ShimmerBridge: Bridging the Gap to Adoption

⌨️ From the editorial desk...

[- by Ness]

The new year started with a lot of good news. Not only do things move forward in the UAE but Shimmer also launched a huge marketing campaign to bring new people to our ecosystem and show the functionality of the ShimmerBridge.

In this campaign a total of $1,000,000 worth of Shimmer token (SMR) – 1.5% of the total SMR supply - will be distributed to the participants of the official Shimmer EVM Bridge Campaign! You can participate on tangleverse.io. All you have to do is bridge your assets from other networks and provide liquidity on selected DeFi platforms on Shimmer.

Besides the official Shimmer Bridge Campaign another 10 projects came together and launched the DeepSeaAdventures campaign. You can complete on- and off-chain tasks to win amazing prizes and support the DeFi and Gaming ecosystem of Shimmer 🔥

In this issue the focus therefore lies on the Shimmer Bridge. Moon provides some insights on the current TVL and gives you more information on the campaign itself.

The Community Spotlight highlights no one less than IOTA Penguin and in the Meet the IF category, Mart had the pleasure to interview Adrian, who currently works as solution architect for the EBSI project.

And don't forget to check out the Shimmer Roadmap 👀

👨💻 Monthly Technical Update

[ - by ID.Iota]

GM 🌅 #IOTA Fam 🤖,

we have a new year and so comes a new update on the latest happenings around IOTA 2.0. The following article will give you an insight into the latest developments of iota core, the node protocol running IOTA 2.0.

What happened since the November?

Since the last monthly update the team did an overhaul on the iota core milestones. They left the old declaration of 1.0 / 1.0 RC / 1.1 / 1.1 RC behind and switched to a new declaration that more clearly indicates the state in which we currently are.

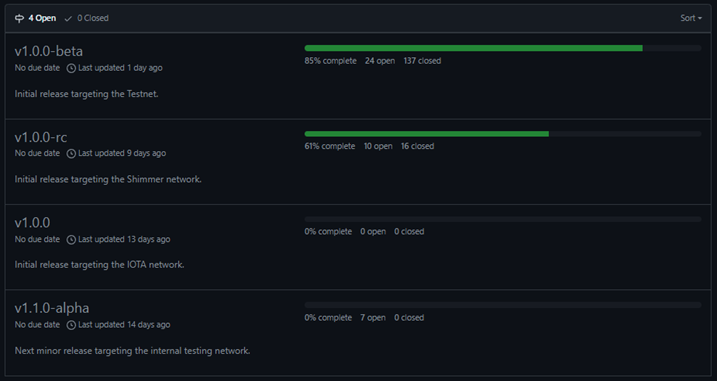

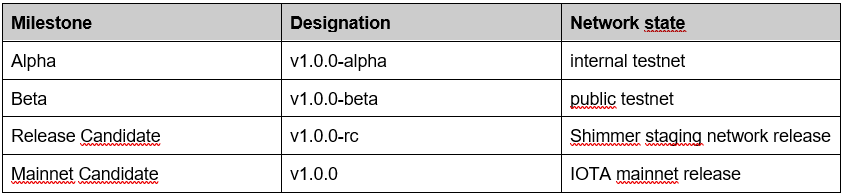

As you can see in the picture above, the team has relabeled the milestones and is now differentiating between four different stages of each release. The indication of each milestone can be read as shown in table below:

After v1.0.0 the next minor release will need to go through all of the stages above to come to the #IOTA mainnet.

So much to the milestones. Since we haven’t seen any public testnet to play with, we currently should be in v1.0.0-alpha, right? Correct. That’s exactly where we are. 3 weeks ago we saw the release of the first v.1.0.0-alpha.1 on GitHub. Following that initial release we have seen 4 additional alpha releases and thus currently are in v1.0.0-alpha.5. You can find the overview of the releases here.

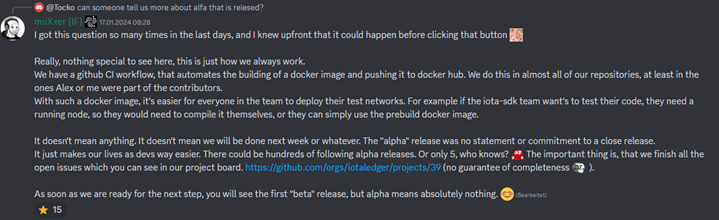

As stated by muXxer the initial alpha release does not indicate any specific milestone, they did the initial release in order to get their GitHub CI workflow running. The CI workflow automates the building (compiling) of the current node software in order to make it easier for everyone to test it. See the short statement on the alpha release below.

While muXxer is pretty clear that we shouldn’t read too much into this alpha release he also states that the best indicator of progress is the amount of open issues on the iota core progress board.

Where are we currently with the node protocol?

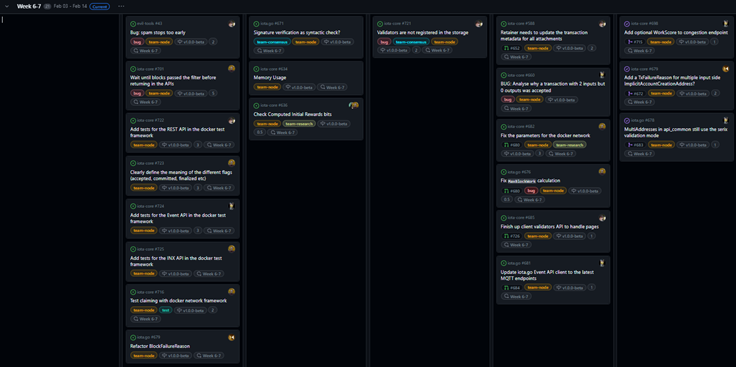

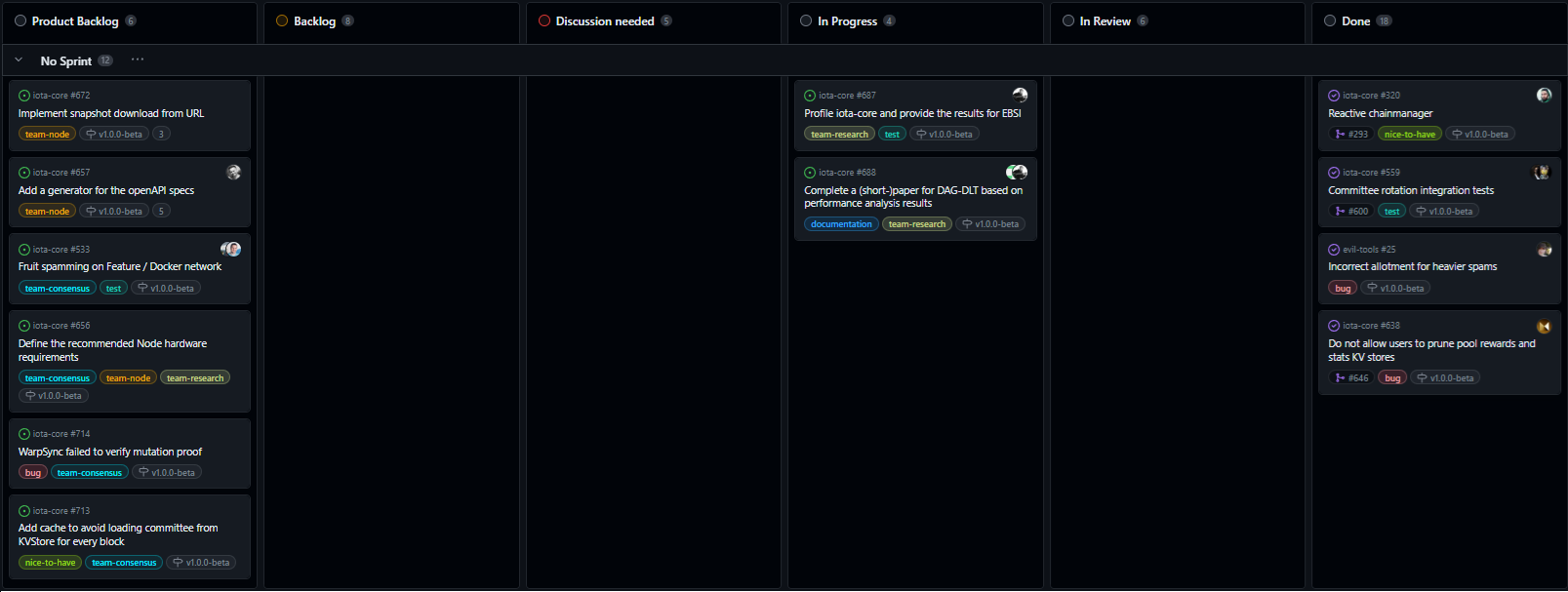

So let’s have a look at the board of milestone v1.0.0-beta. As we can see in the board below, the team started to plan their work on issues in specific sprints. Their sprint length is 2 weeks. So they are planning to have all issues - shown in the overview below - resolved by the 14th of February.

