The Dog Days of Shimmer (Magazine)

⌨️ From the editorial desk...

[ — by @DigitalSoulx]

The sweltering, most uncomfortable days of summer in the Northern Hemisphere are colloquially known as the 'dog days of summer.' Historically, this period of time was not just about high temperatures, but drought, unpredictable weather, physical ailments like fever and stupor, and even bad luck.

Thinking about the IOTA / Shimmer ecosystem right now, this concept resonates with me. While we are trying to be patient, waiting for ShimmerEVM to be released, everyone seems tired and lethargic. Many projects are finished building and just waiting to release. Community members are overly pessimistic and negative. These are the moments that can really test investors. It's easy to think that the grass is greener on the other side and jump ship. But don't take your eyes off of the prize! Personally, I'm convinced that ShimmerEVM will bring huge upside to the ecosystem. We've come this far and it would be a tragic mistake to leave without seeing it through now.

So take a moment to acknowledge that we are currently in what may later be known as the 'dog days of shimmer', and steel your nerves! Take a vacation, spend some quality time with friends and family, and don't let these days get you down. Soon(TM) may be closer than you think.

👨💻 Monthly Technical Update

[ - by ID.Iota]

GM 🌅 #IOTA Fam 🤖

in June we had the first monthly development update on #iota-core within the Tangleverse Times Magazine and I am happy to present you with the second one today.

Disclaimer: The information provided in these updates comes from the official IOTA GitHub (https://github.com/iotaledger) and the IOTA discord server (https://discord.iota.org). The interpretation of that information, however, does not represent official information from the IOTA Foundation. While we strive to ensure the accuracy and reliability of the content, it is important to note that the updates reflect community perspectives. For official announcements and statements, please refer to the IOTA Foundation's official channels and communications.

I got some Feedback and want to address that right at the beginning. I have decided to add a TLDR of every monthly update right at the end. So if you are in a hurry or just don’t want to spend time to read through that wall of text, don’t hesitate and jump to the TLDR at the end of this article. Furthermore those updates aren’t meant to replace the weekly updates on Twitter. I will continue to publish Twitter threads covering the iota-core progress.

With that out of the way, let’s have a short look at what happened last month so we know where we are coming from. In May the efforts around #iota-core took off. The decision to move from #GoShimmer to an experimental prototype implementation of the node protocol towards #iota-core, a production ready node software, led to a situation where the existing GoShimmer CodeBase had to be ported to #iota-core. As a surprise to a lot of nagging community members this took only roughly a month and the team nearly finished those efforts just in time for the first monthly update in June. That was the first time Stardust VM ran decentralized on IF computers.

Since then the efforts have shifted a little… The most important topics in June didn’t contain porting code from #GoShimmer but concerned the implementation of completely new things. June was all about Congestion Control, Accounts, Mana and Staking. Congestion Control is important to avoid people spamming the network and claiming all the network bandwidth for themselves. In order to avoid this, IOTA implements a secondary resource called Mana. You need to own and spend Mana in order to use the network in times of congestion. Mana is obtained as a reward for staking your IOTA tokens and followed up through an individual Mana Account that is connected to your Iota Wallet. This system is essential to avoid or handle network congestion but also has high implications for the token value. It is going to be interesting to see the Mana economy running 😇!

So that’s how everything is coming together, but where are we with the implementation of those features? Let’s have a look feature by feature.

1.Mana and Mana Accounts

The implementation of Mana and Account support has happened mainly in the iota.go repository and is trackable in PR#435. The implementation is realized through a novel Output: the AccountOutput. The implementation has been reviewed roughly two weeks ago and is now merged into the code base. So the protocol is able to keep track of the Mana balances of each Wallet. Based on the Mana balance, the congestion control can kick in.

2. Congestion Control

The implementation of the Congestion Control is visible in the iota-core repository in PR#130. The congestion control is basically the control unit for the block scheduler and it lets you pass only your block to the block scheduler if the stored Mana on the account is high enough. The PR hasn’t been finished yet and the team consisting of research engineers and research scientist are working on it right at the moment. I think we can expect it to be merged into the code base in the coming week(s).

3. Staking

Now the missing piece is how do I earn or generate Mana? Well you guessed it… Exactly through staking. In PR #143 within the iota-core repository you are able to track the progress on staking. You will be able to delegate your funds to a registered validator in order to stake your funds. There your Mana rewards get calculated based on the amount of time and Iota tokens you are staking. Following that you will be able to claim your earned Mana rewards. This PR is also not finished yet and the team is working on it daily. A merge is likely going to happen at the same time the Congestion Control is finalized.

So much towards the implementation of the Mana economy. I am super curious about the progress the team is making and can’t wait to issue my first transactions with Mana on the tangle…

Besides those efforts around Mana and Congestion Control the team is also introducing seamless protocol updates. They are necessary to make sure the protocol is fully decentralized and does not need to be halted whenever a new update goes live. The implementation is visible within the iota.go repository in #PR448. Jonas implied that this way of seamlessly updating the protocol does contain a lot of changes and therefore might take some more time. I would expect it to be finished for the next monthly update, however there are a lot of implications that need to be controlled.

As always there is so much more happening in the code base and I only covered the most important changes that took place in June. Jonas gave a very recent overview about all the things the team is working on, on Discord. If you want to dive a little deeper don’t hesitate to check his latest post.

Very interesting were also Jonas’ comments on the implementation approach and the progress the team is making. At the moment the IF is making progress at an incredible speed, implementing new functions and protocol parts on a weekly or even daily basis. The protocol with all its features is close to a first version of a testing candidate. This rapid progress however comes at the cost of in-depth analysis of all possible attack vectors, bugs and so on. So it's likely the team will shift in the future from introducing new things in the code base towards reviewing, testing and bug fixing the code base.

Jonas was very clear when he said that he is expecting a “hardening phase” in order to clean up the code base. So don’t get too hyped yet… We are coming closer!

TL;DR: The second monthly development update is focusing on the recent additions to the iota-core protocol like Congestion Control, Mana, and Staking. Mana is a secondary resource obtained by staking IOTA tokens and is necessary to use the network during congestion. The implementation of Mana Accounts has been finished. Congestion Control is being worked on and hasn’t been “finished” yet. Staking will allow users to earn Mana rewards. Staking is making good progress, however it hasn't been finished yet. The team is also working on seamless protocol updates and a lot of other stuff. Overall, progress is being made rapidly, but a "hardening phase" to review and fix bugs is expected in the future.

🎤 Interview: Benjamin Bönisch

[ Interview by Mart]

Tangleverse Times: Could you briefly introduce yourself for those who don't know you?

Benjamin Bönisch: In my role as VP Digital Products & Services at ETO GRUPPE I manage all venture projects. Venture is the testing ground ETO has created to successfully and sustainably meet the digital transformation of the service and product portfolio. In this context, I am also responsible for strategic cooperations, acquisitions and ecosystem building, primarily involving new IoT-related B2B and B2C business fields. These include, for example, current new developments such as farm sensors and irrigation valves, which will be marketed by ETO‘s subsidiary farmunited GmbH. We also bring innovations to the market in business areas such as traffic monitoring, precision farming as well as health care. For our IoT devices we put a clear focus on distributed ledger technology. The combination of DLT and Self Souvereign Identities enables our users to manage the sovereignty of their personal data.

TvT: What was the process of incorporating something novel into your product(s) like? Was it like “yeah that makes sense let’s just do it” or did you need to convince a lot of people that DLT can add value to your product?

BB: It all started with the nomination for „ALFRIED“, a project in which ETO develops smart traffic sensors. The project is subsidized by the German Federal Ministry for Digital and Transport. We combined all available new technologies and highlighted them in a project paper on the benefits of DLT. The paper already covered all topics we are still working on, such as decentralized identities, secure data transfer, or cryptocurrency microtransactions to enable machine economy. We were encouraged by the very positive feedback we received from the government, which was a strong confirmation that we had been heading in the right direction. Later on, Germany published the Blockchain Strategy, which further motivated us to continue on this path. Now, with MiCa being in place, we perceive this as a further confirmation that we have evolved from high risk development to a more mature and regulated approach. Actually we never had to convince anybody in management. ETO Venture was designed for exactly such kind of technology perspectives. We even took the quick decision to invest into filancore, a company specializing on decentralized identity mangement. They support from the very beginning with all topics around Self Souvereign Identities.

