IOTA Unchained: The New Era of Tokenization

⌨️ From the editorial desk...

[ - by Ness]

After some sluggish months in the crypto space, things seem to finally turn around. First the ShimmerEVM went live, now IOTA is registered as the first DLT foundation in the UAE. And the pirce... well you probably all saw the graphs. Mart gives you an overview about the recent developments and what that means for the future of IOTA.

But this developement is not only about the IOTA price finally going up again. Real world assets and tokenization are probably the most important thing. Stefan (iota_penguin) dove deeper into the topic of "Tokenizing Reality" and how this might change the DeFi space. DigitalSoulx summarized the Shimmer DeFi session about Tokenomics. So in this issue you'll learn quite a lot about tokenization 🔥

Besides all those amazing things happening around IOTA and Shimmer, the ecosystem itself isn't sleeping as well. A new NFT card game is coming to Shimmer this year, introducing unique mechanics with the help of Shimmer's On-Chain randomness.

Let's grab a cup of Glühwein, read through the latest issue of the Tangleverse Times and enjoy the time before Christmas 🎄

👨💻 Monthly Technical Update

[ - by ID.Iota]

GM 🌅 #IOTA Fam 🤖

It's time for another monthly update on the tangleverse times magazine. The last one was released on the 12th of October and it feels like ages since then. It sometimes really puzzles me how much can happen in such a short time. Fortunately we don’t need to discuss all things IOTA here but only take a look at the latest updates for the IOTA 2.0 node protocol - IOTA.core.

A look back into the open issues from September

The last time I updated you on the progress we were discussing the last features being implemented to the protocol. Remember? The Faucet INX plugin (Iss #110), the solution on how to deal with loss acceptance (Iss #315) and the time restriction on the transaction creation slot (Iss #355). Obviously all of those Issues have been resolved in the code base.

I’d also highlight two Issues that were discussed at that time. The introduction of SegWit (Iss #346) and the transaction issuing user flow with Mana allotting (Iss #345). Both of those Issues have also been resolved.

Since we said those were the last building blocks to get the network towards feature completion, we should be feature complete, correct?

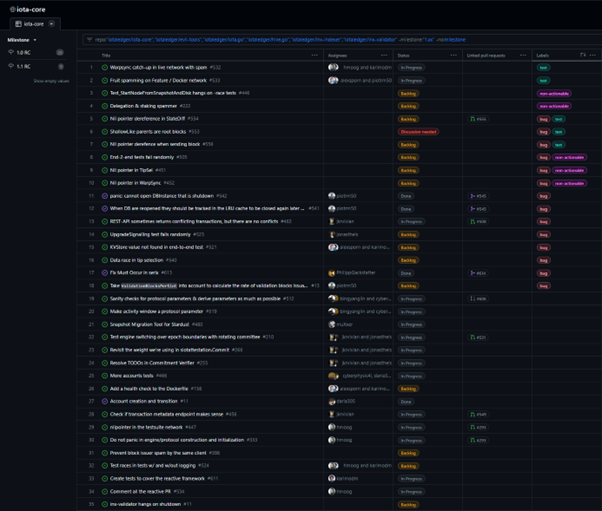

Yes! And the team seems to agree on that statement, marking the progress on milestones 1.0 and 1.1 as 100% complete.

That leaves us with the hardened release candidate milestones 1.0 RC and 1.1 RC and a new milestone 1.xx tracking features that will be implemented once we have experienced IOTA 2.0 on test- and mainnet.

So what has happened since feature completion?

Feature completion is basically a month old,with the last Issue (Iss #410) in Milestone 1.0 being closed on the 31st of October. Since then the team - again - went into full test, cleanup and bug fixing mode. A look into the Issues resolved since then and the Issues currently being worked on proves this. Most of the open Issues are either new test set-ups or bugs.

Besides tests and bugs we still see some clean up chores that the team want to address before they release the network to the masses.

Jonas just recently confirmed that in his latest update on Discord. He also confirmed that they are starting to test the whole setup in an integrated way. So basically they are simulating a fully integrated network consisting of the entire tech stack (iota-core + inx-indexer, inx-validator, inx-*).

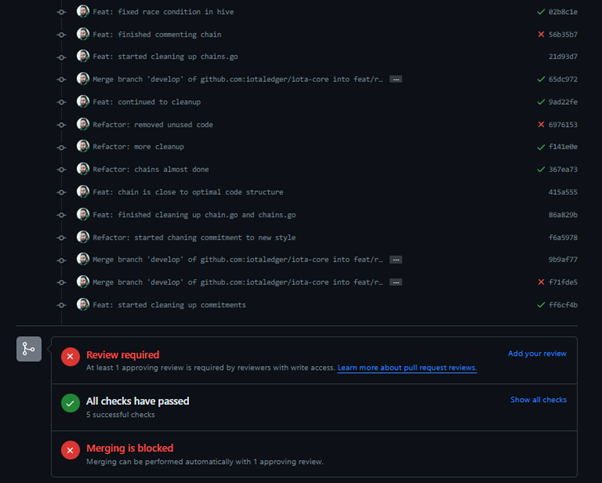

Besides all the bug fixing etc. we see a single PR pushing a bigger code change that is following a reactive approach to “manage” the complexity in the code base. The change is covered in Issue #320 (PR #293). While this change initially was labeled as a “nice to have” and spearheaded by Hans in his freetime it shows now that this rewrite might lead to a few bug fixes.

The attentive reader might have spotted the “non-actionable” label of some Issues. Some of those bugs are waiting for the reactive chain manager, since the team expects that those bugs will be resolved with the implementation of the rewrite.

A look in the PR shows that Hans seems to have come to an end on the reactive protocol rework. He seems to be very happy with the outcome stating that they have reached “close to optimal code structure” in the chain manager.

It’s going to be interesting to see if the team will be able to merge the reactive code rework in the coming week and if and how this rework will lead to a usable IOTA 2.0 testnet release.

What else do we need for a testnet?

Besides the node protocol not being fully ready to be deployed, there is also the wallet, an explorer and the adapted SDK missing to get a working testnet. So I thought I would do a little research on how those topics are progressing.

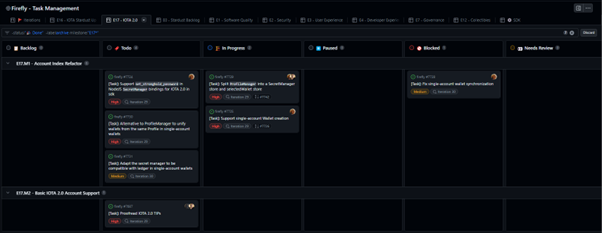

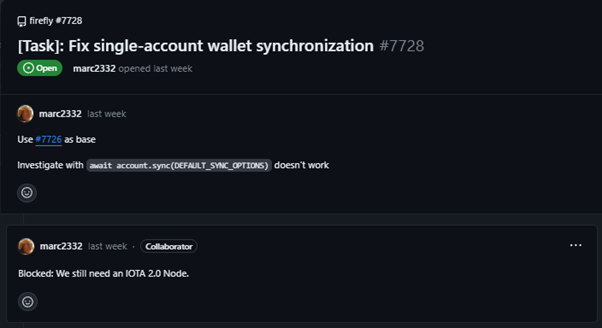

The development of firefly is actually quite easy to follow. As one would expect from an agile working team, we have a pretty transparent overview over their EPICs and the sprints (sprint duration of two weeks) that feed into those EPICs.

We got an EPIC #17 that has the goal to get the wallet software ready for IOTA 2.0. A link to their IOTA 2.0 dashboards is here.

There are a few things we can spot without going into too much detail. The precise sprint planning allows us to get the timeline behind those tasks. As you can see in the screenshot from the dashboard above every task has a specific sprint (Iteration) that it is connected to.

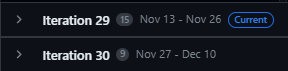

All tasks related to IOTA 2.0 are either in Sprint 29 or Sprint 30 (Iteration 29 / 30). The schedule for those Iterations are the following:

- Iteration 29 | Nov 13 - Nov 26

- Iteration 30 | Nov 27 - Dec 10

So what we can read from those timelines is that the firefly team has been working since November 13 towards a firefly release to support IOTA 2.0. We could also speculate that - at least initially - the team wanted to finish their work on the 10th of December.

But beware (especially the german readers) living in an agile world always means that plans are due to hiccups on the way. So don’t take those dates as specific ETAs or any confirmed dates. Just take them as a confirmation that there is work on a 2.0 wallet happening right now.

We can also read from the tasks that the firefly team is delayed, since they are still waiting on the IOTA.core node protocol. We will see how this develops over the coming weeks.

Since I don't want to bore you, I spare you the insights into the SDK and explorer development. Just so much for both SDK and explorer we can see some work happening in GitHub.

Wrapping things up

So where are we going from here? Testnet this year? Mhmm, I really don’t want to be that guy but I feel like it's hard to hype you up here.

We are really super close to a release. However December essentially consists of only two more weeks. So we either get something under the christmas tree and then play with it for two weeks without feedback from the team or we will have to wait till 2024.

I think all teams could basically release something tomorrow but withhold from it with all kinds of good reason. The best reason likely being that they are progressing faster if they fix everything they can test themselves.

So don’t let your head down. A lot of the tech stack is finally coming together. Piece by piece. There will be a testnet. Soon enough.

And don’t forget, blame me for hyping you up for a testnet release this year.

TLDR:

The IOTA 2.0 node protocol, IOTA.core, has made significant progress, with key issues resolved, marking milestones 1.0 and 1.1 as 100% complete. The team is now focused on testing, bug fixing, and cleanup before releasing the network to the community.