Most of the issues to be addressed in the current sprint are bug fixes or API test cases. So on the node protocol itself nothing too crazy is happening. So let’s not spend too much time going through every single one. If you are interested in all of the specific issues addressed, you can find the project board here.

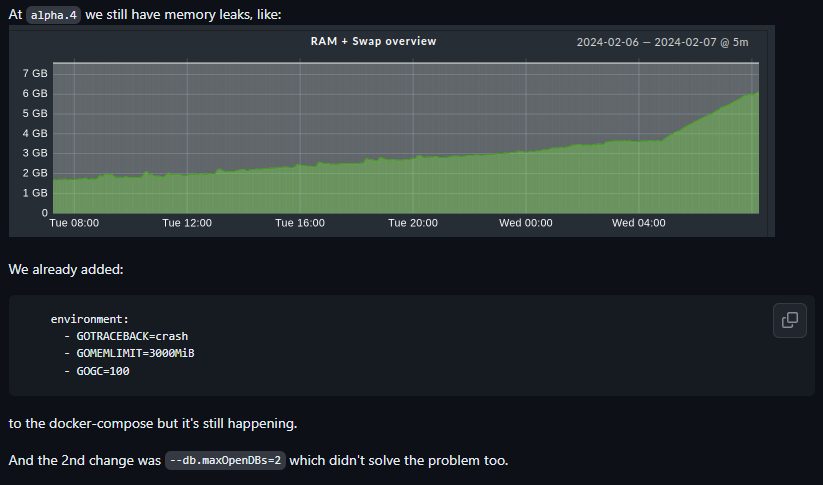

Issue #634 however, seems to be pretty interesting. Having a node running for a few days seems to lead to a slowly increasing memory (RAM). While the overall RAM consumption in the test has never surpassed 3,5 GB it shows that something in the code needs more and more RAM the longer the node runs. This is ultimately unwanted behavior and would lead to decreasing node performance over time.

So basically somewhere in the code data is written into the RAM and isn’t deleted afterwards. Currently it seems that this issue still exists on v1.0.0-alpha.4.

I don’t think this is a critical issue but might be one of those nasty bugs that need a few iterations of deep diving into the code base…

And what comes next?

So let’s assume the team planned their sprint according to what they think they will achieve until the 14th of February. Let’s also assume that all issues they are aware of up to now are created and listed on the iota core project board. If those assumptions are correct then only a very limited number of open issues are left. The remaining open issues don’t look as if they are critical bugs.

Let me be clear, it is likely and expected that the team will continue to find bugs, issues and necessary clean ups. Currently however it does look like there is end in sight.

To put that into perspective. Dom just recently talked on a KuCoin X-Space about releasing the IOTA 2.0 testnet in Q2 2024. The latest Shimmer Roadmap blog states that we should expect IOTA 2.0 on the Shimmer staging net this year. So I think the picture forming is that we will see a public testnet in the next months and then a few months of public testing with the community. Based on those steps it’s likely we will see the IOTA 2.0 update coming to Shimmer at the end of the year.

Being precise i don’t think we will see the IOTA 2.0 upgrade on the iota mainnet in 2024.

With that out of the way, we will see, feel and play with the biggest IOTA upgrade EVER in 2024. I remain optimistic and can’t wait for what this year will bring. Shimmer going L2 multi chain, IOTA EVM, RWAs on IOTA, IOTA 2.0 on a public testnet, IOTA 2.0 on Shimmer. 4$ EOY.

🌉 Gotta bridge them all

[ - by moon]

Hi friends, I’m moon. You may remember me from such X threads as:

“How to Hack the IOTA Coordinator with a Raspberry Pi”

“How to Make Your Own Shimmer NFTs Using MS Paint”

“How to skip IOTA 2.0 and start with 3.0 instead”

Today I’m writing about a more serious topic: the ShimmerEVM bridge.

Let’s GO

Disclaimer: Always conduct your own research.. This post is not investment advice.

We are back baby

Crypto winter was long and cold. It’s still cold outside, I know (unless you live in Australia), but we can now say the bull market has started.

So what happened?

Bitcoin ETFs have been approved and the halving event is getting closer and closer. To be honest, the approval hasn’t started a real rally yet. Keep in mind that ETFs will bring more institutional money into crypto, as they offer a more convenient and regulated way to invest in Bitcoin.

This event is a long-term play, so the real BIG pumps should come from time to time.

As a non-BTC maxi, I care more about altcoins like IOTA and Shimmer, especially since the launch of the ShimmerEVM. We can see DeFi use cases growing, and with it, the whole ecosystem.

You don’t know what EVM is or does? I will explain:

Shimmer EVM

A crypto token without smart contracts is like french fries without ketchup: incomplete. (This post is not sponsored by McDonald's.)

Shimmer does not have SC (smart contract) on its Layer 1 yet. So EVM (Ethereum virtual machine) has to be our ketchup.

ShimmerEVM is the first application layer anchored to the Shimmer network. So it is a Layer 2 solution. It allows the execution of Ethereum based smart contracts in a fast and secure way. Without Smart contracts Usecases like DeFi wouldn’t be possible on the Shimmer network. Thanks to the EVM, the Shimmer ecosystem is growing rapidly especially in the DeFi sector.

Smart contracts facilitate transactions within a dApp, enabling the exchange of value, such as tokens or data, between parties without the need for a third player. It might sound like one of those 'cut the middleman' scenarios, but I swear it is true and legit.

Computer power is necessary to calculate and execute a smart contract, for example, to provide liquidity in a pool. DApps like ShimmerSea, Nakama Labs portfolio, and Tangleswap are the OGs in this scene.

Other use cases, such as minting and swapping NFTs, as well as verifying ownership, depend on smart contracts. By the way, CHECK OUT Soonaverse for your NFT needs.

“It seems legit, but why do we need a bridge?"

Gotta bridge em all

Are you tired of only using Ethereum-based chains? It's time for a change. Shimmer now has a bridge, and it's been in operation for +1 Month.

So we have Stuff like DeFi running already on ShimmerEVM. What benefit does the bridge bring?

Have you ever played one of the first Pokemon editions on the Game Boy? No WLAN, no Bluetooth, no infrared laser stuff, and no internet. So you could do everything on your own device (blockchain) but cannot connect to other devices... unless you were one of the cool guys with rich parents who bought you a "link cable" (bridge). This cable, bridge, whatever enabled your Game Boy to connect to another device to trade your Pokemon.

Well, the same goes within the crypto world. Without a bridge a blockchain would operate in isolation, limiting the scope of dApps and smart contracts to their native blockchain.

Assets like BTC, ETH, and stablecoins like USDT can now be smoothly transferred to the ShimmerEVM network without a hassle. This brings in some fresh cash from outside the bubble, to the Shimmer ecosystem.

Use shimmerbridge.org/bridge for easy transfer between different chains

Powered by LayerZero

One of the most OG bridges is LayerZero. A protocol that helps different blockchains interact with each other. It allows data and value to be transferred across many chains (cross-chain).

It is especially useful when a dApp or a smart contract needs to work on several

blockchains.

This bad boy connects over 50+ blockchains with each other and as of the latest data, LayerZero has transferred over 90 million messages across supported blockchains, with a total value transferred exceeding $50 billion. Not bad!

So where do we stand now?

EVM is ready

Bridge is ready

How can we measure the success of Shimmer?

TVL!

TVL stands for Total Value Locked. It is the number #1 metric to measure DeFi dApps success in a chain. So more TVL means more popularity and trustworthiness. It also shows liquidity and availability.

For example, if you deposit 1 $SMR into a DeFi platform like ShimmerSea on ShimmerEVM, the TVL of that platform increases by the current market value of 1 $SMR. If the user borrows 100 LUM from the same platform, the TVL does not change, because the borrowed LUM is still backed by the deposited SMR. However, if the user uses the borrowed LUM to buy more SMR and deposit it back to the platform, the TVL increases by the value of the newly deposited SMR. I hope this makes sense to you. It is easier to understand if you try it yourself.

