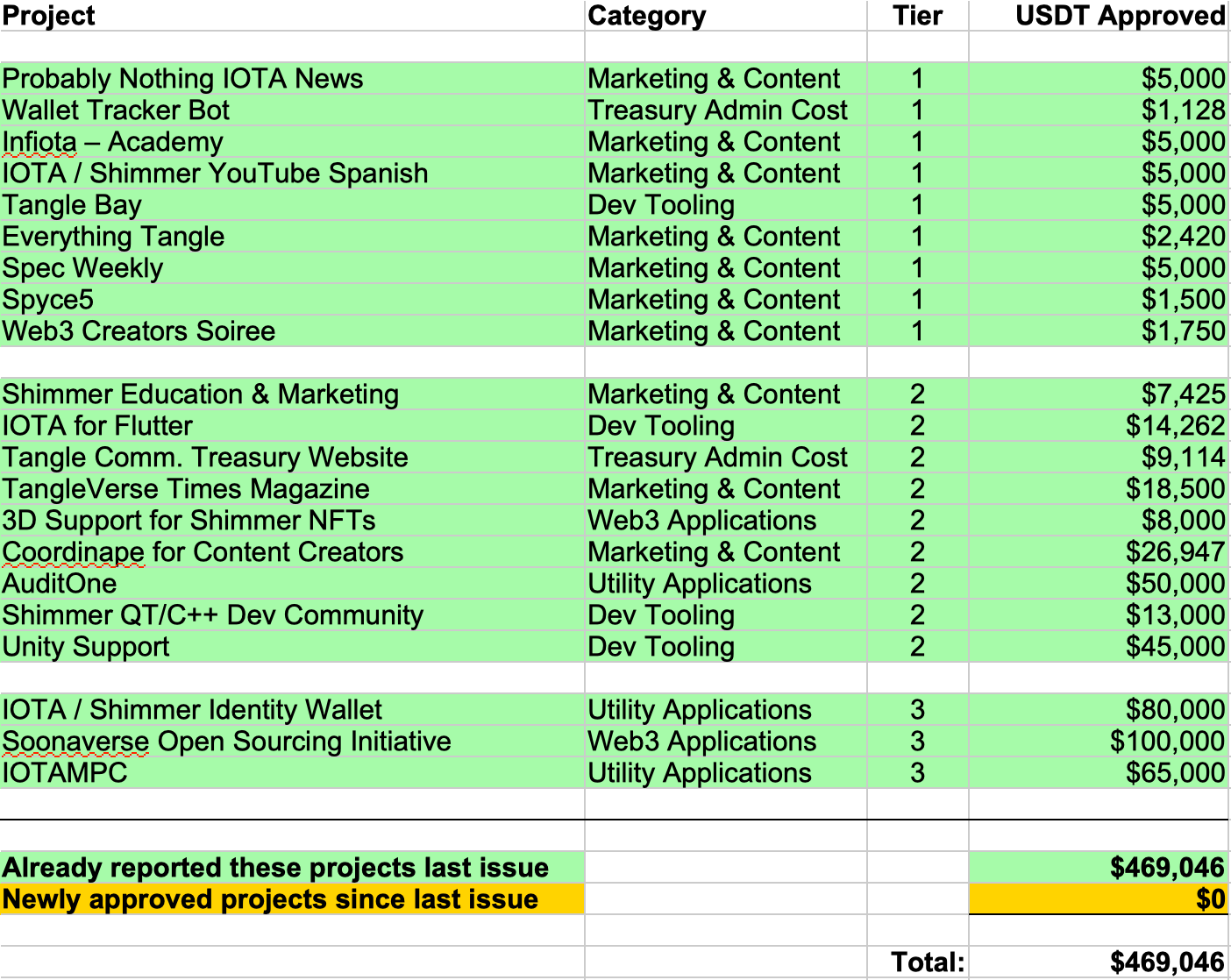

As previously reported, we have offered to include Shimmer community Treasury updates in each issue of the Tangleverse Times, as a way to thank the community for their support of our publication. These updates are intended to be a way to see the status of the treasury at a glance, but for more detail about each of the individual proposals I would highly recommend visiting the great website that JD is maintaining! It is quite complete and up-to-date. So, here is the current status of the treasury as of the end of September 2023:

And that’s a wrap! Please like, share, smash that subscribe… or better yet, join us! Do you love to write? Passionate about the IOTA ecosystem? Do you have a project to share? Master at making memes?

We want to help the community discover their strengths and stay updated about everything IOTA. We cannot do this alone. Community participation and feedback will help keep The Tangleverse Times up-to-date and invaluable. Help us help the ecosystem.

The best way to reach us is through Discord: discord.gg/2BeCTUMPAM

Follow us on Twitter: @IOTAcontentDAO and @TangleverseWeb

Special thanks and honourable mentions to all the hardworking ICCD degens who contributed (in the form of written, editorial, design, advisory, and memetic support) to this edition: DigitalSoul.x (Rob), Mart, Ness, ID.iota, Linus Naumann, Laura Kajtazi, Kutkraft and Epoch Zero.

If you enjoyed the newsletter and would like to see it continue to grow, you can also donate here: iota1qp7l8s5026k7gvd2m0t8cyj754geslnl6vtt0cxzf0xlsvyeug2pv85rh78 smr1qzv5agn7ty5kvmucu6atl4hkhqp3r9cgurh4pdw0rml347tc0jxtwmn4dhk