The release of a fully functional node protocol makes a wallet, explorer, and SDK necessary. The Firefly wallet team is actively working on IOTA 2.0 support, with a potential release date around end of December, though delays may occur.

A testnet release is imminent, the time frame is tight, possibly by the end of December or early 2024.

🌆 IOTA is big in Japan UAE Middle East and Asia

[ - by Mart]

Now that the dust has settled on the announcement that the IOTA Foundation is expanding to the Middle East and the IOTA DLT Foundation is the first entity registered with the ADGM, let's dissect it all.

The news took the market by storm. IOTA’s price surged and big news outlets like Reuters and Dailymail were covering the story. This is not only a milestone for the whole crypto market, but also a big opportunity for our entire ecosystem.

Abu Dhabi and the whole UAE are serious about modernizing and digitalizing their whole infrastructure and IOTA might very well be their match made in heaven. Light-weight, scalable, sustainable, modular. Seems like an obvious choice, right? After the much-discussed decision to fore-go the community and inflate IOTA’s total supply, we are now seeing the first opportunity to put the freshly minted funds to work. 552,000,000 $IOTA: that’s the amount the IOTA DLT Foundation (the entity in the UAE) holds. At the time of writing, this already amounts to roughly $176,000,000. There is ample opportunity to utilize those funds, build a solid network of builders, partners and collaborators and become the number one player, that leads the digital transformation of the Middle East, right? RIGHT? I’m definitely excited and can’t wait to see what’s lying ahead of us in the UAE but also for IOTA in general.

IOTA was an afterthought for too long. Of course, what the IF did over the years with so little funds, is nothing short of impressive. After our rough start, founders getting booted and courses being corrected, we already saw a change in direction and execution from the IF. Chrysalis was the start, Stardust, Smart Contracts, scientific validation and the first testnet of the holy grail, IOTA 2.0, soon. Everything is there, just the price and bigger announcements somewhat lagged behind. But I somehow have a feeling that this was just the start of IOTA’s Cinderella story, the biggest comeback story in crypto’s history... Sounds bold, but I’m all here for it. Honestly who, if not IOTA?

There’s still some news due, with the Dom stating that “new senior leaders” have joined the board. Experienced people who will push real world adoption. If you put your ear on the pulse, there are definitely some exciting names tossed around. We’ll see!

But most importantly, all of these news might mark a turning point in community sentiment. There’s just so much to be excited about, so much to look forward to. With the newly created funds, the “war chest”, the new leaders pushing IOTA forward, I’m sure this is just the start of our amazing comeback journey. And we will not stop, we will not give in, we will work our way back to the top, because this is where IOTA belongs. Trillions or nothing.

🏆 NFT Top 3

[NFT data provided by EpochZero]

With a staggering TVL of 5 million dollars shortly after launch, ShimmerEVM owes its success to the integral role played by DEXs and their native NFTs. The ranking of the top traded NFT projects on ShimmerEVM in the last 30 days further reflects the undeniable impact of NFTs, as their utilization and benefits contribute to the impressive volume witnessed.

#1. TangleSwap Genesis NFT - The recent announcement of TangleSwap's integration into the thriving Cardano ecosystem has sparked a surge in demand for the TangleSwap Genesis NFTs generating an impressive total trading volume of 1,182,454 SMR. These unique NFTs offer a plethora of utility for holders, including exclusive access to the VOID token, ICOs and much more. This exciting development showcases the immense value and benefits that TangleSwap brings to the Shimmer community as well as to the Cardano community.

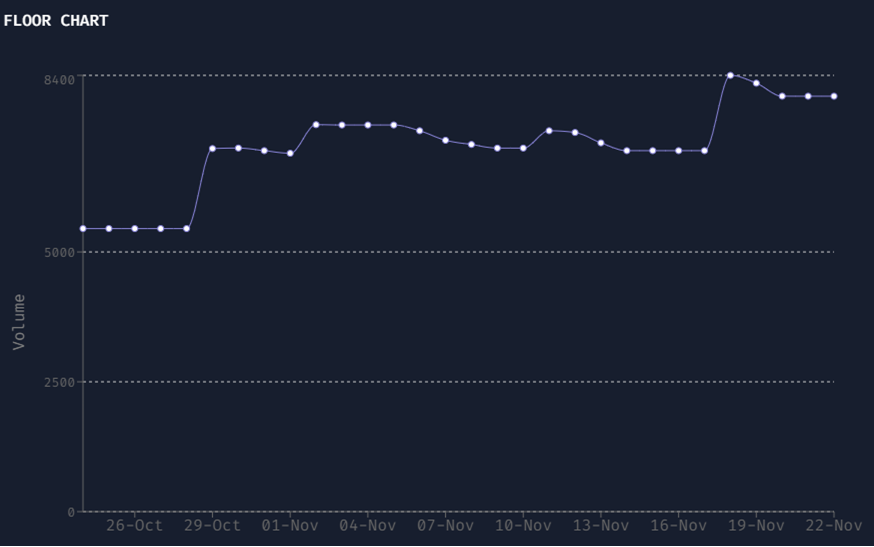

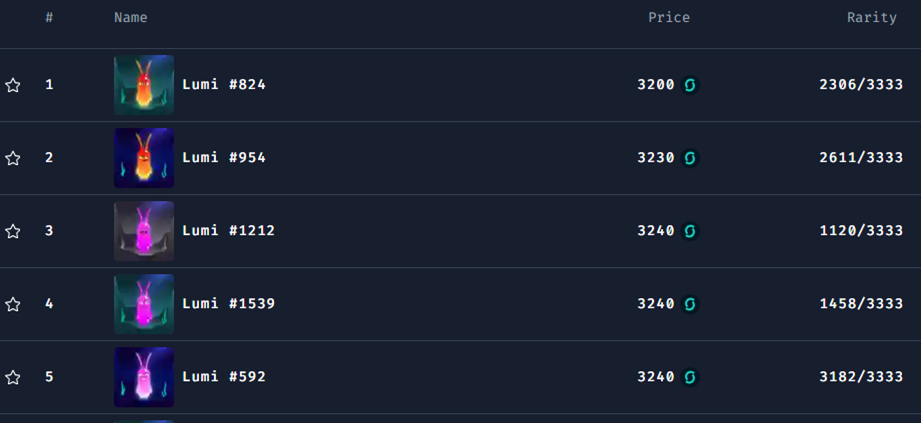

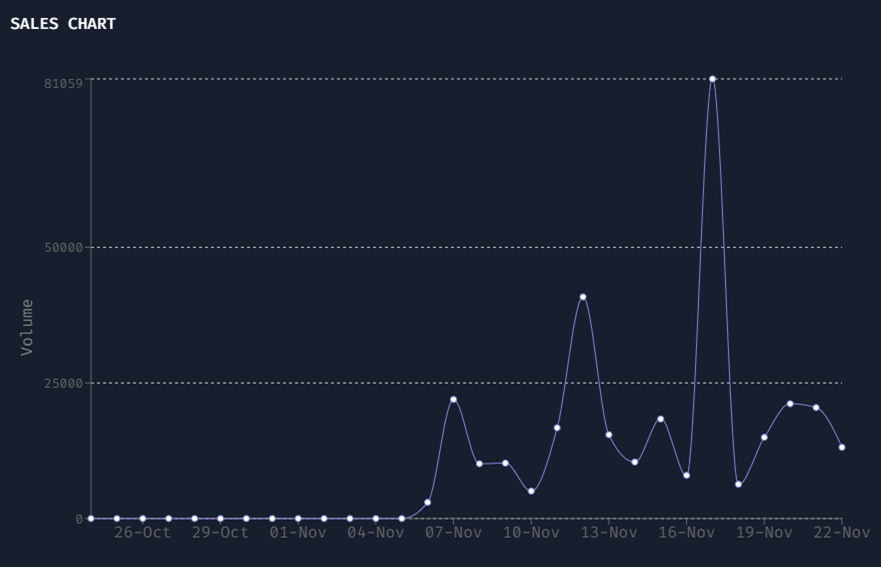

#2. LUMI - Lumis, the native NFTs of another prominent DEX on ShimmerEVM, have secured the second position in terms of volume and most traded NFTs. These unique companions not only provide early access to token launches but have also yielded impressive returns for users.

#3. Rusty Robot - After years of anticipation, the Rusty Robot Country Club was finally able to launch its Main Collection on ShimmerEVM and immediately secured the third position among the hottest projects in the last month, with an incredible trading volume of 321,655 SMR.

SPOTLIGHT - Two truly OG projects have succesfully airdropped their NFTs to the IOTA and Shimmer community. IOTABOTS being the first ever NFT project on IOTA and EARLY ADOPTER$, which is an equally impressive project and also one of the earliest in the space.

Stay vigilant for upcoming news and overhaul of the EpochZero website, as well as the emergence of future sniping bots increasing the utility of the Pharaoh NFTs and $FUEL even more. Until next time, happy trading and collecting.

About EpochZero:

EpochZero began as an NFT project created by several active members in the IOTA community. Their suite of tools for analyzing other ecosystem NFT projects as well as the supporters of those projects has already become the go-to resource for the community. The only requirement for full-access to these tools is holding one of their Pharaoh NFTs.

However, EpochZero is not just about NFTs. The founders of the project also hope to attract early-stage investors who wish to support unique ecosystem projects. This will allow community members to participate in the development of these projects. There are even more ambitious plans like starting a DAO, a game related to the Pharaohs, etc. Sound interesting? More information can be found via the links below. Check 'em out!

👨 Meet the IF — Dr.Electron

[Interview by Mart]

The Tangleverse Times: The first question is a staple by now. How did you find out about IOTA and how did you find your way to the IOTA Foundation?