TvT: How do the farmers perceive the addition of DLT in Farmsense? Is it hard for them to grasp? Is it easy to use for them?

BB: We are about to enter the market, so there is little experience available yet. It will be very interesting to see what happens when farmers not only sell potatoes or wheat, but also weather and soil data. It may also change the perception of data ownership. So far all players in the market use the farmers data, aggregate and monetize them without any participation of the farmer. The farmers even have to accept this in the general terms & conditions. We do not believe in this concept in the future. Web3 means that the person that owns the hardware and creates the data should decide how the data can be used and monetized. It is a long road but we are starting to walk now.

TvT: Are there any plans to monetize the data? Does it make sense in your use cases or is it more about being secure and tamper-proof?

BB: Farmers will be the ones selling their data. We implement a platform fee to run and maintain the entire IoT platform, support the wallets and Apps etc. ETO is a foundation. We want to give a value back to the society. This really is a strong motivation for the ETO GRUPPE and one of the reasons I like to work here. Tamper proof data and secure login comes as an additional benefit, but it is not the main driver to build the ecosystem.

TvT: Speaking of reliable and secure data transmission, the community discusses a lot how and if IOTA is uniquely positioned for use cases like Farmsense or also Project Alvarium for example. From your perspective, are there any alternatives that could do the job?

BB: We need to be open for all technologies at all times. We can also not decide for or against DSRC (Dedicated Short Range Communication protocol), V2X or 5G. We define our requirements and try to find the best suitable technology for it. Scalability, secure network, no or low transactions fees and a high degree of decentralization are extremely important. At the same time, we will not accept high ecological impacts on the environment. If the CO2 footprint is too high we will not go for it. We need a layer 1 solution that solves these topics. Furthermore there are very special requirements coming from cryptographic support of hardware. We need to establish communication between machines. There is still work to do until a DLT can offer all of the features we need.

TvT: Tokenizing real world assets might be one of the next big things in crypto. Do you see any potential in your crypto related projects, or would just be a nice but not really necessary addition?

BB: We focus on what we have started. At the moment we are developing service features, which allow our users to monetize their own data. We cannot jump everytime the market changes its opinion about what is hyped or not. There is definitely a benefit in NFTs and ownership management. And there will be new features coming in the future.

TvT: What are your next plans? Do you have any other ideas that could leverage IOTA or DLT in general?

BB: We have many further plans to use the DLT technology. More projects are coming to the market, but we need to finish what we have started first. I also see other industry companies doing PoCs but not communicating at all. It seems that everybody remains in a waiting position.

TvT: How was your experience at the EIC (European Identity and Cloud Conference)? Are the participants / companies aware of the value that Distributed Ledger Technology can bring?

BB: At the EIC we saw the first companies that offer SSI and DID Solutions. But the activities were still focused on Public Key Infrastructure. We noticed that many participants were not aware of these new technologies, even though the potential benefits are enormous. The identity market will grow exponentially due to the fact that IoT devices, smart cars, smart homes etc. simply need solutions. As soon as SSI is more mature other companies will pick up the technology for sure.

TvT: Purely from a technological point of view, where do you think crypto stands in, let’s say 5 years time?

BB: With MiCa in place in Europe I am 100% sure it will be fully accepted in Europe and DLT will play a major role. In my opinion it will not be noticed in the general public because it runs on every system like TCP/IP. Who cares how exactly emails are being sent? As long as it is free to send them.

TvT: Did you get in touch with Shimmer either personally or with ETO group / Farmsense?

BB: No, not yet. But never say never.

🔥Hot Take: IOTA will never be a currency

... it will be much bigger

[ - by Linus Naumann]

Yes, many in the cryptocurrency space believe that decentralized currencies will displace government-backed fiat currencies like Euro, Yuan or even the US-Dollar. These dreams derive from a general criticism against central banks, which are perceived as being intransparent, to control money by “printing it out of thin air” and potentially censoring money transactions. Some crypto believers even predict that government-backed currencies will crumble fully, for example through hyper-inflation, and that cryptocurrencies will be necessary to replace them.

A different viewpoint

However, other crypto communities, with the IOTA community being one the strongest examples, have a developed a very different vision for the future of distributed ledger technologies (DLTs), the core technology behind all cryptocurrencies. After all, it can be doubted that fiat money really is to fail anytime soon and some even argue, that democratically controlled money is preferable to the alternative, some sort of anarcho-capitalism, anyway.

These communities stand for tech-evolution, rather than revolution, seeing the destiny of cryptocurrencies not in replacing fiat, but to complement it. They understand that public DLTs unlock something much bigger and much more fundamental than just handling currencies: They are fully transparent, immutable and public data-bases that enable completely new classes of digital assets and digital representations:

- Digital identities

- Tokenized assets

- Unique assets (NFTs)

- Elections

- Data anchoring

- Currency

Point is: All of the aforementioned usecases IMPROVE currently established processes. They do not require failing states or currencies. Even though the importance of cryptocurrencies as money might in fact rise in the future, it is more likely that neither of them will become the main medium of exchange in everyday life for the average person anytime soon.

IOTA is digital real-estate

Few DLTs out there are aiming to enable all potential usecases at once. IOTAs vision of the future is different from this majority of DLT projects, because it understood the true value of DLT early. It tries aims to build the best general use DLT, not just another currency. With the IOTA token aiming to become digital real-estate.

To understand the inherent value of the IOTA token we must understand one thing first: Everything in this universe is finite and so are DLTs. And so there are two fundamental bottlenecks when using them, that must be treated as resources whenever there is more demand than capacity in the network:

Transaction throughput - Networks are only able to process a certain amount of transactions per second (tps). If there are more transactions incoming than can be processed at a certain time, naturally a market forms in which users try to get their transactions processed.

Data space – The total amount of data that can be stored in any DLT is finite, because the nodes that run the network must be able to fully store and update the data-base in real-time.

In the IOTA network transaction throughput and data space will be controlled by the IOTA token.

IOTA token derived “Mana” controls transaction throughput: IOTA token will passively create a resource called “Mana” in the network (after the IOTA 2.0 update). Mana in turn needs to be spend in order to issue transactions. This means IOTA token holders will control the first limited resource: Transaction throughput.

IOTA token used as “storage deposits” control data space: Using any amount of data space in the network will require users to lock IOTA tokens as a storage deposit for as long as this data space is used. This means anything from digital identities, NFTs, currencies and other digital assets will need IOTA tokens to be used.

In short: Virtually all usecases of the IOTA network will be powered by the IOTA token. That is why many people expect a future in which IOTA token holders will be able to rent away their digital real-estate and in turn get paid.

The value of the IOTA network depends on supply and demand – and the supply is fix

There exists a fixed supply of around 2.7 billion Mega-IOTA (Mi).

This means that owning 2700 Mi will grant their holder access to 1 millionth of the whole network.

The big unknown: the future demand for the IOTA network

The future demand of DLT transactions and data-space strongly depends on how societal and political acceptance develops over time. Will the upsides of increased transparency and autonomy of the individual be valued high by society? Might future regulations even demand to anchor sensitive data on public DLTs, maybe allow for the bridging of CBDCs? Or will governments shy away from additional transparency in fear of loss of control?