Let's check out the numbers for our boy Shimmer, as per DeFiLlama:

The TVL of ShimmerEVM has seen a big rise in recent weeks, going from $4-$5 million to around $13 million.

There are 7 registered DeFi dApps, and ShimmerSea is numero uno with a TVL of $5.7+ million.

As of writing, ShimmerEVM holds the 73th place among all chains.

Overall, Shimmer had a good start. We have to keep in mind that the IOTA ecosystem missed the DeFi hype train 2 years ago. But now, we are back. The ecosystem is established and working. Other narratives like real-world assets and AI are taking over. But hey, the narratives are always rotating, and I believe we will see DeFi coming back very strong again. Especially when Degens who made a big chunk in the bull market want the tastiest yield. Also, there are Bitcoin L2 Dapps forming, but that's another topic for another rainy day.

$SMR Airdrop

As you may already know there is a HUGE $1,000,000 $SMR airdrop. It has been active for +1 Week now.

I know you are lazy so I will post every relevant info here at a glance:

Cheat Sheet:

Campaign date

➜ Started January 31 3PM CET

➜ Deposit deadline February 14

➜ ending March 16 3PM CEST

You HAVE to

➜ Bridge +$1000 into ShimmerEVM https://shimmerbridge.org/bridge

➜ Connect with tide and complete tasks https://www.tideprotocol.xyz/users/spaces/1500?referralCode=QXP6RY

➜ Hold TVL for at least 30 days (max 45 days)

(Get every day 1% more rewards for holding past 30 days)

⛔️Your TVL below $1k at any time is a BIG NO! = no rewards

The more you invest and hold for a longer period, the more Lambos you may afford.

🧑 Meet the IF - Adrian

[Interview by Mart]

Adrian is currently involved in the EBSI project and works for the IF as a Solution Architect.

The Tangleverse Times: Since we have established our “introductory” question, we just start as always: how did you find out about IOTA and how did you find your way to the IOTA Foundation?

Adrian: I overheard two of my colleagues at work talking about Bitcoin, and I started looking into the crypto space. IOTA quickly caught my attention because I found the Tangle structure extremely interesting. That, in combination with the focus on the machine economy, got me hooked and has never let me go since.

Q2: For the people who don’t know you, where are you from? What’s your favorite local dish and would you mind sharing a recipe?

A: I live close to the Alps in the South of Germany, Bavaria. I would say my favorite local dish is so-called “Kässpatzen”. I just learned some Barbarians translate it to Swabian-German Mac&Cheese, however this recipe looks nice. It’s quite heavy, but delicious and also a great hangover meal.

TvT: Since the IF has been 100% remote from day 1, who from the IF did you meet in person already and could you tell us a funny story that you experienced together?

A: I met most of my colleagues during a summit for the Market Adoption team in Berlin, and I also had the opportunity to join a research summit in Lisbon. Well, there's a funny story involving me and a ridiculously weak wooden door to the room I had at the summit. I'm afraid I'll have to leave the story there, and any colleague who experienced it live can have a good laugh. ;-)

TvT: Do you have a degen side in you and if so, what kind of dApp would you love to see in the IOTA / Shimmer ecosystem?

A: Actually, the 'degen' space has never really interested me. I've experimented with some platforms within our ecosystem here and there, but the majority of my motivation stems from the desire to solve real-world problems using distributed ledger technology. In other words, I prefer an NFT that represents a shipping container over one that represents a monkey avatar.

TvT: Do you have any pets? If yes, you are hereby forced to share cute pictures with us! :P

A: We have two cats at home, here you go. Enjoy our cat’s desire to climb into any kind of bag available.

TvT: Which vegetable do you really dislike, and why?

A: I’m not a big fan of zucchini, but to be honest everything can be fixed with oil and garlic.

TvT: We are currently working on our post-Moonaco world map, where and how would you love to live (at least temporarily) if money doesn’t matter?

A: That's the right attitude! The most beautiful vacation my wife and I ever had was in the Philippines. So, I would probably opt for a nice cabana on the island of Palawan, but of course, only with a first-class fiber connection. It wouldn’t be for very long however, I really enjoy living in a place with 4 distinct seasons.

TvT: You are the Discord Admin for a day and you need to ban one person, who will it be?

A: Hahah I’m not that active on Discord so there's no particular name coming to mind. I’ll leave these decisions to the actual admins.

TvT: In your opinion, what’s the most interesting fact about EBSI that people don’t realize yet?

A: Hm it’s not exactly about EBSI, but a direct result from the work in the project. With the beginning of the current and also last EBSI PCP phase, starting in January 2023, we migrated our solution proposal from IOTA Chrysalis to the Stardust version of the protocol. This step required us to revise the use case implementation patterns of the past. Under IOTA Chrysalis, almost all use cases were built with a strong dependence on a centralized Permanode, to fetch messages from the Tangle’s history. IOTA Stardust allowed us to utilize the UTXO Ledger, which persists on all network nodes, in a much more sophisticated way. During the past year, several generic and reusable building blocks, also involving L2 Smart Contracts, have been developed and these will come in very handy for upcoming projects in 2024.

TvT: What’s your favorite pastime? Sports? Reading? Video-Games? How do you usually spend your free time?

A: I like working out at the gym during the cold months and mountain biking when it’s a bit warmer outside. Other than that I enjoy cooking and spending time with my family.

🏆 NFT Top 3

[NFT data provided by EpochZero]

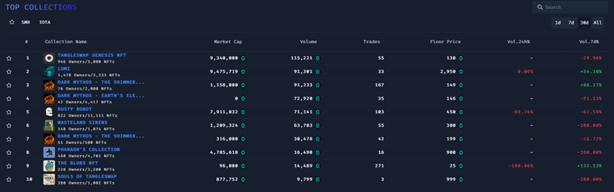

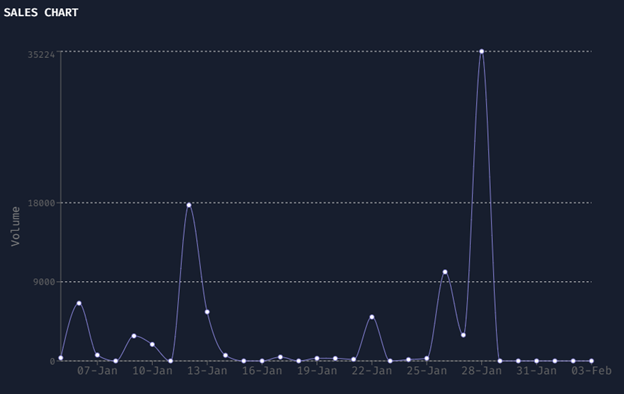

Since the launch of the $1 million Shimmer Airdrop campaign on January 31, 2024, the ShimmerEVM network has experienced an incredible increase in Total Value Locked (TVL) and currently stands at over $12 million. Not entirely unexpected, this is also reflected in the ranking of the most successful NFT projects over the past 30 days, as Decentralized Exchanges are among the main beneficiaries of the Shimmer Airdrop campaign.

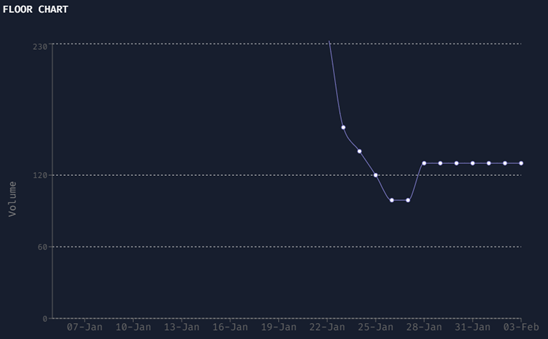

#1. TangleSwap Genesis NFT - After the Cardano and IOTA fairlaunch, establishing the initial price of the VOID token, the community of NFT holders recently conducted a vote to re-assess the direction they would like to see going forward. This resulted in Genesis NFT holders gaining a larger allocation of tokens immediately, rather than progressively over 2 years, avoiding the wait for IOTA EVM, NFT bridging to L2, and a suitable L2 NFT marketplace. Ultimately, this resulted in a universal and harmonized utility structure using the VOID token and VOID Energy across chains and ecosystems. This resulted in a sharp decline of the Floor Price and a surge in volume, with a total of 115,221 SMR over the past 30 days.