Dr. Electron: In the summer of 2017, I worked on an electronics Project for a friend where we wanted to track cows (true story 😉 ). My friend knew someone who went to school with Dom, and we talked about it as we also “knew” Dom from school. But I didn’t believe in the Vision at the start. Over the next 6 Months, I became more interested and finally joined the community in November 2017.

I started to get more involved in the community by learning Rust with the Bee team, leading the GoShimmer X-Team dRNG initiative with Dave[EF], and finally starting the Wiki efforts together with others. The Wiki work began to take so much of my free time at some point that I talked to Navin, who always supported our work on the Wiki, and that’s how my talks to join IF started. While applying for the client team, Dom contacted me indecently, asking if I would like to join the still-to-be-created DX team. So, together with Jeroen, who I worked with on the Wiki, I joined IF.

TvT: Why are you called Dr. Electron? How did you get this name? Is it related to Professor Proton from The Big Bang Theory?

D.E.: Haha, I created the nickname the first time in 2015 when I had too much time in my first year at university (studying EE), where I created a Minecraft server with a friend. As I was already really into electronics (I had it for 3 years in school and built and developed my own drone, concluding everything from software to hardware), I wanted to use Mr.Electron, but that was already used. So, I switched to Dr.Electron.

TvT: Looking back when you first started your crypto journey, is there anything you totally need to laugh about today? Maybe a conviction you had, a mistake you made, a coin you bought, what makes you smile looking back?

D.E.: My Crypto journey actually started with a big scam project (probably no one knows it, so I won’t mention it). I wouldn’t say I liked that I was that stupid. Still, in the end, I’m happy that it happened as it brought me into a great community (IOTA) where I met many friends I wouldn’t like to miss.

TvT: Do you own any other NFTs than your IOTABOT? Any collection you regret missing?

D.E.: I love my IOTABOT, the best bot ever. It's charming that I got a custom one from community member JSto ♥️. I bought the Soonaverse NFT to support my friend Dave and his team. I’m not much into NFTs, but I love the artwork of all the NFTs I got.

TvT: Tell us a story about your hiking trips with Dom. Any funny things that happened? Did you outhike him?

D.E.: I always enjoy hiking with Dom and the south tyrolian community. I think I enjoyed the Hike with Dom and his dad the most. Or the one where we drank and ate the whole afternoon in the Alps. But that was before the “no alcohol before ATH” rule, obviously ;)

In general, I’m not sure if I would be faster than Dom. We never really tried, though. Although we also went on more challenging hikes, we have never tested our limits yet. Maybe we should try 😆

TvT: Do you have any pets? If so, join the official unofficial IF pet club and post a picture and tell us everything about it!

D.E.: I live on a tiny farm. So, I have always had dogs, but currently, I only have two cats. And chicken, ducks, and some geese ;).

TvT: I’m currently re-watching The Walking Dead because my girlfriend hasn't watched it yet (duuh!). What are your favorite TV shows? Any recommendations for a show that’s totally flying under the radar?

D.E.: I also never watched The Walking Dead yet 😆. Tbh, I’m a Movie and Series junky. I grew up with Smallville and the story of Superman, which has shaped me. Currently, I really enjoyed Superman and Lois. Other shows from my watching history: Mr. Robot, The Strain, Supernatural, The Shannara Chronicles, Grimm, Arrowverse, The Boy/GenV, LOTR: The Rings of Power, The Peripheral, Invincible and a lot of movies. I’m not sure if I want to recommend special shows. I love them all 😆

TvT: Let’s say you need to relocate to a certain country, for various, unspecified reasons. Where would you want to live and why?

D.E.: Probably Canada. I would love to get a wooden house in the woods near a lake.

TvT: Since you live close enough to Italy to be relevant for this question, we need to find Antonio’s allies and his opposition: Pineapple on Pizza yay or nay?

D.E.: As an Italian, my answer has to be no. (But just between us: I never tried it and just follow the trend/joke 😆)

TvT: It’s actually crazy (at least for me) but we’re already nearing the end of the year and Christmas is basically just around the corner. Do you have any Christmas habits that you love and like to share? What do you like the most about Advent season?

D.E.: I never really go on vacations, but in December, I take some time to focus on things I don’t have time for in the rest of the year. This year, for example, I want to start working on V2 of my drone and see what I have learned in the nearly 10 years since V1. Other than that, I donate one month's income to different open source projects I use over the year and other organizations every December. I encourage everyone to do something similar if you can. There are a lot of organizations needing help out there, and also, if you use open source software from individuals, help them out there are building something great for the community ♥️

🎴 The Chronicles of Infernal Uprising: Solomon's Revelation

[Promotional Content - contact us to have your project featured]

Greetings, noble travelers of realms both seen and unseen. I am Solomon, the seeker of ancient mysteries and the harbinger of a revelation that will stun those relying on earthly wisdom alone. As the sands of time unfurl, I beckon you to join me on an extraordinary journey into the shadows and light of Aetherfell, where cards bear the power of terrifying demons and the fate of the land itself rests in your hands.

In days of yore, as a seeker of the arcane, I delved into the abyss of forbidden knowledge. It was within the folds of an ancient manuscript, the Ars Goetia, that I uncovered a profound secret — a guide to invoke the potent might of seventy-two demons, their power concealed within the very essence of these enchanted cards.

From the shadows, I harnessed the Dark Arts to enthrall these malevolent beings, sealing their destructive power within the cards. The ethereal sigils etched upon each card became a vessel of control, a testament to the fine line between mastery and mayhem.

Yet, as my reign waned, the infernal forces broke free from their mystical chains, shattering the balance between light and darkness. Now, these cards lie scattered across the realm, conduits of chaos and destruction.

In the dawning era of Infernal Uprising, I extend to you an invitation to embrace the shadows and illuminate the path of destiny. This dark fantasy card game shall awaken your inner cardmaster and unlock the potential hidden within these cryptic cards.

Prepare for a journey that traverses the ethereal and the abyss. Infernal Uprising unfolds as an epic dance of strategy and cunning, where your cards become your allies, your adversaries, and your destiny:

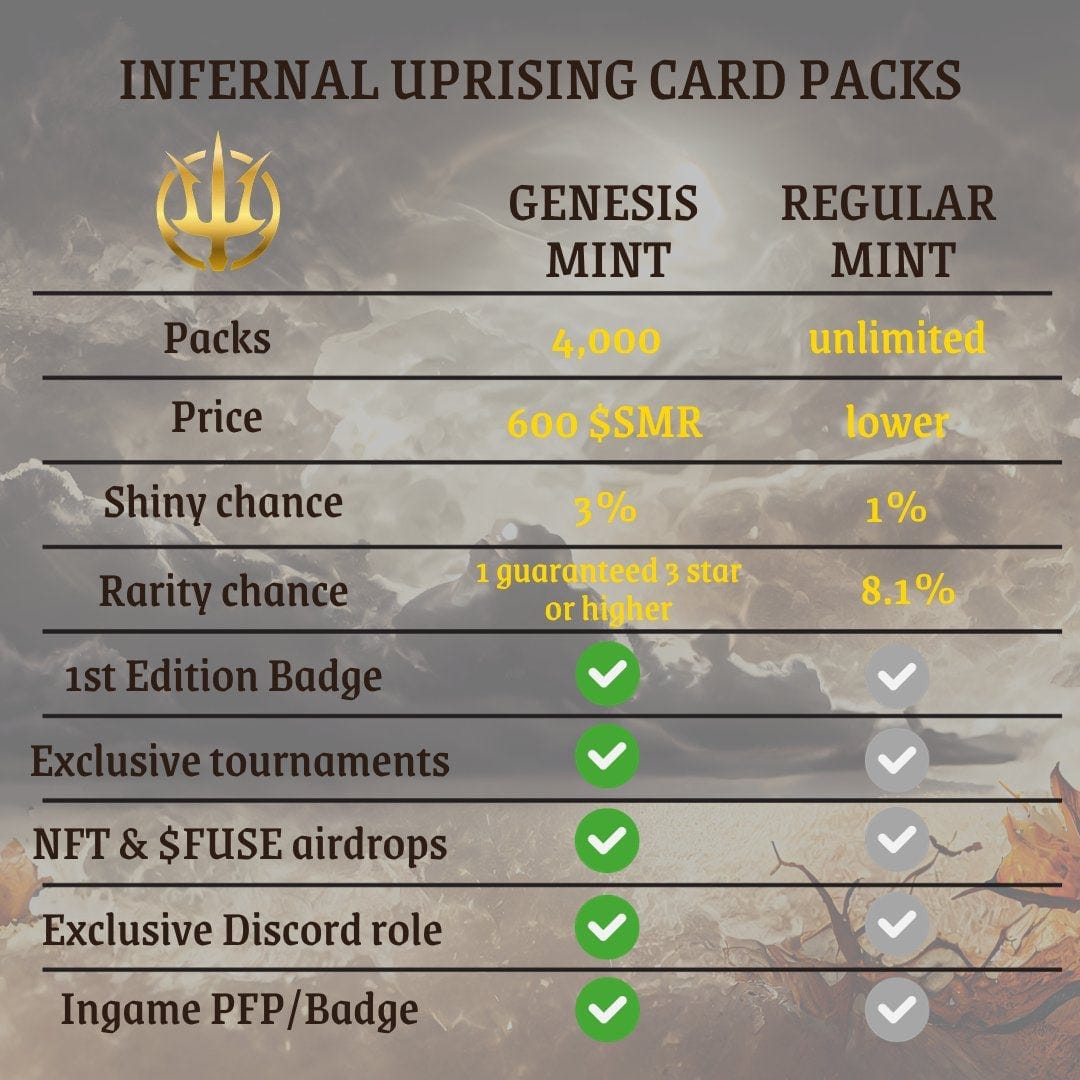

- Collect and Customize: Amass your personal collection of NFT cards beginning 6 December, each one modeled after one of the 72 demons listed in the Ars Goetia. Customize different playing decks to create unique strategies, with each card’s distinct abilities and powers.