Even though the answers to these questions cannot be known at the current time, IOTA is uniquely well positioned to be accepted by industry, society and governments. IOTA is currently tested as being the core technology in a variety of high-profile governmental projects that aim to further the digitization of society. It is out of scope of this article to go into detail about IOTAs links to governmental projects, but I will provide a few selected links for those interested in further research:

- European Blockchain Infrastructure Service (EBSI)

- Trademark East Africa

- Digital MRV (measurement, reporting, verification of climate data)

- EnergieKnip

🏆NFT Top 3

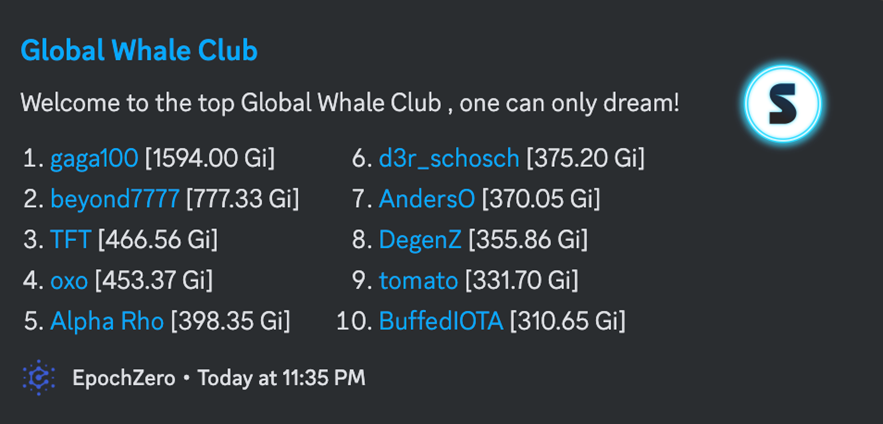

[Editorial intro by DigitalSoulx; NFT data provided by EpochZero]

Here at the Tangleverse Times we are happy to announce that we have entered into a partnership with EpochZero! They have offered to provide custom, monthly NFT statistics for inclusion in our magazine in exchange for a bit of promotion, and we gladly agreed. We hope that you agree that this data is a welcome, value-added addition to our publication. Do you have other ideas of specific NFT-related statistics that would be interesting to include? Reach out to us and let us know!

About EpochZero:

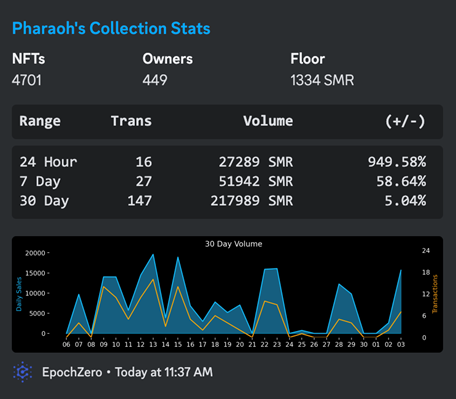

EpochZero began as an NFT project created by several active members in the IOTA community. Their suite of tools for analyzing other ecosystem NFT projects as well as the supporters of those projects has already become the go-to resource for the community. The only requirement for full-access to these tools is holding one of their Pharaoh NFTs.

However, EpochZero is not just about NFTs. The founders of the project also hope to attract early-stage investors who wish to support unique ecosystem projects. This will allow community members to participate in the development of these projects. There are even more ambitious plans like starting a DAO, a game related to the Pharaohs, etc. Sound interesting? More information can be found via the links below. Check 'em out!

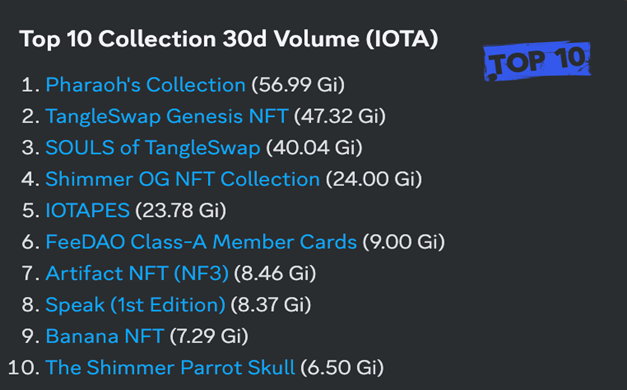

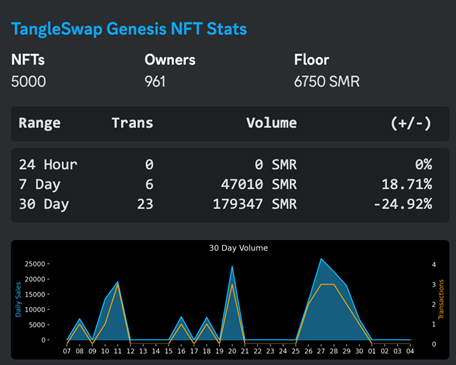

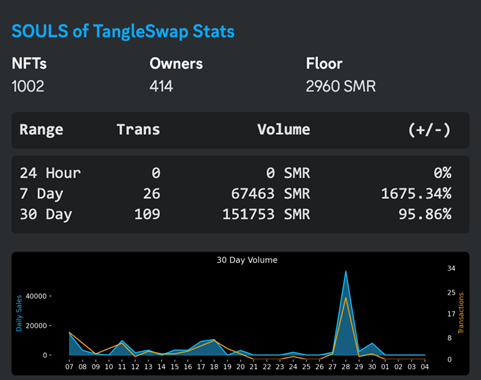

Here are the top 10 NFTs in June:

Over 350Gi worth of trades have taken place in the last 30 days within our vibrant NFT ecosystem. The community is buzzing with activity, showcasing the immense popularity and growing interest in digital collectibles!

Let's give a round of applause to the top 10 collections that have contributed significantly to this trading frenzy. The leading collections include:

We can't forget about our esteemed NFT whales who have made waves with their substantial holdings. Leading the pack is gaga100, who holds an astounding value of 1594 Gi, showing their immense passion for the NFT space. Following closely behind is beyond7777, adding their considerable weight with a hold value of 777 Gi. And not to be outdone, TFT jumps into the spotlight with an impressive 466 Gi of trading volume.

These staggering numbers and active participants showcase the thriving and dynamic nature of our NFT community. Get ready for more incredible moments and opportunities as we continue to push the boundaries of digital collectibles!

👨 Meet the IF - Christian Saur

[Interview by Mart]

Tangleverse Times: So let’s start with an introductory question, how did you find out about IOTA and how did you find your way to the IOTA Foundation?

Christian Saur: I first came into contact with IOTA in 2016 interning at Bosch Venture Capital. A colleague and I were tasked with finding out what this crypto thing was, and if Bosch should take a deeper look into it. Somewhere along the way we came across IOTA and were immediately intrigued.

Fast forward to 2021: I had just graduated and was talking to a colleague at the company I had been working at during my last year in university about interesting companies when he asked me why not join IOTA because I had talked about it a couple of times. I looked at the website and a job opening had gone online that same day that fit well with what I wanted to do, so I applied and things worked out quite nicely.

TvT: What do you love to do in your leisure time? Any specific sports or other hobbies that you engage in regularly?

CS: I just recently picked up Tennis again after playing quite a lot during school and university. Other than that I enjoy reading - books, but also loooooots of articles on all kinds of topics - and playing the piano. And spending long hours in the kitchen cooking simple but very time-consuming dishes (like this ragu here which is fantastic; just blend mushrooms if you want to make it vegetarian). The way that time alone can transform very simple ingredients into something delicious is always fascinating to me.

TvT: Do you have any objects or habits you couldn't live without?

CS: This is a difficult one…off the cuff nothing specific comes to mind, but if anything it’s probably that I really value some alone time prior to going to bed at night. Most of the time I won’t even do anything specific during that time, just sit by myself :D

TvT: Are you more of a coffee or tea drinker, or neither of both?

CS: Definitely coffee! I find that tea is always a bit disappointing. It smells delicious, but then if you drink it, it doesn’t taste like much.

TvT: Let’s say IOTA / Shimmer / Assembly will give you complete financial freedom in the future, would you still be working for the IF? Do you have other passions that you’d love to follow more?

CS: I can’t imagine myself stopping to work completely. But I’m not sure it’d still be at the IF. Maybe I would spend my time working on some more experimental projects. Other than that I would definitely make more room for cooking more insanely time-consuming recipes.

TvT: What's an intriguing pet you would love to have?

CS: I’d love to have a non-smelling dog that can walk itself.

TvT: Do you watch a lot of Netflix or TV shows in general? What are the best ones you’ve seen in the last year?

CS: I recently watched the latest season of Billions and can only recommend it (as any previous season).