#2. LUMI - Lumis, the native NFTs of the most prominent DEX on Shimmer, which currently holds approximately 40 % of the TVL (Total Value Locked) on ShimmerEVM, have secured the second position in terms of volume and most traded NFTs.

#3. Dark Mythos – The ShimmerSea Edition - Dark Mythos, one of the most well-established and successful NFT projects on Shimmer, released another edition of Gaming Cards in January, namely the Earth’s Elements. In anticipation of this event, another edition of Dark Mythos, the ShimmerSea Edition, has capitalized on the newfound excitement and secured the third position in the rankings.

SPOTLIGHT – The community legend and creator of Spec Weekly, kutkraft, recently announced that he will be unveiling his NFT project, The New Elites, doing a special sneak peak on the EpochZero discord on Feb 9th at 8 PM CET.

About EpochZero:

EpochZero began as an NFT project created by several active members in the IOTA community. Their suite of tools for analyzing other ecosystem NFT projects as well as the supporters of those projects has already become the go-to resource for the community. The only requirement for full-access to these tools is holding one of their Pharaoh NFTs.

However, EpochZero is not just about NFTs. The founders of the project also hope to attract early-stage investors who wish to support unique ecosystem projects. This will allow community members to participate in the development of these projects. There are even more ambitious plans like starting a DAO, a game related to the Pharaohs, etc. Sound interesting? More information can be found via the links below. Check 'em out!

🌟 Community Spotlight - IOTA Penguin

[Interview by Mart]

The Tangleverse Times: What did you do prior to your Web3 engagement?

IOTA Penguin: Before immersing myself in Web3, my professional journey began in the corporate communications department of a substantial chemical company. Devoting nearly eight years to this company, I translated the theoretical marketing knowledge gained during my business administration bachelor's studies into practical applications. Our focus extended to comprehensive marketing campaigns spanning both offline platforms, such as large customer meetings and fairs, and online channels, including social media. Notably, amid the challenges posed by the COVID-19 pandemic, we creatively organized a virtual fair, adding a dynamic and enjoyable dimension to our work experience and the way we exchange with customers. I picked up a ton of knowledge and made some awesome connections during that time.

TvT: How did you find your way into Crypto and IOTA in particular?

IP: My journey into the world of investments began quite some time ago, and it took a turn towards the cryptocurrency landscape back in 2017. That's when I started digging into the whole crypto scene, and one particular project – IOTA – grabbed my attention with its forward-thinking vision. From that point onward, I began accumulating and delving into the fascinating realms of DLT and DAG.

Although I kept an eye on developments in the space, it wasn't until May 2020 that I decided to create an IOTA-related Twitter account. It was time to actively participate in conversations and share my passion for the project. People seemed to enjoy reading my thoughts, so I kept at it. My focus shifted towards crafting detailed Twitter threads and conducting thorough research on various ecosystem projects, adding a layer of depth to my engagement in the community. The journey has been quite the ride, and I'm eager to see where the future of IOTA takes us.

TvT: What are your experiences working as a freelancer in Web3?

IP: My journey as a web3 freelancer in communications, marketing, and community building has been diverse, having collaborated with nearly 10 ecosystem projects during my time as a self-employed professional. Working with many different project teams has proven to be the most effective method for expanding my skill set, with a steep learning curve.

Initially, adapting to the uncertainties inherent in freelancing was a challenge for me. You need to get used to the fact that out of the blue, a message on Discord could notify you on a Sunday that your support is no longer required. However, in just as swift a manner, fresh opportunities arise, and within two weeks, you might find yourself involved in new projects. These fluctuations became a part of my routine. Things have changed when I joined Nakama as a core team member, but more on this later.

Overall, I find immense satisfaction in working within the Web3 space, primarily because of the close interaction with the community. The community plays a large role in determining the success or failure of a project, making the work dynamic and rewarding. Interacting with individuals from various countries, each with unique backgrounds, has been a fascinating aspect of my journey. I am grateful for all the connections I've been able to establish throughout this experience.

TvT: What advice would you give people who are considering to start working in Web3?

IP: Prioritize building a robust network before launching into your Web3 freelancing journey, as connections play a crucial role in getting started. Moreover, I've achieved positive results by offering free-of-charge support to chosen ecosystem projects. This strategy has impressed many, leading them to reach out for continued collaboration and, ultimately, they became my clients.

Moreover, it's crucial to be open to receiving payments in stablecoins or ecosystem tokens. The majority of projects tends to prefer non-fiat options. However, if you are deeply involved in the Web3 realm, this payment arrangement should align well with your preferences.

TvT: What's your role at Nakama Labs?

IP: As mentioned earlier, I became a part of Nakama Labs' core team. Armed with the knowledge acquired from collaborating with diverse Web3 ecosystem projects, I felt prepared for the next phase of my career, and joining a core team was precisely what I aspired to do. Collaborating with Gabi and closely aligning with Kappy (Rob), my role revolves around project communications. I am primarily responsible for crafting long-form content, such as Medium articles, for all the dApps within Nakama's portfolio, which currently includes Deepr Finance, Accumulator, Virtue, and Genie's Bounty. Additionally, I actively engage in community activities, including planning and hosting events on platforms like Discord and X Spaces. Ensuring prompt responses to queries from our community members is also part of my responsibilities.

TvT: From your perspective working for an ecosystem project, what things still need improvement in the ecosystem?

IP: In recent months, our ecosystem has undergone significant positive transformations. One persistent concern of mine has been the lack of a well-defined community funding strategy, particularly for proactive members engaged in news creation and outreach beyond our bubble. With a significant war chest in place, I eagerly anticipate the incentivization of these activities, paving the way for broader coverage and a greater influx of individuals into our thriving ecosystem! We might have the best tech around, but if we don't spread the word, no one's going to use it. Time to shake things up!

TvT: Where and how will you live your life when we all made it? Different Country? Warm? Cold? We need some post-Moonaco ideas!

IP: That's an interesting question! While you might think the South Pole is the obvious choice, I'm actually more of a mountain person. We've just had a fantastic time in the French Alps, with breathtaking views from a cozy chalet. However, there are still many places on my bucket list, so I'll probably have to postpone this decision until we all meet up in Moonaco!

TvT: Do you own NFTs, if so which ones are your favorites? Are Penguins into NFTs at all?

IP: Honestly, NFTs aren't really my thing. I've always been more into researching and accumulating ERC20 tokens. It's just a personal preference. Nevertheless, I do like checking out other people's NFT collections and exploring new utility NFT concepts. However, if there's ever a penguin NFT collection launching on IOTA, hit me up!

TvT: Your website said that you are donating to organizations that support penguins. Tell us some interesting and important facts about penguins. Where can people donate, if they want?

IP: Exactly, during the time I was running my freelance business, I used to contribute a portion of my earnings to the Global Penguin Society. This organization is committed to the conservation of penguin species. Global warming poses a severe threat to penguins as it melts their ice habitats and affects their food sources. Supporting initiatives like the Global Penguin Society helps in addressing these challenges.

If you want to contribute, you can make a donation here: Link

TvT: With IOTA EVM and the first RWAs (worth more than 100 million US-Dollar) coming to the ecosystem, what are your expectations for the rest of the year?

IP: From my perspective, RWA stands out as the most exciting development in Web3 at the moment. While IOTA has been late to the DeFi and NFT party, they're now strategically positioned to realize the integration of substantial real-world assets onto the Tangle. Particularly with the swift decision-making in the UAE, I'm confident that the IOTA Foundation has secured the right partnerships to position itself as a leading protocol in this domain. For more details, make sure to check out my recent article in the Tangleverse Times: Link

📖 DeFi Education #7: Risk Management

[ - by DigitalSoulx]

Session #7: Risk Management Practices

Presented by Gruad [27 October 2022]

Summary, organization and additional detail by DigitalSoul.x

Our focus today revolves around the subject of risk frameworks as they relate to cryptocurrency protocols. A methodical approach for evaluation will be presented, unraveling the intricacies through a lens that investigates potential benefits and risks. A critical aspect of our exploration involves differentiating between risk and uncertainty, with a focus on effective mitigation strategies where possible. Note that while risk cannot be completely eradicated, cultivating an awareness of the risks at play and assessing mitigation efforts is crucial to finding those diamonds in the rough.

With a full understanding of risks and uncertainties, how do we measure these factors, if possible, and what actions should be taken when comprehending them? This sets the stage for a critical examination of a crypto project, encapsulated in a series of essential questions that unify the entire process within the framework.