- Combine Weaker Demons into More Powerful Allies: Harness the winds of fortune by trying to fuse your weaker demons into stronger fiends more capable of crushing your foes! Don’t worry, if your attempt fails you will receive $FUSE token(s) which can be used to increase your odds on the next attempt or simply sell them on the open market as early as 9 December.

- Duel Across the Nexus Board: Engage in thrilling duels on the mystical Nexus Board. Strategically place your cards to capture your opponent’s cards and claim dominance over the game board.

- Roadmap of Intrigue: Test your mettle and refine your skills as you await the other battle modes that have been foretold. Prepare for events such as grand tournaments against other cardmasters, high-stakes showdowns where cardmasters can play for each other’s hard-earned NFT cards, the release of a set of angelic warrior cards to balance the hellish power of the demons, and even more that is too cloudy for my ethereal vision to fully discern.

I beseech you, dear traveler, to prepare for the revelation that lies ahead. The Genesis NFT cards, these tokens of destiny packed with limited-time blessings, shall be available for minting on 6 December but only until the game is unveiled to the masses. At that time, only standard NFT cards may be obtained to accompany you in battle. Familiarize yourself with the benefits before it is too late, dear cardmaster! These cards will be your key to the demons of Aetherfall and shall grant you the power to wield them as you reshape the fate of the realm.

Embrace your inner cardmaster, harness the power concealed within these enchanted cards, and become a part of an ageless tale that echoes through the corridors of time.

🪙 Tokenizing Reality: A New Era for Decentralized Finance

[ - by iota_penguin]

In the world of Web3, it's no secret that the buzz often centers around certain trending topics. You've got NFTs blowing up, DeFi causing a frenzy and everyone is talking about blockchain compatibility. While the majority of these trends are focused on the Web3 domain, there's a compelling new topic emerging that boasts even broader potential. Surprisingly, only a few are currently aware of its profound implications for the entire crypto ecosystem.

I'm talking about the tokenization of real-world assets (RWA), which involves converting physical assets like bonds or commodities into digital tokens on a blockchain, offering a bridge between traditional finance (TradFi) and decentralized finance (DeFi). This process has the power to bridge the gap between both environments, fundamentally altering the way we perceive and engage with financial assets in the decentralized realm. In this article, we will explore the integration of real-world assets into DeFi ecosystems and delve into the significance this holds for IOTA and Shimmer.

RWA: Linking TradFi and DeFi

With all these acronyms flying around, let's kick things off by giving simple definitions.

Traditional Finance: TradFi encompasses the established, centralized financial system, including banks, stock exchanges, and other conventional financial institutions.

Decentralized Finance: DeFi constitutes a blockchain-based, peer-to-peer financial ecosystem that operates independently of traditional intermediaries, empowering users to directly access a range of financial services.

RWAs bridge the gap between both worlds. This means that individuals can invest, trade, and earn returns on traditional asset classes directly through decentralized applications, without relying on centralized entities.

The potential impact of RWAs on the DeFi sector could be highly transformative. RWAs have the capacity to provide sustainable and dependable yields to the DeFi ecosystem, supported by the trustworthiness of conventional financial markets. In a landscape where DeFi has proven its ability to make finance more inclusive, the incorporation of RWAs might introduce a previously unattainable level of stability and confidence within the cryptocurrency realm. As real-world assets continue to gain prominence within the DeFi space, the crypto world is presented with a pivotal opportunity to demonstrate its worth and ability to coexist harmoniously with the traditional financial system.

Understanding the tokenization process

The tokenization process typically includes the following stages:

- Asset identification: The initial step involves the selection of a tangible assets, such as real estate, bonds or commodities, while clearly defining the ownership rights and ascertaining its intrinsic value. This sets the stage for the seamless tokenization process, ensuring transparency, trust, and value preservation in the digital asset ecosystem.

- Legal and regulatory compliance: Adhering to legal and regulatory requirements is crucial, particularly when tokenizing real-world assets. Ensuring that every step in the process complies with relevant laws and regulations is essential for the legitimacy and sustainability of the tokenization project.

- Asset valuation: Establishing the accurate value of a real-world asset is a fundamental aspect of the tokenization process. This involves rigorous appraisal and valuation methodologies to provide transparency and confidence to potential investors.

- Token creation: The issuance of digital tokens on a Web3 protocol, representing fractional ownership or rights to the underlying real-world asset, is a pivotal stage in bridging the gap between TradFi and DeFi, offering investors exposure to assets previously inaccessible. Strong tokenomics are the backbone of a thriving ecosystem.

- Investor onboarding: In the realm of decentralized finance, inclusivity is key. Facilitating investor onboarding by allowing interested parties to easily acquire tokens representing fractional ownership opens up opportunities to a broader and more diverse group of participants, democratizing the world of RWA investments.

- Trading and liquidity: The DeFi infrastructure plays a vital role in ensuring that tokenized RWAs are tradable on exchanges, thereby enhancing liquidity and providing a mechanism for the efficient transfer of ownership stakes.

Recognizing the vast implications of this process is crucial. In the past, assets like prime real estate, valuable art, or private company shares were only for the privileged few. But now, we're breaking these assets into digital tokens, allowing people to own a piece of the action. You can easily trade these tokens on decentralized platforms, which is a big step in making them more accessible to everyone. This is a thrilling step for Web3, showing that DLT is a real game-changer, ready to solve real-world issues and deliver a unique benefit.

Hurdles in real-world asset tokenization

In theory, tokenizing physical assets seems straightforward, but in reality, it comes with notable challenges. Regulatory complexities, varying widely across jurisdictions, pose a significant hurdle, emphasizing the need to navigate a complex and dynamic landscape. To mitigate legal risks and ensure compliance with securities laws, strict adherence to regulations is essential.

Let's zoom in on one example: In traditional regulated securities, a Central Securities Depository (CSD) upholds the records, serving as a definitive source of truth. However, in the context of a decentralized ledger, not under the control of a single entity, ensuring the constant accuracy of the ledger state poses a challenge. Legal recognition is essential for token ownership to be equated with asset ownership.

Securing the custody of assets is another noteworthy challenge. Protecting the foundational financial or legal assets supporting digital tokens is critical in preventing theft, fraud, or mishandling. Opting for trustworthy and secure custody solutions is of utmost importance.

Also, let’s not forget about market acceptance and liquidity considerations. Robust marketplaces and exchanges are imperative for maintaining liquidity and stable pricing of tokenized assets. Insufficient trading volumes or limited adoption may lead to illiquidity and potentially eroding investor confidence.

Crypto education is also crucial, as a lack of understanding among investors, companies, and regulators may slow down adoption. Investors must recognize that crypto is more than collectible items and funny meme coins.

The positive aspect is that, although there are clearly some challenges, they can be overcome. Now, let's talk about why I think IOTA and Shimmer are the perfect choices for a solid and secure RWA tokenization.

Why IOTA and Shimmer are the go-to for RWA

IOTA and Shimmer are positioned to emerge as frontrunners in real-world asset tokenization due to their steadfast commitment to regulatory adherence and their affiliations with regulatory bodies and governments.

The IOTA Foundation strongly collaborates with regulators and policymakers, offering legal certainty for those utilizing the networks. Additionally, the IF engages with stakeholders from academia, civil society, and business to advocate for sensible regulatory frameworks, while supporting sustainable and responsible innovation.

In the midst of fierce competition among DeFi protocols, the ice gets thinner when it comes to RWA tokenization. Many Web3 protocols aren't ready to take the lead – they're nowhere near as savvy in regulatory affairs as we can witness with the IF. Their regulatory affairs team actively monitors legal developments, ensuring ongoing compliance by staying abreast of current and future laws. They proactively anticipate changes, publish legal analyses and commentaries, collectively reinforcing my confidence in IOTA and Shimmer swiftly adopting RWA tokenization and assuming leadership roles in this regard.

Moreover, both networks feature cutting-edge technology tailored for scalability, feeless transactions on L1, and various security-related improvements over traditional blockchain protocols. These attributes establish an optimal environment for the seamless onboarding of real-world assets.

I'm thrilled about the prospect of witnessing billions worth of assets being digitized and tokenized on IOTA and Shimmer. With fresh connections in the UAE, known for their swift decision-making and openness to new technologies, and the Web3 builder and venture fund Nakama on board to drive traction, I'm confident that we'll see rapid progress. I’m excitedly looking forward to these ongoing developments that will help crypto outgrow its infancy and onboard massive amounts of liquidity and value over the coming years!

📖 DeFi Education # 6: Tokenomics

[ - by DigitalSoulx]

Session #6: Tokenomics 101 — Value, Market Cap, and Price

Presented by 0xBlockBoy [20 October 2022]

Summary, organization and additional detail by DigitalSoul.x

Welcome to another Shimmer DeFi education series session. The topic of this session is tokenomics, and it’s intended to be an introduction and general overview rather than an in depth primer. Hopefully you will become more familiar with related terminology and principles when you’ve finished, but further research will likely be needed if you really want to become proficient.

We’ll start with an introduction to tokenomics terminology and principles. Next, we’ll explore a number of different tools of the trade. Finally, we’ll outline a number of pitfalls and red flags to avoid while analyzing the tokenomics of different protocols. Let’s begin!

What are ‘Tokenomics’?