TvT: Pineapple on Pizza, Antonio might be fuming right now, but what’s your stance on it?

CS: Absolute no-go

TvT: We also asked Dom about his favorite travel destinations, but this might be a nice permanent addition for this format. Giving our community members some inspiration on where they could travel. What are your favorite places to travel? Where do you really want to go?

CS: Number one on my list of places to visit is Patagonia, but I want to take my time for that one, so I might do it once I have that financial freedom you asked about earlier :) When it comes to favorite destinations it comes down to Italy and Brazil. You can never go wrong when traveling to either of those countries.

TvT: Lastly, many community members love to collect NFTs they like. Do you also own some? Is there anything you collect in real life?

CS: I do own some NFTs. I was lucky enough to get my hands on an IOTABOT, and I also bought some on other networks. But I’m generally not that into collecting things, neither in real-life nor digitally (you can imagine a cringey “I don’t collect things, I collect memories” inspirational post here).

❓ Can Shimmer Compete?

[ - by Blockbytes]

The Iota Foundation is launching a new EVM chain into the crypto market. But, is it too late?

The market is saturated.

There are 184 live alt-chains. Shimmer EVM is currently aiming to be the 185th. But, to be fair, most of their competitors are complete non-entities. The total value locked of Ethereum, Tron, Binance Smart Chain, and Arbitrum is 85% of the entire industry. Of the four, Arbitrum is the only one launched in the last four years. And it is a Layer 2 for Ethereum that pays gas in ETH.

That’s some really entrenched competition.

When we examine the success of these industry leaders, we come across three primary factors that we can point to for their success: security, accessibility, and integrations. To see if Shimmer has a fighting chance, we will compare Shimmer’s proposed performance across the metrics with a couple of its competitors. Specifically, BSC and Arbitrum. Two fundamentally different products with whom Shimmer will be directly competing.

It is quite difficult to compare existing projects with one that has not yet launched, but we will give it a go.

Security

Arbitrum performs very well here. It relies on Ethereum’s robust validator network and utilizes zk-rollup technology to secure communication between the two. This is a strong narrative, as Ethereum has a battle-tested history to back up its claims of security.

However, Arbitrum has one security weak point, its DAO. The Arbitrum DAO experienced intense backlash over its first proposal, which distributed tokens to itself. It disregarded the results of its own vote. Not a good sign for a project that claims to be decentralized.

BSC, on the other hand, secures itself using a system they call ‘Proof of Authority’. Basically, not just anyone can become a validator. They must meet specific requirements and be elected to begin producing blocks. Elections are decided by the amount of BNB (the chain’s native token) delegated to each validator. The purpose of this is to ensure there are no malicious validators manipulating the processing of transactions.

On paper, that sounds pretty good. But when you look at the wallets which hold the most BNB, you quickly find that Binance owns 71% of the total BNB in existence. This effectively means Binance controls the validators. This is fine if you trust Binance. But the company has been hit with numerous lawsuits in the last year, which call into question the legitimacy of their business.

Shimmer is unique and almost completely different from Arbitrum and BSC. The Shimmer EVM acts more like a platform for other projects to build their own chain. So, the selection of validators is defined by the chain creator. So security can be variable from chain to chain. Because of Shimmer’s unique validation process, there is some risk involved. The chain has not been stress tested on the open market and so it is impossible to say what unknown vulnerabilities may manifest.

Shimmer also has a DAO, which is very fairly decentralized. Proposals can be made by the community and voted on. But where Shimmer really shines is its distribution of the voting token, SMR. The token was airdropped to stakers of the Iota token. This guaranteed the token was distributed to users committed to the development of the chain. However, a third of all shimmer tokens are concentrated in 26 addresses. This implies few wallets will have a meaningful say in governance. Still, this is better than the BNB chain, which has no DAO. Shimmer governance is live and unlike Arbitrum, their Foundation has not overruled the community vote.

Accessibility

Arbitrum isn’t too difficult to access, although there are some steps involved. Many users onboard to Ethereum, and there is a bridge that seamlessly connects ETH to Arbitrum. It is still a bit of a pain to get there, but it's nothing too complicated for the average DeFi user to figure out. Arbitrum is also accessible from most alt chains thanks to the many bridge aggregators that have integrated the network.

I consider the efficiency of a network to be part of its accessibility and Arbitrum is very good at being efficient. Transactions settle faster, cost less gas, and they can process more of them than Ethereum.

BNB chain is by far the easiest to access. Many users onboard through Binance and can directly access the chain from that platform. Like Arbitrum, there are many bridges to BSC so native crypto users can easily access the chain.

The speed of transactions on Binance is many orders of magnitude less than Arbitrum. Arbitrum can process 40,000 transactions per second, while BNB can only do 2,200. This is still faster than Ethereum. BNB also has relatively low gas costs.

Shimmer EVM is, again, kind of weird. Currently, Shimmer’s token can only be purchased on two exchanges, Bitfinex and Bitforex. From there, users must send the SMR directly to Shimmer’s custom wallet, Firefly. Alternatively, users can buy the Iota token on Binance and bridge it BNB chain and then swap it for SMR on iotabee.com. This is kind of a process and much more work than the other options. Still, the EVM is not live, so this process may become easier on launch.

Shimmer is quite fast and efficient. Its unique DAG structure is much faster than its competitors. During Shimmer’s testnet campaign, they averaged 1.83M transactions a day with a block time of 0.7-0.8 seconds. This puts it mostly in line with Arbitrum, but the Shimmer block time was about double the amount of time.

Integrations

Arbitrum and BSC are both very much integrated into the crypto economy. Arbitrum has a very popular derivatives platform which has drawn many users to the chain. Arbitrum has also seen an explosion of DeFi projects over the last year, drawn as they are to the security of Ethereum with the speed of an alt chain.

BSC has many more projects integrated into its chain. With over 600 projects, BSC is second only to Ethereum. However, most of these projects are not very popular. The chain has a notorious reputation for rug pulls and scam tokens. Still, there is a thriving DeFi community.

Shimmer’s integrations are largely an unknown quantity as the chain is not yet live. Touchpoint is a community organized to facilitate collaboration between developers with the support of the Shimmer Foundation. The Touchpoint program has ensured that the EVM will launch various projects. There are 101 projects in the program and they run the gamut of crypto protocols. From Bridges to Gaming to DeFi and DAOs, there is a rich ecosystem ready to launch alongside the EVM. The challenge will, of course, be to capture users from other chains, but the existing Shimmer community ensures that there will be a user base of at least 200k wallets. Indeed, one of the strongest arguments for Shimmer’s success is its eager user base, who have been eagerly awaiting the launch of the EVM.

Conclusion

Shimmer is a little late to the scene. Old incumbents dominant in all metrics of success. The last wave of euphoria for alt chains died at the end of DeFi summer. Layer 2’s have dominated the narrative for the entirety of this year. Still, Shimmer has a strong technical foundation with a unique value proposition.

It seems unlikely that Shimmer will crack the top 10 active chains upon the launch of EVM, but it is not impossible. DeFi winter has been long and brutal. Users are hungry for an opportunity to present itself. Shimmer’s EVM may very well be that opportunity if it can capture the attention of jaded users.

🎤 Interview: Holger Köther

[Interview by Mart]

Tangleverse Times: Could you briefly explain what BUILD.5 is and how it came to be?

Holger Köther: BUILD.5’s aim is to provide an enterprise-ready platform designed to seamlessly integrate web2 and web3 technology. The goal is to leverage both decentralized and existing enterprise systems to provide an easy to use solution for businesses and organizations, to access the benefits of web3 technologies.

BUILD.5 is structured into two parts:

A non-profit association dedicated to the support and governance of decentralized, open source technology that aims to have a significant positive impact on society and industry.

An open source platform built to enable seamless co-development experiences for BUILDers in both Web2 and Web3. This is achieved through powerful solutions that leverage the unique characteristics of the IOTA L1 networks (IOTA/Shimmer).