Also, be advised that this is not investment advice but rather a mental model applicable not only to crypto but also to other areas in the broader world as well. The framework revolves around expected benefits versus expected costs and the ways we can quantify these concepts. So, without further ado, let’s embark on an insightful journey as we examine the complexities of risk assessment and mitigation in the realm of cryptocurrency.

Risk vs. Uncertainty

Risk

Risk and uncertainty are two different concepts, but often conflated. Perhaps the easiest way to distinguish risk is that risk can be calculated: there are clear, well-defined probabilities involved. Risk can be thought of as the probability of potential loss relative to the expected return on a particular investment.

Uncertainty

So how does risk differ from uncertainty? Uncertainty pertains to those qualities that elude precise quantification. While we may acknowledge its presence, assigning a concrete number seems impossible. This lack of certainty can manifest in different ways, such as unknown probability of an event occurring or possibly unknown associated costs.

In essence, uncertainty can be thought of as ‘undefined risk’. Consider a scenario where an investment has already been made. What’s the probability of an unforeseen event, such as a meteor striking the company or the team lead encountering an unfortunate accident? Attempting to attach a number to such events is highly speculative and contingent on too many assumptions.

The actionable insight here lies in discerning between what is calculable and what is not. By identifying and segregating the aspects plagued by uncertainty, one can effectively set them aside for consideration later.

Market or Systemic Risk

Market risk, also known as systemic risk, describes risk that is inherent to the entire cryptospace, not an individual protocol or project. To understand market risk, imagine the macro implications if the price of Bitcoin undergoes a severe reduction. It’s likely to have repercussions on all tokens in the market. For instance, if you hold a stablecoin, its dollar-based valuation may remain unaffected, but it would still likely appreciate relative to Bitcoin. Understanding these mechanisms and their susceptibility to market-wide events is crucial.

One example of market risk is political risk. The current landscape is rife with regulatory uncertainties. And when a bombshell announcement regarding regulatory compliance is announced in larger or influential jurisdictions, it often has a spillover effect on the entire market. While it is difficult to predict the outcome of these risks, it’s imperative to consider the potential impact. One way to gain more insight here is to draw on the expertise of the community. Individuals with related expertise in their own region, such as those well-versed in regional politics or recent legislation, can offer insights into potential impacts on the value of crypto platforms in those regions. Even though it’s called political (market) risk, these threats can be difficult to quantify, so for the purposes of our discussion they fall under uncertainty.

A case in point regarding political risk is the U.S. OFAC (Office of Foreign Assets Control) order on Tornado Cash, which not only impacted the platform itself but had spill-over effects on others relying on the Tornado Cash capabilities for funding, particularly in USDC.

Non-Systemic Risks

In addition to systemic risks, it’s imperative to consider non-systemic risks, which are dangers that apply to specific platforms or protocols. One such risk is the ever-present smart contract risk. The crypto landscape has had many instances of economic and smart contract exploits, and you can be sure that many more will come in the future. Platform-specific risks include, but aren’t limited to:

- Smart Contract Risk — Vulnerabilities or bugs in smart contracts can lead to exploits, hacks, or loss of funds.

- Marketing Risks — Poor marketing strategies can lead to a lack of adoption, decreased token value, or negative sentiment among investors.

- Management Risks — Developers or project founders may engage in fraudulent activities such as rug pulls (sudden withdrawals of liquidity) or exit scams (abandoning the project after raising funds), resulting in investor losses.

- Governance Risks — Weak governance structures or centralized control can result in governance attacks, voting manipulation, or conflicts of interest.

- Economic Exploit Risks — Economic mechanisms within protocols can be exploited by malicious actors to manipulate token prices, drain liquidity pools, or destabilize decentralized finance (DeFi) platforms.

- Regulatory Risks (these can also become systemic, as noted above) — Legal and regulatory uncertainties can pose risks to projects, including regulatory crackdowns, compliance issues, or bans on specific tokens or activities in specific jurisdictions.

- Oracle risks — Decentralized applications (DApps) relying on oracles for external data inputs face risks such as oracle failures, data manipulation, or inaccurate data feeds, leading to incorrect outcomes or financial losses.

- Tokenomics risks — Poorly designed tokenomics, including excessive token inflation, lack of utility, or unfair token distribution, can erode investor confidence and undermine the long-term sustainability of a project.

But how can one navigate and comprehend these risks?

The Lindy Effect

The Lindy Effect, rooted in survivorship bias, states that the longer a smart contract or platform remains unexploited, the greater the likelihood it will remain unexploited in the near future. However, this doesn’t guarantee immunity from exploitation. Also, this metric must be correlated with Total Value Locked (TVL) before placing any faith in it. Protocols with low TVL may not be lucrative targets for hackers. If a protocol has yet to be exploited, it could be due to remaining undiscovered or being relatively unknown, with insufficient TVL to incentivize hacking attempts.

When evaluating risks, key considerations include the age of the contract, the team’s experience, and any history of contract exploitation on the same platform or previous platforms. Notably, a team with a track record of multiple contract exploitations on a single platform raises a big red flag, suggesting a heightened risk of continued exploitation, even if the team has reimbursed affected users.

Additionally, it’s essential to assess if there are mechanisms in place to monitor contract upgrades. Contract upgrades can reset the Lindy Effect, and being informed about them is crucial. For instance, if a contract upgrade has a 48-hour window before taking effect, it might be prudent to consider withdrawing funds from the platform temporarily to observe the post-upgrade scenario. These risk mitigation actions contribute to hedging against potential risks, complementing non-monetary strategies well.

Although assigning exact numbers might be challenging, the key lies in acknowledging that there exists a probability associated with each action as well as an expected benefit.

Evaluating Opportunities

When evaluating an opportunity, it is essential to maintain a realistic assessment of what is known and quantifiable in terms of risks. While acknowledging the existence of smaller, unquantifiable tail risks, such as regulatory uncertainties or geopolitical conflicts, try not to dwell on them at this stage. Consider the larger, systemic impacts of these potential threats on the economy and the subsequent implications on any specific investments or platforms you might be considering.

In essence, we are engaged in a strategic battle against uncertainty, striving to tilt the odds in our favor by conducting a sober assessment of the benefits while mitigating the quantifiable risks. The guiding principle is to ensure that the cost of risk mitigation remains proportionate to the benefits derived from such measures. For instance, when insuring a million-dollar house, the choice of an insurance policy should align with the expected loss of the property. In what time frame will the premiums exceed the payout of policy, and does this time horizon align with your goals?

Furthermore, it’s crucial to recognize that when one engages with a token — be it a utility token, governance token, NFT, etc. — it represents a bundle of rights, liabilities, and risks. Mentally cataloging this bundle is imperative for comprehending not only what is gained but also the potential risks associated with changes in value. For example, a governance token may provide a voice in a community, offering value beyond financial gain. However, it may also carry risks, such as a slashing risk, where voting in a particular way could lead to a reduction in tokens held. A multifaceted evaluation should go well beyond pure monetary considerations.

Token Value vs. Token Price

When evaluating opportunities, it’s important not to conflate token price with token value. As just mentioned, tokens can be thought of a bundle of different rights within a protocol, and these rights form the basis of the token’s value, independent of price. Many factors can influence the token’s price without necessarily affecting the overall value. For instance, an inflationary token designed to distribute property rights among token holders may change the allocation proportions without a direct influence on the price of the token. Therefore, it’s imperative to scrutinize the true nature of the token, to understand how an investor might be diluted over time.

It goes without saying that the ‘number doesn’t always go up,’ particularly in crypto winters. As highlighted earlier, value is not synonymous with the token price; rather, value is a more nuanced consideration. This brings us to the core principle of your investigation: identify platforms that generate more value than the resources they consume. Identifying a platform that efficiently creates substantial value could be a positive indicator, especially if it utilizes its resources efficiently. And while true value can be tough to pin down, if a platform’s expenditures surpass its revenues this is a red flag worthy of further scrutiny. Aligning your holding timeframe with the platform’s ability to generate value is crucial.

Bootstrapping a project through a mechanism that encourages support for the token is a legitimate approach for many platforms. However, this method essentially involves exchanging a different valuable asset for the platform’s token or NFT, with the expectation that the platform will utilize that valuable asset efficiently, preserving the value of the medium of exchange. Ideally, the investment should contribute to meaningful outcomes, such as the creation of art, robust community infrastructure, yields, and more. In evaluating a project, the focus should be on identifying the value being generated. A lack of discernible value is a red flag and may indicate potential shortcomings or a lack of substance in the project.