Tokenomics refers to the economic principles and mechanics governing a cryptocurrency token within a blockchain ecosystem. It encompasses the design, distribution, and utility of the token, as well as its impact on the network and its users. Tokenomics delves into how a token acquires and retains value, how it is used within the ecosystem, and the rules that govern its behavior. Understanding tokenomics is crucial for making informed decisions about investing in or utilizing a particular cryptocurrency, especially in a blockchain network where tokens play a pivotal role in governance, transactions, and network operations.

Tokens play several crucial roles in a blockchain ecosystem, and understanding these roles is fundamental for anyone involved in the crypto space. Here are the primary roles of tokens within a blockchain ecosystem:

- Medium of Exchange: Tokens can serve as a digital form of currency within the blockchain network, facilitating peer-to-peer transactions and value exchange. Users can send tokens to each other without the need for intermediaries, such as banks.

- Store of Value: Many tokens, particularly cryptocurrencies like Bitcoin, are used as a store of value. People invest in these tokens with the expectation that their value will either increase over time or even remain relatively stable, providing a reliable means of preserving wealth.

- Unit of Account: Tokens can act as a unit of account within the ecosystem, allowing users to measure and compare the value of various assets, services, or goods within the network.

- Governance and Decision-Making: Some blockchain ecosystems have tokens that grant holders the right to participate in governance and decision-making processes. Token holders can vote on proposals, changes to network parameters, and protocol upgrades.

- Access and Usage: Certain tokens grant access to specific features, services, or dApps within the blockchain ecosystem. For example, utility tokens can be used to pay for transaction fees, access decentralized applications (dApps), or even obtain premium services within the network.

- Rewards and Incentives: Tokens are often used to incentivize network participants. Miners, validators, or stakers may receive tokens as rewards for their contributions to the network’s security and functionality.

- Smart Contracts and Programmable Features: In platforms like Ethereum, tokens can be used within smart contracts to create programmable agreements. This enables the automation of various processes, such as token distribution, lending, and decentralized finance (DeFi) operations.

- Interoperability: Tokens can be used to facilitate interoperability between different blockchains and ecosystems. Cross-chain tokens, such as Wrapped Bitcoin (WBTC), enable assets from one blockchain to be used on another.

- Ownership and Provenance: Non-fungible tokens (NFTs) represent ownership of unique digital or physical assets, proving authenticity and provenance. They are can be used for digital art, collectibles, virtual real estate, and more.

- Fundraising and Crowdsourcing: Startups and projects can create and distribute tokens as a means of raising funds through Initial Coin Offerings (ICOs) or token sales. Investors purchase tokens as an investment in the project’s success.

- Liquidity and Trading: Tokens are often traded on cryptocurrency exchanges, providing liquidity to the market. Traders and investors can buy, sell, and trade tokens to capitalize on price fluctuations.

These roles can vary from one blockchain ecosystem to another, and the specific functions of a token are determined by the design and purpose of the network. Understanding these roles is essential for making informed decisions about how to use, invest in, or interact with tokens within a particular blockchain environment.

Key Token Attributes

The key attributes of cryptocurrency tokens can vary depending on the blockchain platform and the token’s design. Here are some of the most important attributes to consider when evaluating cryptocurrency tokens:

- Fungibility: Fungible tokens are interchangeable with one another, meaning one token is equal in value to another of the same type. For example, one Bitcoin is equivalent in value to another Bitcoin. In contrast, non-fungible tokens (NFTs) are unique and not interchangeable.

- Intrinsic vs. Referential Value: Intrinsic value is derived from the utility the token provides within the blockchain ecosystem. For example, tokens used to pay for transaction fees, participate in staking, or access certain features in a decentralized application (dApp) have intrinsic value. An example of cryptocurrencies with intrinsic value could be Ethereum’s Ether (ETH): used for gas fees and executing smart contracts.

- Referential value, on the other hand, is value that is linked to an external reference. These tokens are typically pegged to the value of a traditional currency (e.g., the US dollar) or an underlying asset (e.g., gold). An example of a cryptocurrency with referential value is Tether (USDT): a stablecoin pegged to the US dollar, with 1 USDT ideally equal to 1 USD. Referential value tokens are generally more stable in price because they are designed to maintain parity with the reference asset. Users often use them as a hedge against cryptocurrency market volatility.

- Utility vs. Security Tokens: Utility tokens provide access to specific services, products, or features within the blockchain ecosystem. The primary purpose of utility tokens is to enable and incentivize users to interact with and participate in the blockchain network. They grant access to various functionalities, such as using dApps, paying for transaction fees, or obtaining specific services. An example of a utility token is Chainlink (LINK): used to access decentralized oracles for data connectivity.

- Security tokens represent ownership of an underlying asset, a share in a company, or a stake in an investment contract. They derive their value from the potential to generate profits or financial returns. In this way, they are similar to traditional securities, such as stocks or bonds. Examples of security tokens might be tokenized real estate offerings or equity in a startup or company. Security tokens grant ownership rights and financial benefits to holders. These rights may include dividends, profit sharing, voting rights, and potential resale of the token. Security tokens are often subject to securities regulations and must comply with legal requirements.

- Transferability: Most tokens are transferable, allowing users to send them to others within the same blockchain network. This attribute is fundamental for peer-to-peer transactions.

- Supply Metrics: Understanding the token supply is crucial. Specifics will be discussed later in this session.

- Minting and Burning: Some tokens, particularly on smart contract platforms like Ethereum, can be created (minted) and destroyed (burned) based on predefined rules. Minting generates new tokens, while burning removes them from circulation.

- Stakeability: Some tokens can often be staked by users to participate in network operations, such as block validation, and earn rewards in return. Staking is a key feature in proof-of-stake (PoS) blockchains.

- Governance Rights: Some tokens grant holders the right to participate in governance and decision-making processes within the blockchain ecosystem. Token holders may vote on protocol upgrades and changes.

- Lock-up Periods and Vesting Schedules: Tokens may come with lock-up periods or vesting schedules that dictate when and how token holders can access or transfer their tokens. This can influence token liquidity.

- Divisibility: Some tokens are divisible into smaller units, allowing for microtransactions. For instance, one Bitcoin can be divided into 100 million satoshis.

- Interoperability: Tokens may have interoperability features that enable them to be used on multiple blockchain networks or within different dApps. Cross-chain tokens are an example of this attribute.

- Liquidity and Exchange Listings: Liquidity and exchange listings affect a token’s tradability and market access. Highly liquid tokens are more easily traded on a variety of exchanges.

- Use Cases: Understanding the practical applications of a token is essential. Some tokens have a wide range of use cases, while others are specific to a particular function or service within the blockchain ecosystem.

Evaluating these attributes is crucial for making informed decisions when investing in, using, or interacting with cryptocurrency tokens. Different tokens may prioritize these attributes differently, and their combination can significantly impact a token’s value, utility, and purpose within the blockchain ecosystem.

Identifying the Token’s Primary Use Case

A use case in the context of cryptocurrency tokens refers to the specific purpose or function that a token serves within a blockchain ecosystem. The primary use case of a token is typically tied to its utility within the blockchain ecosystem. Users acquire and hold the token to access specific features, services, or benefits. Some common use cases for tokens are:

- Transaction Fees: Some tokens are used to pay for transaction fees within a given blockchain network.

- Staking: Tokens can be staked to secure the network and earn rewards.

- Access to dApps: Tokens are used to access and use decentralized applications (dApps).

- Governance: Tokens grant voting rights and participation in network decision-making.

- Data Oracles: Tokens are used to pay for access to data oracles that provide real-world information to smart contracts.

- Decentralized Finance (DeFi): Tokens may be used in lending, borrowing, yield farming, and liquidity provision.

Once the primary use case has been determined, it can be useful to evaluate the importance of the use case. A compelling use case can attract more users and increase demand for the token. Does it solve a real problem, provide a unique service, or offer a new opportunity? Lastly, one should consider whether the use case has the potential to scale and adapt to changing market conditions and technological advancements.

Assessing Token Supply

Total Supply refers to the total number of tokens that can ever exist within a specific cryptocurrency or blockchain network. It represents the maximum quantity of tokens that can be created or minted.

Some cryptocurrencies have a fixed total supply, meaning the number of tokens is predetermined and cannot be altered. A fixed supply is often used to create scarcity and promote store-of-value characteristics, as seen in Bitcoin’s fixed supply of 21 million BTC.

In contrast, others have a dynamic total supply, allowing for changes over time through mechanisms like inflation or deflation. A dynamic supply is commonly used to incentivize network participation or maintain price stability, as seen in some stablecoins.

Circulating Supply represents the portion of the total supply that is actively available and in the hands of token holders, excluding tokens that are locked, reserved, or not in circulation. The formula for calculating circulating supply is straightforward: it is the total supply minus any tokens held by the project team, locked in smart contracts, or not available for trading. The circulating supply is an important metric when determining the market capitalization and trading liquidity of a cryptocurrency. A larger circulating supply can affect price stability and market dynamics.

Maximum (Max) Supply, refers to the maximum number of tokens that can be in circulation at any point in time. It is often set as a cap to control inflation and ensure the scarcity of the cryptocurrency. Max supply is a crucial component of a cryptocurrency’s economic model. It influences factors like price appreciation, inflation rates, and the token’s long-term viability. Examples of cryptocurrencies with max supply limits are Bitcoin with a maximum supply of 21 million coins and Litecoin with a maximum supply of 84 million coins.