Song (Shonuff) and I have been in conversations since last year, on how we best transition the developments of the IOTA Foundation into tangible products and services, which enables a better utilization of the ecosystem, and even more importantly enable organizations outside our “bubble” into our ecosystem. That is where real world adoption is happening and “blockchain” is being integrated into real life use-cases, as an additional aspect of trust. That is why and how BUILD.5 came to be.

TvT: What exactly are the differences between the offered products from SPYCE.5 and BUILD.5 and how will they complement each other?

HK: That is a good question. Both brands/organizations are closely associated with each other, and both were motivated by the challenges faced by enterprises in adopting Web3 technology.

SPYCE.5 offers Distributed Ledger Technology (DLT)/Blockchain and Web3 infrastructure as a service. It aims to make it easy for innovators, builders, and enterprise customers to bring and scale their dApps and products to market faster by providing highly performant and easy to use access to the blockchain/Tangle itself . This includes features like digital identity management and secure data exchange. SPYCE.5 is designed to help enterprises simplify operations and provide improved security for their data and infrastructure at a higher scalability than what traditional blockchains can offer.

The BUILD.5 platform is an open source operating system that operates with infrastructure like SPYCE5. It expands on the capabilities of services like our infrastructure product by enabling any enterprise or ecosystem access to them. In addition, it increases the utility of the service itself by incentivizing developers to launch their own modules, connectors, DAO management tools, tokenization frameworks, etc., that can interact and expand on any service that integrates with the platform So, BUILD.5 is much more open-source, governance, application, and ecosystem oriented. Every developer can launch a module with specific utility (e.g. “enable IOTA payments”, or “add a KYC”) through BUILD.5, and enterprises can access those and later thousands of others like it through their utilization of the platform.

TvT: Many community members were pleasantly surprised when David Sønstebø joined forces with you and invested in SPYCE.5. Will he become a permanent part of the team, or is he more of an investor?

HK: David and I have been in contact since I joined the IOTA in 2018. In 2022 Regine, Dom and I aligned that the IF would focus on the technology and Regine and I would establish SPYCE.5 as a key driver for scaling the use of IOTA and Shimmer in commercial applications. As founder of IOTA it was natural to loop David into the founding discussion of SPYCE.5 as well, and it quickly peaked his interest. What sets David apart is his genuine enthusiasm for our vision to make a change in the real-world, paired with great confidence and a deep belief in our capabilities.

Although he is not directly involved in day-to-day operations, we value his input and jointly discuss strategic topics to have the assurance that our decisions are rooted in sound judgment and a shared vision for the future.

TvT: The BUILD.5 announcement said that it will be set up as a non-profit association. While this certainly adds a lot of trustworthiness, will this hinder your freedom to spend funds?

HK: Absolutely “no”. A large part of our organizational planning discussion centered around where to house our association. We evaluated many jurisdictions and consulted legal advisors from each region. We agreed to Switzerland, based on that process. There is a reason that everyone from the Ethereum Foundation to Cardano is based there. Even, our own IOTA Foundation founded “TEA”, the Tangle Ecosystem Association, is established in Switzerland and incidentally through the same legal format as the BUILD.5 Association. So, we established the organization in Switzerland to not limit ourselves to how we fund ecosystem growth but to catalyze serious enterprise specific activities like tooling integrations and association membership for partners. All things we are actively engaged in.

TvT: What is the perception among enterprises, is there a lot of interest?

HK: Having built and managed the market adoption function at the IOTA Foundation for nearly its entire existence I got to see first hand the evolving perception of enterprises when it comes to blockchain generally and IOTA specifically. There has always been a lot of interest, the problem hasn’t been interest, its how to do we implement the technology into existing systems. No successful enterprise is going to throw out their operations and start from scratch. So, we founded SPYCE.5 and now BUILD.5 to specifically close this gap between the technology itself and its application in the wider enterprise context. Every organization and individual constantly faces the “make or buy” decision. Should I invest my time to learn or do something, or outsource it and have an expert handle it.

Enterprises are successful generally when they focus on their core competence - their unique “thing”which nobody else can do and why customers contract and work with them in the first place. They rather invest into this core competence and then just pay for a professional service from a provider for productivity enhancing service outside that competency. Of course an enterprise can also install and use their own blockchain node if they manage to cater to incidents, problems, change processes (like protocol updates), scaling, continuity management, outage management, capacity management etc. (best google “ITIL” or “ITSM” for a first glimpse), but that’s usually outside their own core business. At the IOTA Foundation we have seen how organizations and innovation departments are struggling. They often lack the technical expertise and in-depth knowledge for the current benefits that web3 has to offer - creation and management of digital identities, tokens, wallets, infrastructure etc.. all requires domain specific expertise.In addition, they don’t have the capacity to expand on what web3 will have to offer that we have yet to discover. This is where you need a thriving open source ecosystem of developers to achieve. Unpredictable fees are also a big red flag. So they are excited about what we plan to offer with SPYCE.5 and BUILD.5, as it provides them with a shortcut to utilize the benefits of blockchain with their existing teams.

Plus, now with the regulatory aspects becoming clearer (a big “thank you” to Mariana at this point, who is constantly engaged at the IOTA Foundation to work with regulatory bodies and provide exactly this clarity), enterprises are much more comfortable evaluating blockchain related technology for better automation, decrease of costs and risks, or improve revenue by creating new business models. These are all things that make it a “no brainer”, which is important for achieving global adoption.

TvT: You said you are going to release more information in the coming weeks, together with enterprise partners. Is there something the community can look forward to in terms of partnerships, adoption etc.?

HK: We recently released the first advisors for BUILD.5, holding senior positions at large scale IT companies at Cisco, RedHat and IBM. I will not spoiler anything in discussion. Let’s first build diligently and then release the news, not the other way around. I understand that a bit of hype and speculation is natural, but excessive anticipation often leads to unrealistic expectations and disappointment. Rest assured, we will share the news with the community when we are ready to deliver tangible results.

TvT: How do you plan to utilize the Shimmer network?

HK: We recognize the importance of progress and innovation, which is why we have decided to invest our efforts in building upon Shimmer rather than the current state of the IOTA Mainnet, which will soon be outdated. By utilizing Shimmer, any advancements, features, and solutions we create will transition and be deployed on the IOTA Mainnet. This strategic approach ensures that we stay at the forefront of technology and deliver the best possible experience for the Shimmer and IOTA ecosystem users, developers and projects.

TvT: Do you plan to separate different use cases between IOTA and Shimmer?

HK: As an infrastructure provider with SPYCE.5 - no. However with BUILD.5 it will be a little different, as it will only launch on IOTA, where the Soonaverse is the more experimental platform on Shimmer. Ultimately it will be up to the projects having to decide to utilize the latest but potentially untested features or wait longer until they have been battle tested and are carried over to the IOTA mainnet.

TvT: The crypto space can be really challenging and competitive at times. What really sets you apart from the competition? What are the unique selling points no other company / protocol can offer?

HK: Well when it comes to any competitive environment it all starts and ends with your team. It’s your people that sets you apart and gives you a chance at success. Crypto moves at the speed of light and you need to have a group of innovative, agile thinkers to navigate the constantly changing landscape to succeed. We have a “best in class” group of developers, designers, marketers, strategists, technologists, and business development experts in not just IOTA, but crypto. I am extremely excited to work hand-in-hand with like minded experts, because it truely is the collective that makes us strong. Much of crypto is a bunch of egos battling each for the spotlight and that isn’t how we function, it's also why I think we will win!

As far as our attributes as a protocol, I think the concept of fast, feeless, secure, and scalable are well walked paths for followers of the IOTA protocol. What people are underestimating are things like L1 smart contracts which our platform is already designed to integrate. The new features and capabilities that will enable are things no one is developing. We are very excited to show the world what we are building.

TvT: Finally one of the most important questions for the community: While $SOON holders will get an airdrop of the $BUILD token, will there be another way to invest into BUILD.5 and if so, wen?

HK: While we value our community greatly, we also recognize the importance of solid foundational backing for BUILD.5. Thus, we are actively considering partnerships with venture capitalists and larger private investors who wish to contribute to our initial funding and scaling process. Please note, however, there isn't a public ICO or similar means of investing in $BUILD at this time.

Thank you for the interview.