Specific Tokenomics-Related Considerations

As it relates to tokenomics / economic exploit risk, assess whether the token can be shorted, borrowed against, or used for short selling. Can tokens be minted indefinitely? Is there a controlled minting function? Access to information such as burn rates through tools like a Dune dashboard is valuable for assessing a platform’s financial health. Understanding how the supply changes over time affects the proportion of long-term ownership on the platform.

The Team

The team itself also deserves scrutiny. Delve into their vesting schedule, particularly if they have immediate unlocks or if their unlocks precede those of other investors. For bonding tokens, analyze whether your lock-up period is more extended than that of the team or other investors. Also, identify who holds the authority to mint tokens (if possible) and their incentives regarding supply release or reduction. This is crucial in evaluating whether the current token price accurately reflects the expected benefits and risks associated with the platform and can help you to avoid pronounced sell-offs when tokens are released to other protocol participants.

Liquidity Concerns

Critical to this evaluation is an examination of the treasury’s status. In the event of a sudden decline in the native token’s value, the platform’s ability to meet financial obligations becomes pivotal. Understand the potential consequences of a fall in value, such as a liquidation cascade and its impact on market liquidity. Assessing whether the treasury can sustain payments or faces a liquidity crunch is a crucial aspect of risk assessment. Evaluating whether the platform is profitable, approaching profitability, or experiencing escalating losses is integral to this analysis.

Addressing liquidity risk is essential in evaluating the ability to exit a position, particularly concerning unlock schedules. Consider a scenario where you’ve locked your tokens for a year, but a significant portion controlled by VCs unlocks in six months. Assessing whether these stakeholders are incentivized to hold or dump their tokens on the market is important. The impact on pricing and the platform’s ability to convey its valuation to the market before unlocking can affect your exit strategy. Knowledge of these schedules relative to exit possibilities is paramount, as higher exit barriers correspond to increased risk if alternative hedges are not employed.

Yield

When considering yield, an analysis of the source of value paying for the yield is fundamental. Distinguishing whether the yield comes from token minting or actual value creation aids in comprehending the platform’s mechanics. Understanding the source of yield helps to assess whether the token’s current price aligns with its intrinsic value and where the price might stabilize in the long term.

Imagine a project offering a high 115% APY. Why does the market demand such a high APY, and what justifies it? Delving into the background can reveal if risks are simply offloaded to token holders to justify the APY, or perhaps it serves as an incentive to hold an inflationary token. Scrutinizing the sustainability of this yield and the potential for the token’s price to decline substantially is crucial. The mantra ‘there’s no free lunch’ applies here, urging a thoughtful examination of the market dynamics and one’s own assumptions when lured in by high yields.

Much more information regarding token supply can be found in the last Shimmer DeFi Education Series presentation: Tokenomics.

Roadmaps, Analytics, & Economic Audits

Roadmaps

The presence of a roadmap is another essential factor to consider when evaluating a project. The absence of a roadmap raises concerns and signals a lack of transparency. Given that your participation may involve investing time, effort, or resources, a clear understanding of the project’s direction is crucial.

Analytics

Conducting analytics is another valuable approach. Does the project have a Dune dashboard or a self-created dashboard? Analyzing this tool can provide insights into the treasury wallet addresses, resource composition, trends, total platform value, burn rate, and token decentralization. Exploring these aspects can inform you about specific risks associated with the project’s treasury. Consider whether the roadmap aligns with the token trajectory and cash burn, and assess if there are individuals who could potentially impact the project significantly if they decide to exit abruptly.

Taking GMX as an example, their dashboard at GMX.io offers a snapshot of outstanding tokens, generated fees, and platform value. While it’s illustrative, additional analytics tools and documents are available for deeper exploration of GMX’s tokenomics, roadmap, rewards, and platform value creation/distribution mechanics.

For a more sophisticated analysis, delve into the platform’s future revenue and loss flows. Discounting these flows to present value (though the calculation is beyond the scope here) allows for a comparison against the cost of investment. As an illustrative example, if the net present value of a token, according to calculations, is $10 while the current token price is $5, it signifies a favorable margin of error. While not intended to be specific investment advice, these considerations can guide you in assessing the net benefit relative to the current market value.

Economic Audits

Conducting a simple experiment may shed light on the matter. In the realm of smart contracts, numerous audits are conducted to mitigate technological risks, typically funded by the projects themselves. The results are often made public on their websites, providing potential investors and other stakeholders with insights to build trust in the protocol. The entire process of evaluating risks and economic concerns could be circumvented if economic audits were mainstream. Although occasional semi-related reports may exist, this practice is not prevalent in the crypto space. The availability of such an audit could significantly enhance community confidence in a project.

While several companies are working on establishing insurance markets, it’s unclear if any are currently developing economic audits. The feasibility of such audits may be limited by the inherent uncertainty in the crypto space. Providing a comprehensive audit becomes challenging when clear probabilities or costs cannot be assigned to specific, uncertain threats. While such an audit could outline potential threats, delivering a definitive thumbs-up or thumbs-down would definitely be tough.

Community Engagement & Due Diligence

Complexity is certainly prevalent in the crypto landscape, and community collaboration can aid in navigating these complexities. Understanding the mechanics of a platform, its tokenomics, and their interactions becomes vital in determining the token’s true value relative to its current price, and the community should be able to assist you in this endeavor.

When seeking answers about a project’s potential, it’s crucial to engage with the project. Start by visiting the project page and thoroughly reading the tokenomics section; any reputable project should have one. The absence of this information can be a red flag, indicating a lack of transparency. If the project cannot articulate what they are doing with their tokens, their model, and the token holding structure over time, caution is warranted.

To deepen your involvement, learn about the team and their expertise. Investigate the team’s background, audit history, and any track record with previous platforms. In cases where the team is not doxxed, explore their reputation within the community as a potential risk mitigation strategy. Understanding team incentives and reputation can help identify potential risks, like rug pulls.

Even if you lack the technical expertise to read smart contracts, a legitimate vulnerability, the community may be able to help. Developers within the community may be able to offer more specific answers regarding any smart contracts. The smart contracts should also be audited by a reputable company, and you should consult the auditing company to verify.

Engage with the community, including core team members, and expect forthcoming answers to your questions. Assess whether the community is enthusiastic and willing to share information about the project. If the community seems guarded, and the team is not transparent, it raises another red flag. A reputable project should have accessible representatives who regularly engage with the community through calls or AMA sessions, providing opportunities for in-depth discussions with core members and access to detailed information. In a positive community, there will be transparency and friendliness, serving as green flags.

Applying an Evaluation Framework

Assuming that you have identified a potential opportunity in which the potential benefits appear to outweigh the expected cost of risk mitigation, the next step is to apply a more in-depth evaluation framework. The first step in this process is to construct a complete checklist or, ideally, formulate an investment thesis. Begin by brainstorming all of the potential positive and negative aspects of the endeavor. It’s crucial to account for even the smaller tail risks now, as outlined above, to include regulatory concerns, geopolitical conflicts, or unlikely events like meteor strikes. While individually these may seem inconsequential, collectively they can result in a substantial impact on the evaluation of a token or platform. As discussed, insurance policy premiums can help in converting uncertainties to clearer risks.

Take marketing as an example of a tail risk. Marketing professionals possess a nuanced understanding of the risks associated with ineffective promotional efforts. Even if a product is exceptional, inadequate marketing can significantly impact the value of the token or platform. Neglecting to thoroughly assess these tail risks creates a vulnerability in your cost-benefit evaluation, potentially leading to adverse consequences if these risks materialize.

While it may be impossible to list all potential uncertainties, the key lies in striving for as comprehensive a list as possible. Complete risk mitigation or hedging against all uncertainties is a lost cause, but understanding as much as possible about these threats is key.

As mentioned above, this exercise gains further efficacy when conducted collaboratively within a community. Building the checklist with others allows for diverse perspectives and experiences to converge, enhancing its comprehensiveness. Additionally, engaging a community in this process may transform items initially perceived as uncertainties into well-defined risks. For instance, an economist may struggle to quantify the risks associated with the loss of community, but someone with experience in community management on platforms like Discord might offer insights into the tangible costs of such a loss. In this way, collaborative efforts enrich the checklist, ensuring a more holistic and insightful evaluation.