Supply metrics are an important consideration for investors and users evaluating a cryptocurrency. For instance, understanding total supply can help investors assess the scarcity of a cryptocurrency, which can impact its long-term value. Total supply and circulating supply can influence the price, liquidity, and trading activity of a cryptocurrency, which, in turn, can affect market dynamics and investor sentiment. It’s also worth noting that the token’s supply metrics play a role in its overall value proposition. A reasonable total supply and circulating supply can provide confidence in a cryptocurrency’s utility and stability.

Token Distribution Mechanisms

It’s important to understand how tokens are initially distributed and how they may be allocated or acquired over time within a cryptocurrency project.

Initial Token Distribution

- Crowdsales and ICOs: Many cryptocurrency projects initially distribute tokens through crowdsales or Initial Coin Offerings (ICOs), where early investors purchase tokens at a specific price. It is very important to perform your due diligence when considering participating in these events.

- Airdrops: An airdrop is a mechanism where tokens are distributed for free to a target group of wallet addresses, often as a promotional or community-building effort.

- Pre-mined Tokens: Some projects pre-mine a portion of tokens before launching, which can be used for development, partnerships, and other purposes.

Ongoing Token Distribution

- Mining and Staking: Miners or validators in proof-of-work (PoW) and proof-of-stake (PoS) blockchains are rewarded with newly minted tokens as well as transaction fees. This process encourages network security and participation.

- Vesting Schedules: Vesting schedules dictate when team members, advisors, or early investors can access their allocated tokens. Vesting schedules can help prevent token dumps and maintain long-term commitment to the project.

- Community Rewards: Some projects allocate tokens as rewards for active community participation, such as contributing to development, reporting bugs, or proposing improvements.

Token Allocation Breakdown

It is particularly useful to analyze how the tokens are distributed to the team and advisors. Reputable projects will be transparent about disclosing these token allocations and the role these stakeholders play in the project’s success. Some projects may create a reserve fund, which holds tokens for various purposes, such as future development, partnerships, and liquidity support. Some tokens may be reserved for ecosystem growth, including funding dApps, projects, and initiatives that contribute to the network’s expansion. Also, there may be some allocation of tokens saved for the community and users, as they are essential for adoption and network growth.

Regulatory and Compliance Considerations

Tokens issued through certain distribution mechanisms may be considered securities, subject to specific legal and regulatory requirements. It’s particularly important that token sales comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) laws, particularly in ICOs and other fundraising activities.

Token Burn and Minting Policies

Token burn is the process of permanently removing a specific number of cryptocurrency tokens from circulation. These tokens are often sent to a burn address or a smart contract that renders them unspendable. Token burn can serve various purposes, including:

- Reducing Supply: By decreasing the total supply, token burn can create scarcity and potentially increase the value of the remaining tokens.

- Removing Unsold Tokens: In ICOs or token sales, unsold tokens are often burned to manage the supply.

- Network Security: In proof-of-stake (PoS) systems, burned tokens may be used as collateral for validators, enhancing network security.

Again, transparency is extremely important in token burn processes. Auditable and verifiable smart contracts or public records should be available to confirm token burns.

Token minting refers to the creation or issuance of new cryptocurrency tokens. Minting can be a one-time event or an ongoing process, depending on the token’s design. Token minting can have various purposes, such as:

- Rewarding Miners/Validators: In PoW or PoS systems, new tokens are minted and rewarded to miners or validators for securing the network.

- Incentivizing Users: Minting can be used to incentivize users to participate in governance, staking, or other network activities.

- Expanding Supply: Inflationary cryptocurrencies use minting to expand the token supply over time.

Note that token minting can lead to inflation (increased token supply) or deflation (decreased token supply), depending on the token’s economic model. A fixed supply sounds good on paper, but in reality it can limit the growth of a project. When there is a variable supply that grows slowly over time, the protocol can use the inflation to incentivize more people to join the project. Inflating the token supply too quickly is clearly detrimental, because it will quickly dilute the token value. However, striking a proper balance through modest inflation can help to bring new people into the ecosystem, adding more value than the reduction in token price due to inflation.

Vesting Schedules and Lock-up Periods

Vesting schedules are time-based release mechanisms that control when and how individuals, team members, advisors, or early investors can access and sell their allocated tokens. They are used to align the interests of token recipients with the long-term success of the project. They discourage quick profit-taking and promote commitment to the project’s goals. Vesting periods can vary but often range from several months to multiple years. Longer vesting periods encourage long-term commitment.

There is also the concept of a cliff period, a waiting period at the beginning of the vesting schedule during which no tokens are released. This ensures recipients remain engaged with the project.

The release schedule stipulates how tokens may be released gradually over time, with recipients gaining access to a percentage of their allocated tokens at regular intervals. Generally, these unlock schedules are linear — the tokens are released periodically (e.g. monthly) without being based on productivity or milestones. The problem is, once these tokens have vested, the contributors holding the tokens may sell, putting pressure on the price of the token. Also, once these actors have realized the return on their investment, they may leave to explore other opportunities, and this can be detrimental to a protocol. A better model might require deliverables or milestones to attempt to retain the best talent.

An example of a vesting schedule would be a 4-year vesting period with a 1-year cliff, where 25% of tokens become accessible after the cliff period, and the remaining tokens vest linearly over the following 3 years.

Lock-up periods are fixed time frames during which token holders are restricted from selling or transferring their tokens. Lock-up periods can overlap with vesting periods. Lock-up periods serve a similar purpose as vesting schedules, discouraging early selling and promoting a long-term commitment to the project. The length of lock-up periods can also vary, but often extend from a few months to years. Longer lock-up periods provide stronger commitment signals. Once the lock-up period expires, token holders gain the freedom to sell or transfer their tokens as they choose.

Governance Participation and Decision-Making

Governance tokens are digital assets that confer voting rights or influence within a blockchain network’s governance process. Holders of these tokens can influence the network’s development by participating in decision-making. Governance decisions have a direct impact on the network’s rules, functionality, and future development. Users’ participation can shape the network’s trajectory.

Users often need to stake or lock up governance tokens to participate in governance. The number of tokens staked can influence the weight of their votes. The primary way users participate in governance is by voting on network proposals. These proposals can include changes to protocol parameters, upgrades, and funding allocation. Some networks allow users to submit proposals, suggesting changes or improvements to the network. This enables community-driven innovation. Many networks hold governance meetings or discussions where participants can voice their opinions and reach consensus on important decisions.

There are several characteristics of the decision-making process in governance. First of all, there is the concept of quorum, which represents the minimum number of votes needed for a proposal to be valid. Also, decisions are often made based on majority rule, where the outcome is determined by the highest number of votes. Lastly, it’s important to note that there are usually time frames for decision-making processes, such as the duration of voting periods and the deadlines for implementing accepted proposals.

Goverance does have a couple of associated risks. One is the risk of governance decisions being dominated by a small number of large token holders, known as “whales.” This can lead to centralization of power. The second is the possibility of Sybil attacks, where malicious actors create numerous accounts to manipulate the governance process. There have been a number of different proposed solutions to these risks, but none are perfect and there are always trade-offs. To learn more about these issues, refer to the Shimmer DeFi Education series session on Governance.

Tools of the Trade

Diagrams

Many people that have been in the crypto space for some time have come in contact with tokenomics diagrams. These are simple tools that provide information about relevant token allocations or schedules at-a-glance. In many cases, these diagrams will be accompanied by a token vesting schedule so you can assess the emission time schedule and the rewards that are paid out. Diagrams may include token allocation pie charts that show how the tokens are allocated to different groups of contributors. It’s important to note that this is just a snapshot at launch, because soon after launch the allocations will likely look very different due to trading and emissions schedules.

Those that find token flow diagrams interesting may also be interested in Tokenomics DAO. This community is focussed on analyzing the tokenomics of different web3 protocols and blockchain applications. This can offers insight into the value change in a token over time and in a way that shows how all of the components are interconnected. This might include people, smart contracts, actions, etc. in one diagram rather than relying on several different diagrams to show the inflows and outflows of value in a given system.

Modeling Tools

There are a spectrum of modeling tools ranging from simple, standard tools to more complex and customizable options. On the simple side, a useful and extremely flexible tool is a spreadsheet. Metrics might include the vesting schedule, token supply, inflation, distribution schedule, ownership and so on. Spreadsheets are easy to organize and sort and have easy to implement formulas.

A couple of other popular tools follow:

Machinations:

Key Features:

- Interactive Visualizations: Map out the flow of resources within a token system.

- Simulation Capabilities: Test different scenarios to evaluate the resilience of tokenomics.

- Optimization Tools: Fine-tune parameters to achieve specific economic goals.

Use Cases:

- Token Design and Iteration: Collaboratively design and refine tokenomics.

- Risk Management: Assess and manage risks through simulations.

- Community Education: Simplify visualizations for community understanding.

- Investor Pitching: Clearly communicate economic viability to investors.

Increasing a bit in complexity is the machinations tool. This tool allows for customized visualizing and analysis of the tokenomics of blockchain projects. It provides interactive tools for modeling, simulating, and refining the economic dynamics of these tokens. Machinations are especially useful for determining the movement of value within a token economy. With features such as sources, syncs and converters, a user has the ability to generate time-bound economies. Every second that passes results in a step that is triggered by the machination, reacting to the controls you activate. Recently these machinations acquired the ability to incorporate external data which is a really useful feature. Previously these machinations were siloed, but now they can connect to the real world to obtain external data. Also, the community and support team at machinations is very helpful; there are a lot of examples and support to assist you.

cadCAD:

Key Features:

- Modular Design: Allows the creation of modular and reusable components for system modeling.

- Parameterization: Easily tweak and test parameters for comprehensive scenario analysis.

- Integration with Python: Leverages Python’s flexibility for system modeling and analysis.

Use Cases:

- Token System Modeling: Design and simulate intricate token systems.