📖 DeFi Education #4: Yield Farming

[ - by DigitalSoulx]

Session #4: Yield Farming

Presented by 0xBlockBoy [6 October 2022]

Summary, organization and additional detail by DigitalSoul.x

Welcome to the fourth installment of the Shimmer Community DeFi Education series. This session will focus specifically on yield farming. In it, we will first explore the meaning and purpose of yield farming. Then we will delve into specific strategies and risks involved. Finally, we will explore three popular tools that can assist you as you begin yield farming yourself. Let’s dig in!

Introduction to Yield Farming

Yield farming is the passive delegation of crypto assets to a network with the intent of generating well-defined interest. The term ‘passive’ refers to the fact that you’re deploying your position without constant management needed on your part. Although the phrase ‘well-defined interest’ may not be entirely realistic, it’s relevant for the purposes of our discussion. The interest rate will change over time, but it is calculable and can be rebalanced based on your goals as an investor. All of these strategies involve risk, so please do not consider any of this information specific investment advice and always do your own research.

The Reason a Network offers Yield Farming

Yield farming allows projects to compensate farmers for helping generate the core value of their offering. At the start of a network it is extremely hard to generate value. This is commonly known as the Cold Start problem, and this problem affects many networks, not just blockchain networks. For example, if you have a phone and you’re the only one in the world that does, it’s basically worthless. This is because there’s no one you could call since no one else is on your network. But, as more people get on the network, it becomes incrementally and almost exponentially more valuable. This is why companies like Facebook, Uber, etc. are so successful — they’re able to generate mass amounts of value because they’re able to create these ‘walled gardens’. People get trapped and can’t take their data to competing networks. This is the reason that many cryptocurrency projects offer yield farming: they’re trying to seed their networks in order to get to a point where their network hits critical mass and can grow more organically.

Perhaps we can better illustrate the cold start problem by offering examples of two traditional companies and their solution for seeding their network. First, consider that Uber might offer a $1000 bonus to a new driver who completes 50 rides in the first 30 days. Uber has very localized networks which leads to a problem: every single time they enter a new city, they have to seed the new network. This is a huge task! By offering to incentivize new drivers, they are effectively seeding their network. As another example, consider Venmo offering to deposit $10 into your account before you even use their platform. In this case, they’re incentivizing one of two actions: 1) The user will transfer the $10 to their bank, meaning they will need to add their bank details to the app. Once all of their details are entered, they will be more likely to continue using the app. 2) The user will send the $10 to someone else. This third party will either be an existing Venmo user or they will be someone new to Venmo. If a new user, they will also need to choose one of the paths mentioned, helping to further seed the network.

A cryptocurrency protocol also needs to seed their network to help it gain traction. A popular way of doing so is by offering incentives to users in the form of yield farming. The network receives new users and activity to support the network while the farmers receive yield on their assets and other incentives. The rewards are generally relatively high in the early stages of a network, encouraging early participation.

Before proceeding to the different methods of yield farming, we should define a few general terms that may be referred to throughout the rest of the presentation: Annual Percentage Yield (APY) and Annual Percentage Rate (APR).

Annual Percentage Yield (APY): This figure is useful to those lending assets as an investment. The APY is expressed as a percentage and represents the amount of money (interest) you would realize if you held your investment for one year. Note that this figure assumes that you will be reinvesting the interest you earn, a practice known as compounding.

Annual Percentage Rate (APR): This figure is generally used by borrowers. The APR is also expressed as a percentage and represents the cost of a loan including interest rate, fees, and (if applicable) insurance. If there are no fees or other costs associated with a loan, the APR should be the same as the interest rate. APRs can be fixed or variable depending on the product.

Now we can move on to discuss the different methods of yield farming.

The 5 Pillars of Yield Farming

- Supporting Network Operations

- Providing Lending Capital

- Providing Liquidity to Exchanges

- Delegating Tokens to Aggregators

- Following Protocol Incentives

1. Supporting Network Operations (Staking)

This is a fairly safe predictable yield strategy. Here, farmers allocate their holdings to a network validator to allow the network to run more efficiently and securely. In return, they are paid by those who intend to use the network by staking. To illustrate this, imagine if Uber paid you to rent out your car for their drivers to use. In a way, you would be staking your car to the network to allow the network to run more efficiently and you would earn interest on your asset (your car) in return. When considering crypto staking, there are actually a few different types: custodial, decentralized, and liquid staking.

In the case of custodial staking, you offer your tokens to a third party and they perform actions on your behalf. Crypto exchanges like Coinbase or Binance would be considered custodial.

Benefits of custodial staking: Relatively Easy Onboarding | Great for Beginners | Usually Decent Liquidity

Risks of custodial staking: Less Transparency | Reduced APY

As the name suggests, if you elect decentralized staking, the activities are carried out in a decentralized manner. In this case you would most likely run your own node on the network and act as a validator yourself.

Benefits of decentralized staking: Full Control of Assets, Higher APY, Promotes Network Decentralization

Risks of decentralized staking: Must Maintain Your Infrastructure, Your Assets are Illiquid, Exposed to Counterparty Slashing (more on this later)

Building on decentralized staking, there’s another concept called liquid staking. Since the minimum amount of cryptocurrency required to engage in staking can be high for some protocols, several users may pool their funds together and delegate them to a trusted actor. When engaging in liquid staking, the protocol gives you a derivative asset in exchange for staking your real assets. This derivative asset is similar to an IOU that can be exchanged for the original asset when you unstake. In this way you’re not really locking your assets away, but you get something in exchange that you can use instead. This derivative asset is a liquid token that you can use for other yield farming strategies. When you unstake your tokens you exchange the derivative asset for your initial asset.

Benefits of liquid staking: Easy to Participate, Doesn’t Require Infrastructure, Assets are Liquid, Can Promote Decentralization

Risks of liquid staking: May Realize a Lower APY, Exposed to Counterparty Slashing, May Reduce Decentralization

In general, staking requires a minimum amount of staked tokens, and they must be locked up for a period of time. Liquid staking can be good for decentralization because a user without the minimum number of tokens for fully decentralized staking can still participate without utilizing a centralized, custodian account. However, if many users elect to delegate their tokens to the same validator, those tokens become more centralized.

Considerations Prior to Staking

While staking is generally a low risk, mid-yield activity, there are several considerations that a prospective staker should keep in mind before deploying their assets. Some of these considerations will also apply to some of the other pillars of yield farming, but it makes sense to introduce them now.

APY

This is fairly self-explanatory, but if you are considering staking your tokens it’s important to know the APY even if it will change over time. Consider the amount of rewards you expect to receive through staking, and weigh these rewards against the other considerations to ensure that the reward is worth the risk.

Counterparty Slashing Risk

This risk is specific to staking. Participants in Proof of Stake (PoS) cryptocurrency networks (validators, block producers, delegates) are trusted to maintain the integrity and security of the network. They are required to stake a minimum amount of cryptocurrency as collateral to be able to contribute to network operations. In return for performing properly, they receive staking rewards. However, if they behave maliciously or otherwise violate the rules of the network, penalties will be levied in the form of slashing.

Slashing typically involves permanently destroying or confiscating a portion of the participant’s staked funds as punishment. The degree of the slashing depends on the severity and nature of the offense, and varies by protocol. Slashing will commonly occur due double-signing (signing conflicting blocks), censorship, or other forms of malicious behavior that undermine the network’s consensus. So, although staking may seem like a very safe method of earning yield, users should be mindful of those to whom they delegate their funds. If you have delegated your assets to a validator who is slashed, you will lose your funds as well! By sure to do your own research when choosing a specific validator to support.

Inherent Token Risk

These risks are typically associated with the characteristics, design, and underlying technology of the token itself. These risks will apply to all cryptocurrencies. Here are some examples of inherent token risks and their relation to staking:

- Market Volatility: The value of many cryptocurrencies can experience rapid and significant fluctuations due to factors such as market demand, speculation, regulatory developments, or macroeconomic conditions. This volatility can easily counteract the rewards gained from staking if one is not careful.