Insurance as Mitigation for Unresolved Uncertainty

Even in the face of uncertainty, where the probability of a specific risk is unknown, it is still possible to mitigate it through insurance. For instance, it may be impossible to know the probability of an event like getting struck by a comet, but one can acquire life insurance. This approach transforms a potential uncertainty into a known value by ensuring a payoff to my family in the event of such an occurrence. Many individuals utilize insurance as a tool to convert uncertainty into risk, transferring the burden of that uncertainty to another party — the insuring entity.

However, this transfer introduces a new set of considerations, including the capability of the insurer to meet obligations in the event of significant events such as a comet strike. Despite these concerns, the value lies in converting uncertainties into known costs. While acknowledging the potential knock-on risks and various considerations, the act of listing them allows for potential mitigation strategies or means to convert them into manageable and known expenses.

If you can transfer the uncertainty to a third party for a fee, it eliminates the uncertainty from your calculation, converting it to a risk. The known benefit is the payout in the event that the uncertain event occurs. It’s crucial to note that the aim isn’t to recommend insurance for all uncertainties but to recognize that insurance provides two valuable pieces of information — 1) the premium for a specific risk event, and 2) the payout for a policy.

The first point provides insights into how others assess the risk associated with potential events occurring. Platforms like Nexus Mutual offer a means to explore insurance premiums. You might find that a policy covering contract bugs, economic attacks, oracle failures, and governance attacks costs 2.6% per year. The decision on whether the coverage justifies the cost rests with you, contingent on a thorough reading of the entire insurance policy contract.

The second point signifies that others are willing to bear risks that might be challenging for you to quantify, especially uncertainties. In the mentioned example, this insurance policy would incur a cost of 2.6% per year. If you anticipate a yield of 10%, the insurance policy reduces your expected payoff by approximately a quarter. However, it encompasses all those elements that might be difficult to quantify. It is crucial to assess whether the insurance sufficiently offloads risk, enhancing the likelihood of a positive cumulative average growth rate for your investment. It’s also important to consider if the cost of coverage is justified by the potential benefits or if it could result in an overall loss of funds.

The Kelly Criterion as a Risk Management Strategy

The Kelly Criterion, developed by John L. Kelly Jr. in the field of information theory, has found applications beyond its original domain, particularly in the realm of financial investments and now cryptocurrency. In this context, the Kelly Criterion serves as a valuable tool for managing risk and optimizing capital allocation.

At its core, the Kelly Criterion is designed to help investors determine the optimal size of a series of bets to maximize long-term capital growth while avoiding significant losses. The key principle revolves around finding a balance between capital preservation and capital growth.

In cryptocurrency investments, where market volatility is inherent, the Kelly Criterion can probably best be applied to position sizing. Here’s a simplified explanation of how it works:

1. Determining the Edge or Advantage: Before applying the Kelly Criterion, investors need to assess their perceived edge or advantage in a given investment strategy. This could be based on technical analysis, fundamental factors, or some combination of both.

2. Calculating Optimal Bet Size: The Kelly Criterion formula is expressed as: f∗=(bp−q)/b

- f∗: Optimal fraction of capital to bet

- b: Decimal odds received on the bet (net odds + 1)

- p: Probability of winning

- q: Probability of losing (1−p)

The formula provides the fraction of the capital that should be invested in a particular trade or bet.

3. Implementing Capital Preservation: The result obtained from the Kelly Criterion may suggest a fractional bet size. This reflects the delicate balance between maximizing returns and preventing significant drawdowns. By reserving a portion of the capital, investors are effectively implementing a form of self-insurance against losses.

4. Adapting to Sequential Risk: In cryptocurrency investments, where sequential risk is prevalent, the Kelly Criterion helps investors adapt their bet sizes based on changing circumstances. For instance, if faced with a series of losses, the formula would recommend reducing the bet size to protect capital.

5. Risk of Ruin Consideration: The Kelly Criterion inherently considers the risk of ruin, helping investors avoid aggressive betting that could lead to substantial losses and potential financial ruin.

6. Continuous Monitoring and Adaptation: Cryptocurrency markets are dynamic, and factors influencing trades can change. Regularly reassessing the perceived edge, recalculating optimal bet sizes, and adapting to new information are crucial elements of applying the Kelly Criterion effectively. Reapply the formula often to account for more recent developments.

While the Kelly Criterion is a powerful risk management tool, it’s important to note that its application requires accurate estimation of probabilities and returns, which can be challenging in the unpredictable world of cryptocurrencies. Furthermore, individual risk tolerance and preferences play a role in determining the optimal fraction to be applied from the calculated result.

Still, the Kelly Criterion offers a systematic and disciplined approach to position sizing, aiding investors in optimizing risk and reward in their cryptocurrency portfolios. As with any financial strategy, due diligence, continuous monitoring, and adaptability are essential for successful implementation.

Wrapping It All Up

In summary, our exploration delved into the intricacies of cryptocurrency investments, emphasizing the critical importance of a meticulous and comprehensive approach. From understanding the distinctions between risk and uncertainty to evaluating tokenomics, platform value, and potential risks, investors are equipped with a multifaceted framework to guide their decisions. The consideration of insurance, exemplified by platforms like Nexus Mutual, emerged as a valuable risk mitigation strategy.

The discussions extended to the significance of community engagement, due diligence on project teams, and leveraging available analytics for a thorough evaluation. The Kelly Criterion provided a mathematical perspective on optimizing capital allocation, underlining the importance of strategic risk management.

While economic audits and advanced risk evaluation tools are still evolving, the overarching theme remains clear: informed decision-making in the cryptocurrency space demands continuous learning, adaptability, and a proactive approach to risk mitigation. As the crypto landscape evolves, staying attuned to emerging trends, refining due diligence processes, and embracing strategic risk management practices will be instrumental in navigating the dynamic world of cryptocurrency investments.

📢 Tl;dr: Fluent Finance issuing RWAs on IOTA

[ - by Ness]

For the first Spec Weekly of the year, Kutkraft had a special guest: Bradley Allgood, the founder of Fluent Finance. In this episode they talk about what Fluent Finance is and what their plans with IOTA are and what all of that has to do with RWA tokenization.

One important advantage for Fluent Finance is that their deposit token market operates under existing regulatory frameworks. That means that there is less regulatory scrutiny and that they can operate through banks and offer their deposit tokens.

So what does the minting cycle look like with a deposit token since the liquidity is coming directly from the bank? The handling is quite easy. Users can just go to their bank dashboard, type in the amount of money they want to transfer and receive the token to their non-custodial wallet. This way users don’t need to log into an exchange and can enter and exit DeFi without any counter parties.

Fluent and IOTA

Everything Fluent builds is focused on operational policies, procedures, technology, infrastructure to take things from core banking systems and ERPs to public networks. The focus now lies on bringing a lot of assets onto IOTA, the IOTAEVM and Shimmer.

Allgood himself participated in the ICO of IOTA and always loved the consensus mechanism of the Tangle. After working on sovereign identity systems where he needed EVM he finally found his way back to IOTA when Kowei reached out to him.

Tokenizing Real World Assets

Fluent has a technical and product infrastructure that is perfect for the transparent tokenization of nearly everything. When Allgood was in the UAE he did not only talk to Dom but also got in contact with one of the largest real estate firms in the UAE. They want to launch a tokenized Sukuk (a sharia-compliant bond-like instrument used in Islamic finance) and start with 100 million going to billions later. The largest carbon credit fund traded on the New York stock exchange was also interested in tokenizing large parts of their carbon products. The first launch of the tokenized assets of those projects is planned for January/February. And all of this will happen on IOTA!

Getting yield from RWA Tokens

According to Allgood, once the LP Tokens are launched, users get a base yield of 6 to 9%. Putting those LPs in DeFi might bring them another 4 to 12%. For builders this is a huge opportunity. They get a 20% low risk yield for the traditional investors that are looking at that real estate investment and the same type of yield from the DeFi people.

🆕 Tangle Treasury Update

[ - by DigitalSoulx]

As previously reported, we have offered to include Shimmer community Treasury updates in each issue of the Tangleverse Times, as a way to thank the community for their support of our publication. These updates are intended to be a way to see the status of the treasury at a glance, but for more detail about each of the individual proposals I would highly recommend visiting the great website that JD is maintaining! It is quite complete and generally up-to-date.