- Governance Modeling: Simulate the impact of different governance mechanisms on token ecosystems.

- Scenario Analysis: Evaluate the effects of various scenarios on token values and user behaviors.

On the highly complex end of the spectrum would be a solution like cadCAD. cadCAD is a powerful open-source framework designed for complex system simulation. It is widely used for modeling and simulating the dynamics of blockchain token ecosystems. This is a python package requiring the user to code their simulations line by line. Using this system, extremely complex and customizable models can be developed. However, since cadCAD is quite advanced and complicated it may only be appropriate for advanced users.

Additional Tools for Discovering Opportunities

Token Terminal:

Key Features:

- Financial Data: Offers a wide array of financial metrics for crypto assets.

- Comparison Tools: Allows users to compare the financial performance of different tokens.

- Historical Analysis: Provides historical data to track the token’s financial evolution.

Use Cases:

- Financial Assessment: Evaluate the financial health and sustainability of crypto projects.

- Investment Decision-Making: Make informed investment decisions based on real-time financial data.

- Market Research: Conduct in-depth market research by comparing multiple tokens.

A very popular and useful tool is Token Terminal. Token Terminal is a comprehensive platform that provides real-time data and analytics for various crypto projects. It focuses on financial metrics, helping users assess the economic health and performance of different tokens. On the left hand side of the screen the stats of the protocol can be found. On the right there is a list of parameters that can be customized. Changing these parameters will have an effect on the diagram at the bottom of the screen. Some of the variables that can be changed are Total Locked Value (TVL), Market Capitalization, Size of Treasury, Number of Token Holders, Revenue, etc. You can use this tool to easily compare different protocols and see how the different parameters effect one another.

CoinGecko:

Key Features:

- Price Tracking: Displays real-time prices and historical price charts for a wide range of cryptocurrencies.

- Market Data: Provides market capitalization, trading volume, liquidity, and other essential market data.

- Community Metrics: Includes data on community engagement, developer activity, and on-chain metrics.

- DeFi Information: Covers decentralized finance (DeFi) projects and their associated metrics.

Use Cases:

- Price Analysis: Track cryptocurrency prices and historical performance.

- Market Research: Explore comprehensive market data for various cryptocurrencies.

- Portfolio Management: Manage and track your cryptocurrency portfolio.

- DeFi Insights: Stay informed about the latest developments in decentralized finance.

The next tool we’ll discuss is CoinGecko. CoinGecko is a widely-used cryptocurrency data aggregator platform that provides a comprehensive overview of various crypto assets. It offers a user-friendly interface with a multitude of features catering to both beginners and experienced users. This is a good repository for many protocol statistics and it also has a useful tokenomics tab. Although offered at a relatively high level, a user can still obtain specific knowledge about the tokenomics of different projects using this tool. While not as detailed as Token Terminal, it does offer basic information about the token distribution, vesting schedule, launch statistics, incentives, etc.

Dune:

Key Features:

- Customizable Queries: Users can create and customize SQL queries to extract specific data from the Ethereum blockchain.

- Dashboard Creation: Build personalized dashboards to visualize and analyze on-chain data.

- Community-Driven Data: Benefit from a wealth of community-created queries and dashboards for a variety of DeFi protocols.

- Smart Contract Analytics: Explore and understand the performance of smart contracts deployed on the Ethereum blockchain.

Use Cases:

- DeFi Research: Analyze and understand the performance of various DeFi protocols.

- Investment Decision-Making: Make informed investment decisions based on on-chain data.

- Community Collaboration: Contribute to and leverage community-generated analytics for decentralized applications (dApps).

Lastly we’ll consider Dune (formerly Dune Analytics), which was mentioned in another Shimmer DeFi Education presentation. Dune is a powerful analytics platform designed specifically for decentralized finance (DeFi). It provides users with the tools to create, explore, and share blockchain data in a customizable and user-friendly manner. Dune could be considered a community-run research project. For example, one user might offer their own graphs that can be viewed by other users of the platform. Or, a specific protocol may be of interest, and a user could explore all of the different community-based representations of the tokens in that protocol. Taking this a step further, users can even generate their own dashboards using the data these tools provide.

Risk Management and Due Diligence

Identifying Scams and Ponzi Schemes

When considering tokenomics, there are a number of red flags to keep on your radar. Projects with tokenomics that seem too good to be true should be avoided. Unrealistic tokenomics, such as extremely low initial prices with guaranteed future spikes, can be indicative of scams. Also, be skeptical of projects with unclear or unfair token distribution. Unequal or unfair token distribution, where early contributors receive disproportionately high allocations, can be a sign of a pump-and-dump scheme or a poorly designed project. Ponzi schemes may distribute tokens in a way that benefits early investors at the expense of later participants.

Scams often lack transparency in providing essential project details. Projects that don’t openly share information about their team, mission, vision, and technology should be considered suspect. Perhaps the team simply values their privacy, but it is recommended to exercise caution when considering projects with team members who hide their identities. Genuine projects are typically transparent about the backgrounds and roles of their team members. Lack of transparency could set up an exit scam (also known as a “rug”), where project developers abruptly disappear with funds raised from investors, leaving the project unsupported and investors empty-handed.

Projects that promise unrealistically high returns on investment (ROI) should be considered dangerous. Exaggerated and overly ambitious claims, especially related to future price increases or market dominance, can be red flags. Legitimate projects focus on realistic goals and milestones. Ponzi schemes often lure investors with the promise of quick and exorbitant profits. Similarly, watch out for projects that guarantee profits. Legitimate investments always carry risks, and projects that claim otherwise may be deceptive.

Furthermore, scams often lack a clear and viable use case for their tokens. Scrutinize projects that don’t articulate a practical purpose for their tokens within their ecosystems. For instance, ponzi schemes often lack real-world applications or utility for their tokens. Genuine projects will typically aim to solve real-world problems or enhance existing processes.

Community engagement is extremely important to a cryptocurrency project and can make or break it. Scams often lack an active and engaged community, as they may not have a genuine user base. Projects that engage in or encourage fake social media activity, such as buying followers or engagement, may lack genuine community support. Also, projects that censor discussions or criticisms may best be avoided, as genuine projects welcome open dialogue and constructive criticism. Censorship or removal of critical discussions and dissenting opinions in community channels can indicate an attempt to control the narrative and hide potential issues. Lastly, be sure to report suspected scams to relevant authorities or community platforms. Reporting helps protect the wider community from falling victim to these fraudulent schemes.

Copycat projects are another red flag. Perhaps the project is using plagiarized whitepapers or other content. Projects that copy content from reputable projects may lack originality and genuine intentions. Perhaps the project is using copy-paste code without proper attribution or understanding. This can be indicative of developers lacking the necessary skills to build a robust and secure platform.

Scams often operate outside legal boundaries and lack clear regulatory compliance. Legitimate projects will strive to adhere to legal and regulatory standards. It is especially important to be wary of projects that operate as unregistered securities. Ponzi schemes may attempt to evade regulatory scrutiny, exposing investors to legal risks.

A lack of proper security measures is another clear red flag. Smart contracts that have not undergone proper security audits pose a risk of vulnerabilities and potential exploits. Reputable projects will prioritize smart contract security and provide audit reports. Also related to security is fund management. A project not employing multisig wallets for fund storage (when available) or unclear procedures for fund use can raise concerns about the security of investor contributions.

Wrapping it All Up

In conclusion, the realm of tokenomics is a complex, multifaceted topic in the blockchain ecosystem. While many nuanced aspects have been introduced in this session, we have really only scratched the surface and a true understanding would take an even more involved exploration. Luckily there are already a wide range of analytical tools and platforms available that can ease the burden.

But make no mistake: the true power of tokenomics lies in its ability to reshape traditional economic structures, providing the financial flexibility required of today’s blockchain applications. As this space continues to evolve, the importance of comprehending a token’s primary use case is of the utmost importance. Once understood, tokens may be identified that not only transform industries but also become an integral part of tomorrow’s decentralized, community-driven economies.

📢 Bloom Wallet: IOTA and Shimmer’s portal to Web3

[ - by Ness]

On October 12th a new wallet appeared in the IOTA ecosystem: Bloom. Developed by the core team that also developed the Firefly wallet. The goal with Bloom is to create a modular cross chain wallet. In the latest Spec Weekly, Kutkraft had a closer look at what the new wallet has to offer and how it can be used.

Unlike the Firefly wallet, the Bloom wallet combines the whole IOTA stack in one place: Shimmer, ShimmerEVM and later IOTA as well. You won’t even have to use MetaMask for the app interactions. But that’s not all. While MetaMask works with extensions, people don’t spend much time in the wallet itself but rather in the dApps. So, the wallet is just used to sign transactions basically. Bloom however will also feature third-party integrations. The first to be featured will be fiat on-ramps and swaps. This means that users can buy and sell IOTA and Shimmer directly via Bloom. In the future Bloom will not only be a wallet but a DeFi Hub within a wallet.

Bloom vs. MetaMask: When being asked about whether Bloom could overtake MetaMask the answer of Charlie is pretty clear: “It’s actually gonna replace it.”

Using Bloom for the first time

In theory this all sounds very promising, but what does Bloom look like in practice? Of course, Kutkraft wants to find out and tests the wallet for the first time.

First thing he mentions: great design, great visuals. The setup is quite easy:

- Download and install the app

- Choose your network (while Shimmer is the default network you can also connect to any network with custom settings)

- Create a new profile or restore an existing one

- Secure your profile by setting up a password

- Add a PIN number

- Bloom is ready!