- Regulatory Risks: Regulatory uncertainty and changes pose risks to cryptocurrencies as well as staking. Different jurisdictions have varying approaches and regulations regarding cryptocurrencies and staking, which can impact acceptance, usage, and trading. Regulatory actions, such as bans, restrictions, or unfavorable regulations, could pose risks to specific tokens as well as their ability to be staked.

- Technological Risks: Tokens rely on blockchain technology, which is still evolving. Vulnerabilities or flaws in the underlying protocols or smart contracts using for staking can lead to security breaches, hacks, or exploits. These risks can result in the loss of funds, manipulation of token supply, or other adverse consequences for token holders and stakers.

- Governance and Consensus Risks: Tokens that are part of decentralized networks often involve community governance, consensus mechanisms, and even staking. The decision-making processes, such as voting or consensus algorithms, can be subject to manipulation, centralization, or conflicts of interest. Disagreements among token holders or community members may result in hard forks, contentious governance decisions, or network splits, which can affect the value and viability of the token and its ability to be staked.

- Adoption and Utility Risks: The adoption and utility of a token can impact its value and success. Factors such as network usage, real-world applications, partnerships, developer activity, and user demand play a significant role. Tokens that fail to gain adoption or offer meaningful utility may struggle to maintain value or achieve their intended purpose.

- Liquidity Risks: Tokens with low trading volumes or limited availability on exchanges may experience liquidity risks, making it challenging to buy or sell your token and token staking rewards at desired prices if at all.

Economic Rebasing Risk

Some cryptocurrency protocols will periodically adjust the supply of tokens in the network based on preset formulas or rules, a practice known as Economic Rebasing. The purpose is to maintain price stability and reduce volatility. In order to accomplish this, the token supply of each holder is increased or decreased proportionally. If the price of the token is consistently higher than the target value, the mechanism may decrease the total number of tokens available by removing a proportional amount from everyone. Conversely, if the price of the token is consistently lower than the target value, the mechanism might increase the total number of tokens available by adding a proportional amount to everyone.

You may encounter a protocol offering a very high APY for their yield farm. While participating in this farm, you might receive a large number of tokens. However, if economic rebasing is employed, the total value of your holdings might not actually increase even though you hold more tokens. Instead, only the number of tokens you hold increases, resulting in increased ownership percentage of the total number of tokens. This means that you effectively own more of the network itself even though the value of your holdings remains constant.

Liquidity Lockup Period

Some protocols employ a lockup period — a predetermined timeframe in which a liquidity provider cannot withdraw or transfer their liquidity. This is used to ensure stability and constant liquidity by incentivizing liquidity providers to commit their assets to the platform for a specific duration. It is important to know how long this period is before deploying capital to a protocol.

2. Providing Lending Capital

This describes the process of farmers allocating their holdings to capital-constrained borrowers in return for fees that can be subsidized by the network. This is likely the safest form of yield farming and the process is similar to a bank offering a loan. The safest opportunity would be over-collateralized lending, and a few examples of such protocols are AAVE, Compound and Maker-DAO. More information on this topic can be found in a previous Shimmer DeFi Education Series post Session #3 (Part 1): DeFi Lending & Borrowing.

Benefits of providing lending capital: Fast | Promotes Liquidity | Permissionless | Relatively Safe

Questions to Ponder Prior to Lending Capital:

- Is there a lock-up period for your deposited funds?

- Is there a protection against insolvency?

- Is over-collateralization (if applicable) appropriate for you?

- Have the smart contracts been audited, and by whom?

- How stable are the fees?

3. Providing Liquidity to Exchanges

In this method of Yield Farming, farmers provide liquidity to centralized exchanges in return for trading fees or native tokens. The biggest risk that you’re going to encounter is impermanent loss. This describes the opportunity cost of being a liquidity provider compared to simply holding the initial assets instead and was explored in detail in of the Shimmer DeFi Education Series Session #2 (Part 3): Token Swaps — DEX vs. CEX.

Benefits of providing liquidity to Exchanges: Permissionless | High Potential for Yield.

Questions to Ponder Prior to Providing Liquidity to Exchanges:

- What is the split fee on the pool?

- What are the fees paid in? Are you being paid in a native currency or a different token? What is the risk for impermanent loss?

- What is the actual trading volume of the pool? Are people using the pool?

- What are the underlying token risks? (see relevant portion of Staking considerations)

4. Delegating Tokens to Aggregators

The risk here is fair for a decent yield. If there is a yield farming strategy that anyone could do confidently, it would likely be delegating tokens to aggregators. This process involves farmers providing their tokens to aggregators to take advantage of economies of scale for lower transaction costs and higher returns. To do this, a user would deposit their tokens into a single smart contract for yield farming or other DeFi transactions. Doing this collectively results in lower costs and higher returns. It’s fairly safe but there is a distinction to be made between a true aggregator and an auto-compounder.

A true aggregator combines and consolidates various DeFi protocols and services into a single interface. It allows users to access and interact with multiple protocols, trade assets, provide liquidity, and access various DeFi services within a unified platform. A true aggregator offers benefits for passive yields, passive benefits, variety in strategies, socialized gas costs, etc. Yearn is a good example here. They have vaults where you can deposit your DAI, USDC, ETH, etc. and they give you a fixed APY in return. One downside here is that they take a small fee off the top. Also, there’s composability risk: you don’t necessarily know the strategy that they’re utilizing. While you can dig into their documentation and attempt to figure it out, they’re still using multiple smart contracts that could have inherent risk.

An auto-compounder focuses specifically on optimizing yield farming strategies by automatically compounding users’ funds. It identifies the best opportunities for yield generation across different protocols and performs automated compound actions to maximize returns. One example of such a protocol is Convex, which is built on top of another protocol. By allowing them to manage your funds, they collect the rewards automatically on a regular basis and reinvest them for you. This aggregates your rewards and allows you to earn rewards on your rewards. There’s still always the underlying token risk but it’s a little larger here because you’re only generating yield from one specific source. An auto-compounder like this will typically have governance or other incentives in mind. They’ll focus on a single token to try to obtain enough to influence governance decisions.

Questions to Ponder Prior to Delegating Tokens to Aggregators:

- Is the protocol you are considering a True Compounder or is it an Auto-Compounder? Which is more appropriate for you?

- Where are the sources of yield?

- What are the strategies being taken? It’s always good to understand the token flow and there should be a diagram available from the protocol that illustrates this.

- How risky is the strategy of the protocol?

- Is there any issue with composability?

- Have the smart contracts been audited, and by whom?

5. Following Protocol Incentives

This structure is a high risk, high reward approach in DeFi. Farmers increase awareness and usage of a protocol and receive rewards in exchange. These rewards are offered as a way to seed new networks.

For instance, the protocol Arbitrum Odyssey guides users through its ecosystem, providing various incentives and rewards like NFTs and airdropped tokens. The goal is to familiarize users with different products and encourage their adoption within the network.

On the other hand, AAVE on Avalanche demonstrates a different approach. By subsidizing extra APY with Avalanche tokens, AAVE incentivizes users to bring liquidity to the Avalanche network. This strategy aims to attract users to a new ecosystem and offers benefits like free tokens and the highest yield opportunities.

However, it’s important to consider the risks associated with these incentives. Firstly, the tokens received as incentives may not be known in advance. Secondly, the long-term value of the protocol and its associated network is uncertain. Protocols offer these incentives to attract capital and bootstrap their networks. In the end, it’s crucial to conduct thorough research and due diligence to ensure you’re not investing in a Ponzi scheme or falling for deceptive practices. Understanding the goals and risks of protocol incentives is essential for making informed investment decisions in the DeFi space.

Questions to Ponder Prior to Following Protocol Incentives:

- Where does the yield come from, and is it sustainable? Be careful of extremely high yields, because it could due to rebasing. At the same time, it could be a token that has no value. Don’t get enticed by promises of large amounts of tokens, because a large number times 0 is still 0.

- Is there any specific platform risk? For example, if we are considering Solana and the network experiences one of its outages, would you be okay with potentially losing the ability to remove your capital for some period of time?

- If you’re moving your capital from one network to another, how strong is the bridging risk? Have the bridges been is use for long enough without a hack that you have faith in using them? (See the Lindy Effect discussion in the next section.)