Below you will find the current list of approved projects as of early February 2024. Projects with hyperlinks to the approved proposal page are new since our last issue.

| Project | Category | Tier | USDT Approved |

| Probably Nothing IOTA News | Marketing & Content | 1 | $5,000 |

| Wallet Tracker Bot | Treasury Admin Cost | 1 | $1,128 |

| Infiota – Academy | Marketing & Content | 1 | $5,000 |

| IOTA / Shimmer YouTube Spanish | Marketing & Content | 1 | $5,000 |

| Tangle Bay | Dev Tooling | 1 | $5,000 |

| Everything Tangle | Marketing & Content | 1 | $2,420 |

| Spec Weekly | Marketing & Content | 1 | $5,000 |

| Spyce5 – Side event at Berlin Blockchain Week | Marketing & Content | 1 | $1,500 |

| Web3 Creators Soiree | Marketing & Content | 1 | $1,750 |

| Mosquito Pay – Pay with Shimmer | Utility Applications | 1 | $4,200 |

| Spyce5 – RPC Endpoint for ShimmerEVM 2024 | Infrastructure | 1 | $2,500 |

| BlockPit IOTA & Shimmer Crypto Tax Calculator | Utility Applications | 1 | $5,000 |

| Shimmer Education & Marketing | Marketing & Content | 2 | $7,425 |

| IOTA for Flutter | Dev Tooling | 2 | $14,262 |

| Tangle Comm. Treasury Website | Treasury Admin Cost | 2 | $9,114 |

| TangleVerse Times Magazine | Marketing & Content | 2 | $18,500 |

| 3D Support for Shimmer NFTs | Web3 Applications | 2 | $8,000 |

| Coordinape for Content Creators | Marketing & Content | 2 | $26,947 |

| AuditOne | Utility Applications | 2 | $50,000 |

| Shimmer QT/C++ Dev Community | Dev Tooling | 2 | $13,000 |

| Unity Support | Dev Tooling | 2 | $45,000 |

| IOTA SDK.NET | Dev Tooling | 2 | $25,320 |

| Block Monitor for Shimmer | Utility Applications | 2 | $12,500 |

| Fluent Stablecoin & Deposit Token | Utility Applications | 2 | $50,000 |

| Peppy Finance – Perpetual Trading on Shimmer | Utility Applications | 2 | $47,250 |

| Bloom Wallet & IOTA Command Centre | Utility Applications | 2 | $50,000 |

| Cointracking Integration for IOTA & Shimmer | Utility Applications | 2 | $10,843 |

| Tide Protocol for Ecosystem Growth | Marketing & Content | 2 | $30,000 |

| IOTA / Shimmer Identity Wallet | Utility Applications | 3 | $80,000 |

| Soonaverse Open Sourcing Initiative | Web3 Applications | 3 | $100,000 |

| IOTAMPC | Utility Applications | 3 | $65,000 |

| Demia – Zero Knowledge File System | Utility Applications | 3 | $100,000 |

| Digital Wealth Insider – Capital Flow & Grant DD | Marketing & Content | 3 | $99,500 |

| Already reported these projects last issue | $758,316 | ||

| Newly approved projects since last issue | $147,843 | ||

| Total: | $906,159 |

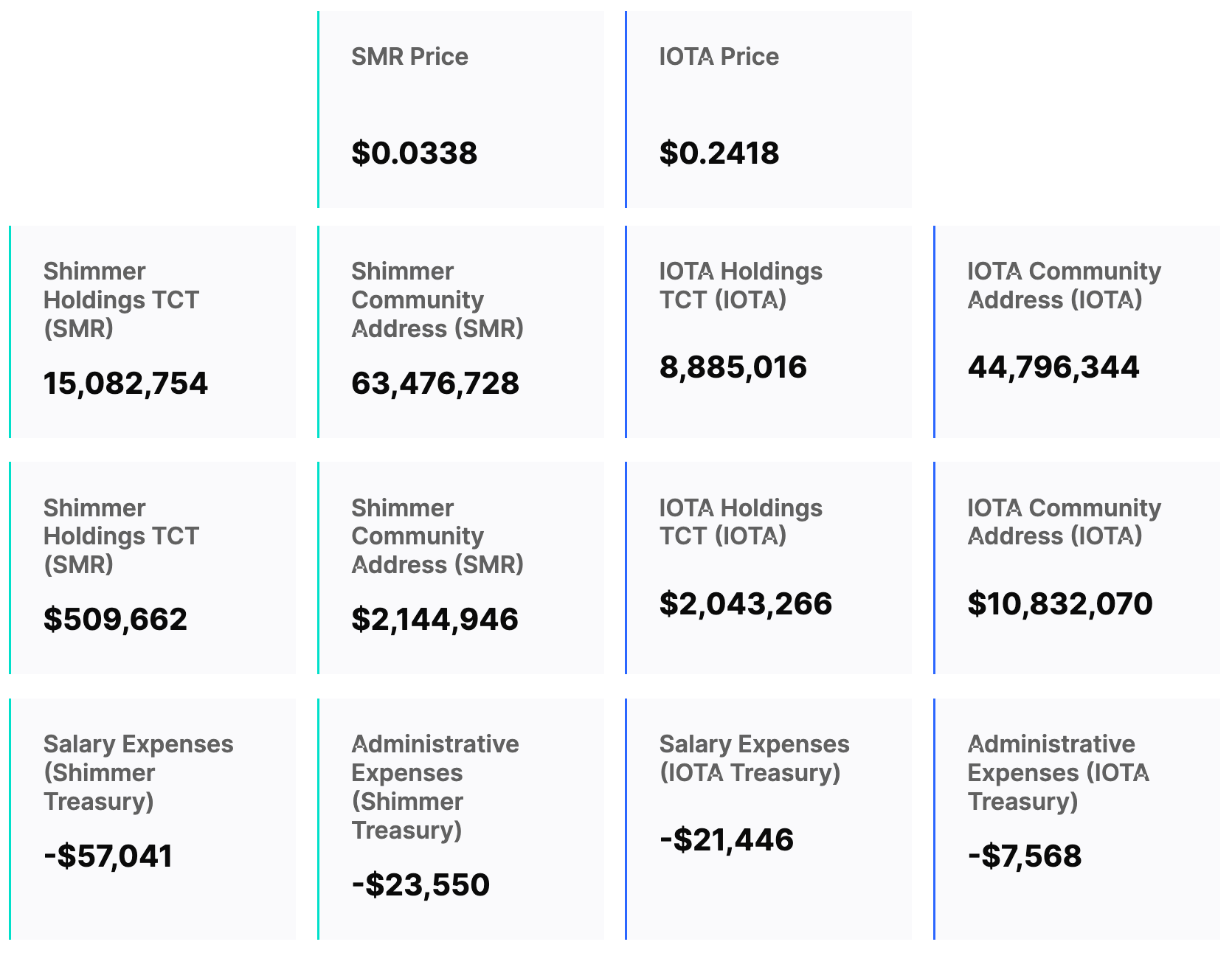

There have been some changes to the Treasury website since my last visit, and the information is presented in a different way. Below you will find a snapshot taken from the treasury website that provides a good overview of both the Shimmer and IOTA treasuries. In the chart below, the Shimmer Holdings TCT (Tangle Community Treasury) is the SMR the committee manages for the year since we essentially work in one year epochs. The Shimmer Community Address is the remaining SMR committed to the Treasury from the initial supply mint. The vote that went through allowed for the committee to use 30% of those tokens.

Note that this information is just a snapshot in time, and without specific integrations it does not update in real time (for instance, to include accurate DeFi holdings). Still, it offers a good indication of the current state of our treasuries:

And that’s a wrap! Please like, share, smash that subscribe… or better yet, join us! Do you love to write? Passionate about the IOTA ecosystem? Do you have a project to share? Master at making memes?

We want to help the community discover their strengths and stay updated about everything IOTA. We cannot do this alone. Community participation and feedback will help keep The Tangleverse Times up-to-date and invaluable. Help us help the ecosystem.

The best way to reach us is through Discord: discord.gg/2BeCTUMPAM

Follow us on Twitter: @IOTAcontentDAO and @TangleverseWeb

Special thanks and honourable mentions to all the hardworking ICCD degens who contributed (in the form of written, editorial, design, advisory, and memetic support) to this edition: DigitalSoul.x (Rob), Mart, Ness, moon, ID.iota, iota_penguin, Adrian and Epoch Zero.

If you enjoyed the newsletter and would like to see it continue to grow, you can also donate here: iota1qp7l8s5026k7gvd2m0t8cyj754geslnl6vtt0cxzf0xlsvyeug2pv85rh78 smr1qzv5agn7ty5kvmucu6atl4hkhqp3r9cgurh4pdw0rml347tc0jxtwmn4dhk