After setting up Bloom you are ready to discover all its features. The interface looks “sleek and simple” and shows you your own funds as well as the market information of the tokens you are holding. The first test transaction took a while until it was visible in the Bloom wallet and Kutkraft had to log out and in again. The second transaction however was there within seconds. Same thing with the third transaction. So, sending funds from MetaMask to Bloom works pretty fast. Once the funds are in your Bloom wallet you can transfer them from the SimmerEVM to the Shimmer network and vice versa with just a few clicks.

🆕 Tangle Treasury Update

[ - by DigitalSoulx]

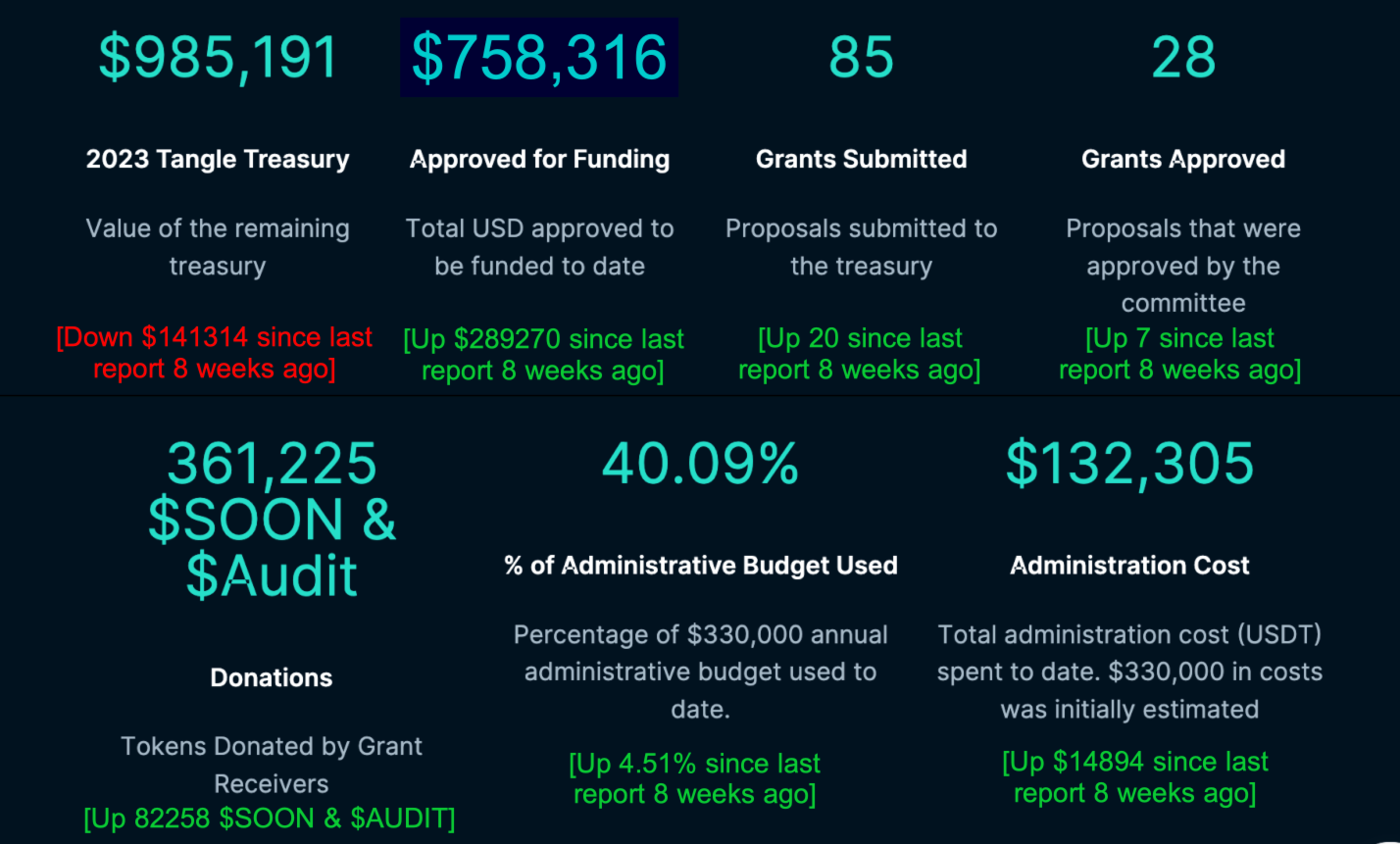

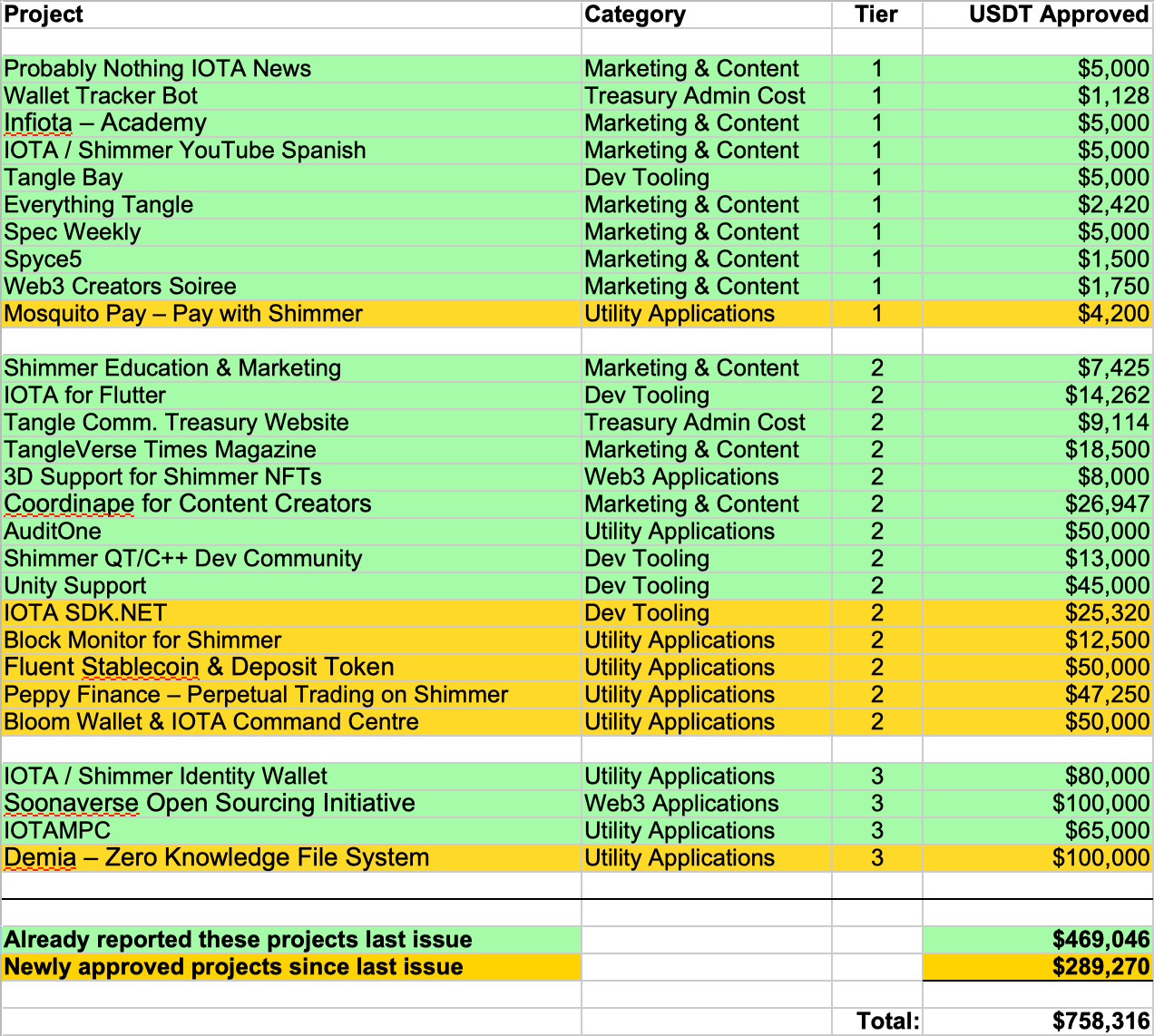

As previously reported, we have offered to include Shimmer community Treasury updates in each issue of the Tangleverse Times, as a way to thank the community for their support of our publication. These updates are intended to be a way to see the status of the treasury at a glance, but for more detail about each of the individual proposals I would highly recommend visiting the great website that JD is maintaining! It is quite complete and up-to-date. So, here is the current status of the treasury as of early December 2023:

And that’s a wrap! Please like, share, smash that subscribe… or better yet, join us! Do you love to write? Passionate about the IOTA ecosystem? Do you have a project to share? Master at making memes?

We want to help the community discover their strengths and stay updated about everything IOTA. We cannot do this alone. Community participation and feedback will help keep The Tangleverse Times up-to-date and invaluable. Help us help the ecosystem.

The best way to reach us is through Discord: discord.gg/2BeCTUMPAM

Follow us on Twitter: @IOTAcontentDAO and @TangleverseWeb

Special thanks and honourable mentions to all the hardworking ICCD degens who contributed (in the form of written, editorial, design, advisory, and memetic support) to this edition: DigitalSoul.x (Rob), Mart, Ness, ID.iota, iota_penguin, Infernal Uprising, Dr.Electron and Epoch Zero.

If you enjoyed the newsletter and would like to see it continue to grow, you can also donate here: iota1qp7l8s5026k7gvd2m0t8cyj754geslnl6vtt0cxzf0xlsvyeug2pv85rh78 smr1qzv5agn7ty5kvmucu6atl4hkhqp3r9cgurh4pdw0rml347tc0jxtwmn4dhk