Now that we’ve fully explored the 5 pillars of yield farming in DeFi, it should be clear that there is likely an opportunity for farmers of any risk profile and target yield. However, with all of the protocols that are currently offering yield farming and considering that more are entering the market everyday, savvy farmers will need to utilize effective tools to identify the best protocols for them. In this next section, we will discuss a few ways that you can assess a protocol on your own before exploring three different popular tools that can assist you.

Notable Tools to Assist with Research & Analysis

Rather than simply relying on third party tools to assess a given protocol, you can also employ some relatively simple, universal methodologies yourself. Most people can’t scrutinize a protocol’s smart contracts to make sure they are safe. However, there are a few basic methods for obtaining a quick assessment on your own.

- Total Value Locked (TVL): This number represents the overall value of assets deposited in a DeFi project. DeFi assets include rewards and interest, coming from lending, staking, and liquidity pools. TVL can also be noted specifically for protocol staking. In this case, it represents the amount of assets deposited by liquidity providers.

- The Lindy Effect: This postulates that the longer that a protocol has been active without a hack, the more safe it is. The idea here is that these protocols are like a honeypot to hackers. They will try to attack them to drain the funds using every tool in their toolbox. If they’ve been unsuccessful for a significant amount of time, you can have increasing confidence that they won’t be able to. An important note here is that the Lindy Effect applies to a specific version of a protocol. As soon as revisions, updates or new features are applied, the timer resets!

- Protocol Forks: It is quite popular for a new network to utilize a previous, proven platform or protocol in the form of a clean fork. The contracts involved have likely already been battle-tested and have evolved into a stable, trusted version. If the fork really is clean, perhaps you won’t need to rely as much on TVL or the Lindy Effect for the new protocol. Instead you would refer to the stability of the original protocol. However, be careful! If new features or revisions have been included, they must be fully audited and perhaps it would be best to wait for some time before deploying significant capital in such a protocol.

- Insurance Rates: If you want additional peace of mind after utilizing the methods above and even some of the tools that follow, you can purchase insurance. One such product is offered by Nexus Mutual, and they operate in a manner similar to a traditional insurance company. The offer products to insure against protocol failure and even against ETH slashing risk. You pay a premium for the coverage, and if there is a failure you submit a claim for reimbursement. Even if you decide not to purchase an insurance policy, there is valuable information you can obtain just by comparing the premiums required for different protocol policies. The higher the premium, the more risky the protocol. If there had been a recent wallet or platform hack, you would expect to pay more for insurance. Comparing premiums can be an effective way of comparing the relative risk levels of different protocols you are considering.

While it’s always good to have a basic idea about how to evaluate a protocol on your own, inevitably you will need to do a deeper dive. Fortunately, there are some really great tools out there that can make this task much easier on you. Below we will explore three such tools and their respective features.

DeFi Llama

Defi Llama is a user-friendly data analytics platform and aggregator. It provides real-time, comprehensive data, rankings, and insights into DeFi ecosystem projects. By serving as a valuable resource for users, investors, and researchers, it empowers them to make informed decisions by allowing them to explore and track various DeFi protocols and their associated metrics.

DeFi Protocol Tracking: Defi Llama tracks and aggregates data from a wide range of DeFi protocols, including lending platforms, decentralized exchanges (DEXs), yield farming projects, stablecoins, and more. It provides up-to-date information on key metrics such as total value locked (TVL), trading volume, liquidity, token prices, and various performance indicators. DeFi Llama key features:

- TVL Rankings: As was mentioned earlier, total value locked (TVL) is a widely used metric in the DeFi space, representing the total amount of assets locked within a specific protocol. Defi Llama ranks many DeFi protocols based on their TVL, allowing users to assess the prominence and popularity of different DeFi projects.

- Protocol Details and Analytics: Defi Llama provides detailed information about many tracked protocols, including key statistics, tokenomics, supported assets, governance mechanisms, and even historical data. Users can explore various charts, graphs, and analytics to gain insights into a protocol’s performance and growth over time.

- Portfolio Tracking: Users can track their personal portfolio’s value in DeFi Llama, even across multiple protocols and tokens. This is done by first connecting one’s wallets to Defi Llama. The platform then aggregates and displays the portfolio’s value, asset allocation, and historical performance, offering a complete, consolidated view of their holdings.

- News and Updates: Defi Llama includes a news section that provides the latest updates, announcements, and insights from the DeFi space. Users can stay informed about important developments, new projects, partnerships, and regulatory changes affecting the DeFi ecosystem.

- API Access: Lastly, Defi Llama offers an API for developers and analysts who want to access and utilize DeFi data programmatically. This allows integration with other applications, and programmers can build custom tools using the provided data.

Dune Analytics

Dune Analytics is a powerful, open-source and user-friendly data analytics platform specifically designed for blockchain and decentralized applications (dApps). It allows users to explore, query, and leverage on-chain data from various blockchain networks. This enables them to gain deep insights into specific activities and trends, empowering them to make data-driven decisions. Its user-friendly interface, customizable dashboards, and collaborative features make it an extremely valuable tool. Here are some of Dune’s key features:

- Data Exploration and Querying: Dune Analytics provides a user-friendly interface that allows users to explore and query on-chain data from popular blockchain networks, such as Ethereum. Users can write SQL-like queries to extract specific data points, filter results, and perform calculations on the blockchain data directly.

- Customizable Dashboards and Visualizations: Users can create personalized dashboards and visualizations using the data they pull from Dune Analytics. The platform offers several different visualization options, including charts, graphs, tables, and even heatmaps, allowing users to present and analyze data in a visually appealing, intuitive manner.

- Public and Shared Dashboards: Dune Analytics allows users to share their dashboards and queries publicly if they so desire, making it a collaborative platform for the crypto community. Users can discover and explore dashboards created by others to learn from their analysis. They can even fork and modify those dashboards to suit their own needs.

- Integration with DeFi Protocols: Dune Analytics has deep integrations with various DeFi protocols, enabling users to access and analyze available data. This includes lending platforms, decentralized exchanges (DEXs), yield farming projects, liquidity pools, and more. Users can gain learn about the trading volumes, liquidity, user activity, and other important metrics of these protocols.

- Community and Learning Resources: Dune Analytics intends to build a strong community of data analysts, developers, and enthusiasts. Users can interact with other like-minded individuals through discussions, forums, and collaborative projects. The platform also provides learning resources, tutorials, and documentation to help people get started with data analysis and methods of querying the blockchain.

- API Access: Similar to Defi Llama, Dune Analytics offers an API that allows developers to programmatically access and integrate blockchain data into their own applications, products, or services. This enables developers to build custom analytics tools, data-driven dApps, or automated workflows using the plethora of on-chain data available.

Nansen

Nansen.ai is an advanced analytics platform that provides in-depth insights and data analysis for the Ethereum blockchain. It focuses on extracting valuable on-chain data and providing actionable intelligence for users by helping them to identify market trends. Here are some key features, but note that there are fees associated with the use of this platform:

- On-Chain Data Analytics: As mentioned, Nansen.ai offers comprehensive on-chain data analytics for the Ethereum network. It collects and processes large amounts of data from the blockchain, including transaction history, token transfers, smart contract interactions, and even user behaviors. This data is then analyzed and presented in a user-friendly format for easy exploration.

- Token and Address Tracking: Users can track and monitor specific tokens or addresses using Nansen.ai. This feature allows users to gain insights into token flows, track specific wallet balances, and understand the activity and trading patterns of those addresses.

- Transaction Clustering and Labeling: Nansen.ai employs advanced algorithms to cluster and label Ethereum transactions. This helps users identify the different types of addresses (such as exchanges, liquidity providers, or smart contracts) and understand the relationships and interactions between them. It provides valuable context and helps to identify trends, whale activity, market movements, etc.

- Whale and Token Holder Insights: Nansen.ai offers insights into the activities of large Ethereum holders, also known as “whales.” Users can track whale movements, analyze their trading patterns, and learn about their accumulation or distribution behaviors. This information can be valuable for understanding market trends and identifying possible investment opportunities.